Navigating Speculative Business in Income Tax for Legal Pros

- Rare Labs

- 2 days ago

- 16 min read

When you hear the term 'speculative business' in income tax circles, what comes to mind? For many, it conjures images of high-stakes trading, but the legal definition is far more precise. At its heart, a speculative business involves transactions where a contract to buy or sell something—like shares or commodities—is settled without anyone ever taking actual delivery of the goods.

Think of it as a bet on price movements. The whole game is about profiting from the fluctuation, not about owning the underlying asset. This crucial distinction is why speculative activities get their own special rulebook under the Indian Income Tax Act, 1961, with Section 43(5) laying down the law.

Demystifying Speculative Business Under the Income Tax Act

Let's break it down with a simple scenario. Imagine you "buy" 100 shares of a company, convinced the price is about to shoot up. A few hours later, it does. You then "sell" those same shares, pocketing the profit. But here's the catch: the shares never actually landed in your demat account. The entire transaction was squared off based purely on the price difference.

That, right there, is the soul of a speculative transaction. It's a world away from a regular business where you buy raw materials, create a product, and sell it. Here, the only thing changing hands is money based on price swings. The taxman sees this as a higher-risk venture, which is why its profits—and more importantly, its losses—are treated very differently.

The Foundation Stone: Section 43(5)

The bedrock for all this is Section 43(5) of the Income Tax Act. This provision cuts through the noise and gives us a clear-cut definition. It labels a "speculative transaction" as any deal involving the purchase or sale of a commodity (including stocks) that is ultimately settled without the actual delivery or transfer of that commodity.

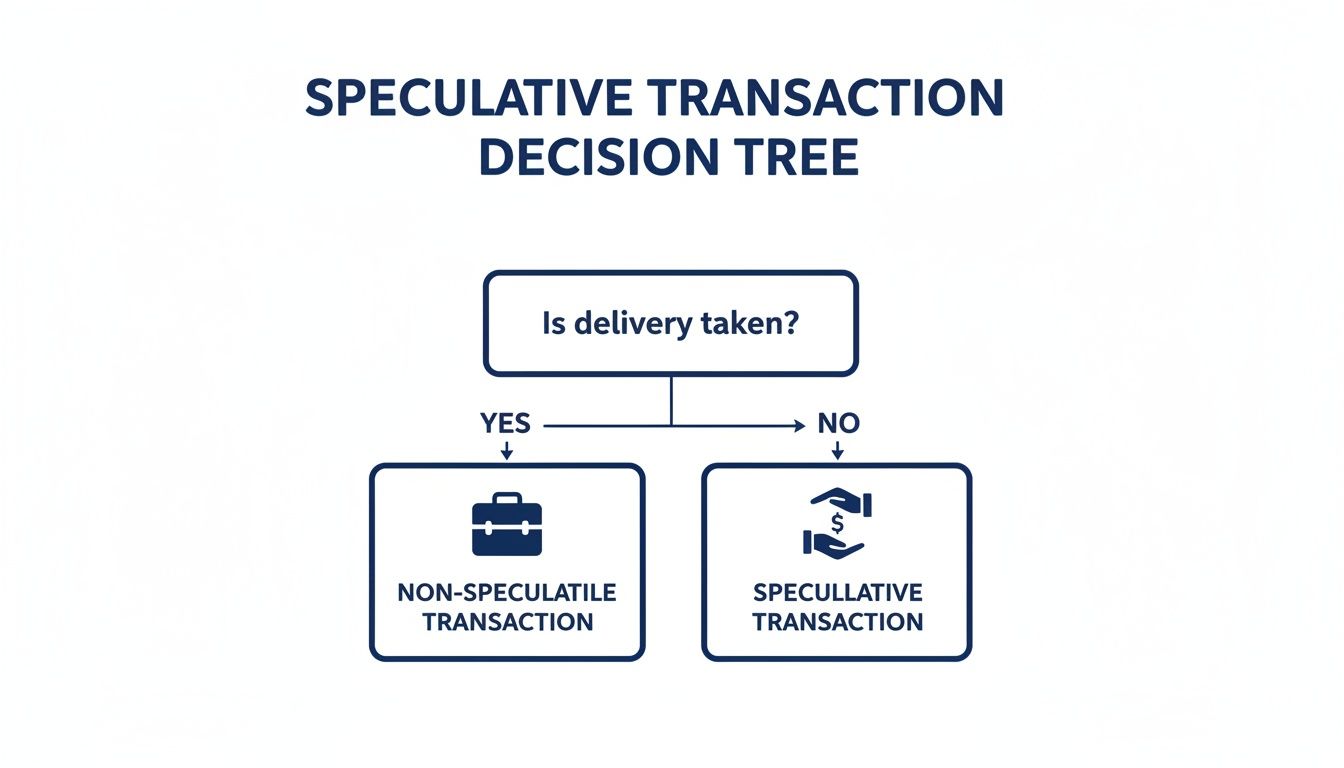

This gives us a simple, bright-line test:

Actual Delivery: You buy shares, and they show up in your DEMAT account. That's a non-speculative transaction. It’s a genuine investment or delivery-based trade.

No Delivery: You get into intraday trading, buying and selling the same stock on the same day. Since you never take ownership, the net profit or loss is settled in cash. This is a textbook speculative transaction.

The law’s unwavering focus on "actual delivery" is the primary litmus test that separates genuine investing from speculation.

To give you a clearer picture, here’s a quick comparison.

Speculative vs Non-Speculative Transactions At a Glance

This table offers a handy reference to quickly distinguish between the two based on their core characteristics.

Characteristic | Speculative Business (e.g., Intraday Trading) | Non-Speculative Business (e.g., Delivery-Based Trading) |

|---|---|---|

Primary Test | Settlement happens without actual delivery of shares/commodities. | Settlement involves the actual delivery and transfer of ownership. |

Intention | To profit from short-term price fluctuations. | To invest, hold the asset for a period, or use it in business. |

Holding Period | Extremely short, often within the same trading day (intraday). | Can range from a few days to several years. |

Tax Treatment of Loss | Speculative losses can only be set off against speculative gains. | Non-speculative business losses can be set off against most other incomes. |

Understanding these differences is key, as the tax implications are worlds apart.

Why Does This Distinction Matter So Much?

The Income Tax Act doesn't just create this category for academic purposes; it has massive real-world consequences for taxpayers. By treating speculative business as a separate and distinct activity, the law puts up a wall around it, especially when it comes to losses.

InsightsThe logic behind this ring-fencing is pretty straightforward. The government wants to stop people from using high-risk trading losses to wipe out their tax liability from stable income sources like a salary or regular business profits. It’s a way of ensuring that the risks you take in the market don’t unfairly reduce the taxes you owe on your more predictable earnings.

For us legal professionals, getting this classification right is step one. A simple mistake—labelling a speculative loss as a regular business loss, for instance—can lead to rejected claims, tax notices, and a whole lot of trouble for your client. Under Section 28, speculative business income is treated as a unique beast, entirely separate from standard business profits. For a deeper dive into tax data, the official reports from the Income Tax Department offer some fascinating insights.

When you're wading through complex tax matters, a Legal AI can be an incredibly useful co-pilot. For example, a tool like Draft Bot Pro can help you quickly sort through transaction histories to identify which ones fit the speculative mould. Just upload the contract notes or trading statements, and you can ask the AI to pinpoint all transactions settled without delivery. This gives you a clean, accurate classification right from the start, which is absolutely vital for preparing a solid tax return or a winning appeal.

Exploring the Core Rulebook: Section 43(5)

To really get to grips with what the taxman considers a "speculative business," we need to go straight to the source: Section 43(5) of the Income Tax Act, 1961. This is the legal bedrock, and the definition it provides is actually quite straightforward, hinging on one powerful idea.

A transaction gets branded as 'speculative' if a contract for buying or selling a commodity (including stocks and shares) is settled without the asset actually changing hands. In simple terms, if a deal is squared off with a cash payment based on price differences and no one ever takes actual delivery or transfer of the goods or scrips, it's a speculative transaction. That's the heart of it.

This "actual delivery" test is the bright line the law draws between genuine investment and pure speculation. Think of it like this: you order a custom-tailored suit. You go to the tailor, get measured, pay, and walk out with the suit. That’s a real transaction with actual delivery. But what if you just place a bet with the tailor on whether the price of wool will go up or down next month, and you settle that bet in cash? No suit is ever made or delivered. That’s a speculative act.

This simple decision tree helps visualise the fundamental test under Section 43(5).

As you can see, the classification hinges almost entirely on the physical act of taking or giving delivery. This single factor becomes paramount for how the transaction is assessed for tax.

Crucial Exceptions to the Rule

Of course, the law isn't a blunt instrument. It understands that not every deal settled without delivery is a gamble. Section 43(5) wisely carves out specific exceptions for genuine business activities that might otherwise be unfairly painted with the speculative brush. For any legal professional, understanding these carve-outs is non-negotiable.

The main exceptions are:

Hedging Contracts: A contract a manufacturer or merchant makes to protect themselves against future price swings in their raw materials or merchandise.

Forward Contracts: A contract used by a member of a forward market or stock exchange to guard against potential losses in their stock and share holdings.

Derivatives Trading: Eligible transactions in derivatives (like futures and options) that are carried out on a recognised stock exchange.

These exceptions are crucial. They shield legitimate risk management strategies from the tough tax treatment reserved for speculative business income.

Understanding Hedging Contracts

Let's take a jewellery manufacturer who needs a large quantity of gold in three months. They're worried the price might shoot up, which would crush their profit margins. To lock in a price, they enter a futures contract to buy gold at a pre-agreed rate on a future date.

This is a classic hedging contract. The goal isn't to bet on the price of gold; it's to eliminate risk and bring predictability to their costs. Even if this contract is ultimately settled in cash without any physical gold changing hands, Section 43(5) explicitly says this is not a speculative transaction.

InsightsThe legislative intent here is clear: support genuine business. The law recognises that companies need tools to manage the price volatility of their raw materials and inventory. It would be counterproductive to penalise this kind of prudent financial management by labelling it as speculative.

The Role of Forward and Derivative Contracts

The other exceptions work on a similar principle. A stockbroker holding a massive portfolio of shares needs a way to manage the risk of a market crash. A forward contract helps them hedge against those potential losses.

But the most significant exception for today's market is for derivatives. Futures and options traded on a recognised exchange are, by their very nature, often settled without physical delivery. The law specifically deems these non-speculative (provided they meet certain conditions) because they are vital tools for hedging and price discovery. This carve-out ensures the entire, bustling derivatives market isn't automatically classified as a speculative casino.

For legal advisors, this means you have to dissect a client's trading activity carefully. A legal AI tool like Draft Bot Pro can be a game-changer here. You can upload entire trading ledgers and instruct the AI to segregate the transactions. For instance, you could ask it to specifically identify and list all futures and options trades on recognised exchanges. This automates the painstaking process of applying the exceptions under Section 43(5), helping you get the classification right from the start.

The Tax Consequences of Speculative Activities

Knowing how to correctly classify a transaction as speculative is one thing. The real test comes when you have to deal with the unique—and often unforgiving—tax rules that apply. Unlike regular business income, the profits and losses from a speculative business in income tax are treated as if they exist in their own separate universe.

While any gains you make from speculative activities are simply taxed at your applicable slab rates, just like other business income, it's the handling of losses that draws a firm line in the sand. This distinction has massive implications for your financial planning and tax compliance.

The Strict Rule of Set-Off for Speculative Losses

The single most important rule to grasp is how speculative losses are handled. Under Section 73 of the Income Tax Act, a loss from any speculative business can only be set off against the profit from another speculative business. This is a complete departure from how non-speculative business losses are treated.

What does this mean in plain English? You can't use a loss from your intraday trading to lower your taxable income from your day job, your rental properties, or even your primary, non-speculative business. It's completely ring-fenced.

InsightsThis isn't an accident; it's a deliberate policy. The tax authorities see speculative activities as fundamentally different and far riskier than mainstream business. By isolating these losses, the law prevents taxpayers from using high-stakes trading to conveniently slash the tax bill on their more stable, primary income sources.

A Practical Example of Loss Set-Off

Let's walk through a real-world scenario to see how this plays out. Imagine a professional with the following financial picture for the year:

Salary Income: ₹12,00,000

Profit from a manufacturing business (non-speculative): ₹5,00,000

Profit from speculative business A (intraday stock trading): ₹2,00,000

Loss from speculative business B (commodity futures): ₹3,00,000

First, we net out the speculative activities: a ₹2,00,000 profit minus a ₹3,00,000 loss results in a net speculative loss of ₹1,00,000.

Because of the strict set-off rule, this ₹1,00,000 net speculative loss cannot be touched. It can't be used to reduce the salary or the manufacturing profit. The taxpayer's total taxable income remains ₹17,00,000 (₹12,00,000 + ₹5,00,000), and that ₹1,00,000 loss has to be carried forward. For active traders, it’s also crucial to understand concepts like the wash sale rule to report gains and losses accurately.

The Four-Year Carry-Forward Limitation

So, what happens to that ₹1,00,000 speculative loss that couldn't be used? The law allows you to carry it forward, but the clock is ticking. A speculative business loss can only be carried forward for a maximum of four assessment years after the year the loss was incurred.

In our example, the ₹1,00,000 loss moves to the next financial year. During that year, and for three more after, it can only be set off against future speculative profits. If you don't generate enough speculative gains within that four-year window, the loss simply evaporates and can no longer be claimed. This creates real pressure to generate new speculative gains just to make use of old losses.

Of course, staying on top of your tax obligations goes beyond just one section. You can check out our guide to learn more about how Section 269T compliance can impact your filings.

Keeping track of all this can be a headache, which is why proper documentation is key. A Legal AI tool like Draft Bot Pro can be a massive help here. It can analyse trade logs and financial statements to automatically flag and separate speculative transactions. This ensures you calculate gains and losses correctly, apply the set-off rules properly, and file returns that minimise your risk of getting flagged by the tax authorities.

How Courts Interpret Speculative Transactions

While the Income Tax Act lays down the black-and-white rules for what constitutes a speculative business in income tax, it's the courts that truly colour in the details. Landmark judicial decisions have been absolutely critical in shaping how these rules are applied in the real world, often pushing past mere technicalities to uncover the real heart of a transaction.

When you sift through these judgments, two core legal principles surface time and again: the intention of the parties and the doctrine of substance over form. These principles give tax authorities and judges the power to peel back the layers of a deal and figure out if it was a genuine business transaction or just a speculative gamble dressed up in paperwork.

Substance Over Form: The Guiding Principle

The "substance over form" doctrine is a cornerstone of tax law. In simple terms, it means the actual economic reality of a transaction is far more important than how it's labelled or structured on paper. Courts lean on this principle heavily to decide if "actual delivery" has genuinely taken place.

Think about it this way: a rapid-fire series of buy-and-sell trades where shares are credited and almost immediately debited from a DEMAT account might technically look like "delivery." But the courts will look closer. They’ll scrutinise these patterns to see if the real intention was ever to hold those shares as an investment. If the sole purpose was to cash in on tiny, fleeting price shifts, the substance of the deal is speculative, no matter what the superficial form of delivery suggests.

InsightsThe Supreme Court has repeatedly stressed that the words "actual delivery" in Section 43(5) mean a real transfer of ownership with the intent to actually possess the asset, not just a blink-and-you-miss-it book entry designed to sidestep the law. This judicial stance stops people from creating sham delivery trails to disguise what is, at its core, speculative trading.

Intention of the Parties: A Decisive Factor

Beyond the mechanics of delivery, the intention of the people involved plays a massive role. The judiciary consistently asks: what was the real motive behind this contract? Was it to acquire goods for a legitimate business need, or was it purely to bet on where the price would go next?

Several landmark cases have cemented this principle.

CIT vs. Shantilal P. Ltd: In this influential case, the court made it clear that the assessee's intention at the very moment of entering the contract is what matters most. If the plan was always to settle the deal by paying price differences without any real desire to take or give delivery, the transaction is speculative from the get-go.

Davenport & Co. Pvt. Ltd. vs. CIT: This judgment added another layer, clarifying that the intentions of both parties to the contract are important. If one person intended actual delivery while the other didn't, the whole situation needs a careful look based on all available evidence, like contract notes and emails.

These judicial precedents give legal professionals some serious firepower. You can move beyond a simple delivery checklist and build a solid case based on your client's genuine business motives, as long as you have the documentation to back it up. To explore more key judicial decisions, check out our deep dive into the 9 Landmark Case Laws on Income Tax You Must Know.

How Legal AI Sharpens Your Arguments

Analysing case law and building arguments around subtle principles like "intention" can be a grind. This is where a Legal AI tool like Draft Bot Pro becomes a game-changer. Instead of spending hours digging through legal databases, you can use it for surgically precise research.

For instance, you could ask Draft Bot Pro to find all High Court judgments that discuss the "substance over form" doctrine in the context of Section 43(5). The AI can instantly pull together relevant case summaries and highlight the most important judicial observations. This lets you quickly find precedents that support your client's position, turning dense legal theory into a practical weapon for building a more persuasive case before tax authorities or an appellate tribunal.

A Practical Compliance Playbook for Legal Advisors

Knowing the law around a speculative business in income tax is one thing; putting it into practice is another challenge altogether. For legal advisors, this is where the real work begins—guiding clients away from theoretical knowledge and towards meticulous, on-the-ground action. The aim isn't just to tick a compliance box but to forge an iron-clad paper trail that can withstand any scrutiny from tax authorities.

Think of it as pre-emptive defence. By setting up clear compliance protocols from day one, you drastically slash the risk of your client facing misclassification issues, disallowed loss claims, or drawn-out legal battles. This playbook offers a structured game plan to get every transaction documented and reported correctly.

The Cornerstone of Compliance: Record Keeping

Your first line of defence in any tax enquiry is always impeccable documentation. For any client juggling both speculative and non-speculative trades, maintaining separate and detailed records isn't just good practice—it's non-negotiable. This clean separation is the bedrock for applying the right tax rules to each income stream.

Here’s a quick rundown of essential record-keeping habits to instil in your clients:

Maintain Separate Books of Accounts: Insist that they keep completely distinct ledgers for speculative and non-speculative transactions. This simple act prevents the accidental mixing of profits and losses, which is a major red flag for tax officers.

Preserve All Contract Notes: Every single contract note from a broker is a crucial piece of evidence. These notes capture the time, date, price, and nature of the trade, serving as primary proof.

Document DEMAT Statements: Regular DEMAT statements are the key to proving or disproving actual delivery of shares. A clean record showing shares moving in and out of the account is your strongest argument for classifying a trade as non-speculative.

InsightsTax authorities are trained to look for patterns. A well-organised set of books that clearly distinguishes intraday trades from delivery-based investments is powerful. It demonstrates your client's intent and shows they understand and respect the law.

Drafting Tax Returns and Appeals

When it's time to file, clarity and precision are everything. The Income Tax Return (ITR) forms have specific schedules just for speculative income. Any ambiguity or sloppy reporting is an open invitation for the assessing officer to dig deeper.

Keep these drafting points in mind:

Accurate ITR Form Selection: Make sure the right form is used, like ITR-3 for individuals earning business income. This form has dedicated fields to report speculative profits and losses separately.

Clear Bifurcation of Income: In the Profit and Loss statement, speculative business income must be shown under its own head. Never merge it with regular business profits or capital gains.

Detailed Loss Carry-Forward Schedule: If your client has a speculative loss, the ‘Schedule CFL’ (Carry Forward of Losses) must be filled out perfectly. Specify the assessment year the loss occurred in and the exact amount being carried forward.

When it comes to appeals, your arguments must stand on this foundation of solid paperwork. In your written submissions, directly reference specific contract notes and DEMAT entries that back up your client's claims. An evidence-based approach will always be more persuasive than relying on legal theory alone.

For any professional navigating these complexities, a solid compliance framework is essential. The following checklist breaks down the key areas to focus on, ensuring no stone is left unturned.

Compliance Checklist for Speculative Business Activities

Compliance Area | Action Required | Key Consideration |

|---|---|---|

Record Segregation | Maintain separate books of accounts for speculative and non-speculative transactions. | Prevents co-mingling of profits and losses, which is a primary trigger for scrutiny. |

Transaction Evidence | Systematically file all broker-issued contract notes and periodic DEMAT statements. | This forms the primary evidence trail to prove the nature (delivery vs. non-delivery) of each trade. |

ITR Reporting | Report speculative income/loss in the dedicated schedule of the correct ITR form (e.g., ITR-3). | Incorrect reporting or omission is a direct compliance failure and can lead to penalties. |

Loss Set-Off & Carry Forward | Ensure speculative losses are only set off against speculative profits and correctly reported in Schedule CFL. | Cross-setting off losses is disallowed and will be reversed by the assessing officer. |

Turnover Calculation | Calculate turnover for tax audit (u/s 44AB) by aggregating the absolute value of all profits and losses. | The method is unique to speculative business; getting it wrong can lead to missed audit requirements. |

Statutory Definitions | Regularly review if any transaction falls under the exceptions listed in the proviso to Section 43(5). | Transactions like hedging or commodity trades by certain dealers are not speculative. Proper classification is key. |

Following this checklist helps create a robust and defensible position, making it much harder for tax authorities to challenge your client's filings.

Tackling Turnover Calculation for Tax Audits

One of the most common tripwires is calculating turnover for tax audit purposes under Section 44AB. The method for speculative transactions is unique and trips up even seasoned professionals.

For a speculative business, turnover isn't the total value of sales. Instead, it’s the sum of the absolute values of both profits and losses. For instance, if a client makes a profit of ₹50,000 on one trade and a loss of ₹30,000 on another, the turnover is ₹80,000 (₹50,000 + ₹30,000).

Getting this calculation right is critical for knowing whether the tax audit threshold has been met. A mistake here can result in failing to get an audit done, leading to unnecessary penalties.

For complex situations, like analysing a high volume of trades or building a case for an appeal, a Legal AI can be a game-changer. Tools like Draft Bot Pro can sift through thousands of transaction records in minutes to calculate turnover accurately or find relevant case law on Section 43(5). To see how this works in practice, you can learn more about how AI is helping tax law professionals handle these exact kinds of compliance tasks. It helps ensure your advice is not just spot-on but also delivered efficiently.

Common Questions on Speculative Income Tax

When you're dealing with the nitty-gritty of speculative business rules, a few practical questions pop up time and time again. Let's tackle some of the most common queries that lawyers and their clients grapple with, breaking them down into clear, straightforward answers to help with compliance and planning.

Can I Set Off F&O Trading Losses Against My Salary?

Yes, you can, but it's all about a critical distinction. Any profit or loss you make from futures and options (F&O) trading on a recognised stock exchange is treated as non-speculative business income, not speculative.

This is a huge exception carved out under Section 43(5) of the Income Tax Act. Because of this, a loss from F&O trading can absolutely be set off against other income heads like your salary, rental income, or interest income. Just remember, you can't set it off against capital gains.

Is Intraday Forex Trading Speculative?

Here, the answer is "it depends." Intraday trading in currency derivatives on a recognised exchange follows the same logic as F&O on stocks—it's generally treated as non-speculative.

However, if you're trading forex using non-derivative instruments and the deal is squared off without actually taking or giving delivery of the currency, it will almost certainly be tagged as a speculative transaction. The deciding factor is always the nature of the contract and how it's settled.

InsightsThe entire classification hinges on whether the transaction fits into the specific legal carve-outs for derivatives. For legal advisors, this means you have to dig into the exact platform and financial instrument the client used. Only then can you give them accurate advice on the tax treatment.

What Happens If I Forget to Carry Forward a Speculative Loss?

This one is a hard and fast rule. If you don't report a speculative loss in your income tax return for the year it happened, you lose the right to carry it forward. Period.

The law is incredibly strict here. You can't just claim an old loss in a later return if it wasn't properly declared and carried forward in the original filing. Timely and accurate reporting isn't just a good idea; it's non-negotiable.

Sorting through countless trades across different asset classes can be a real headache. Manually categorising every single transaction is where mistakes happen. This is exactly where modern legal tech tools can step in and save the day.

A Legal AI assistant like Draft Bot Pro can chew through an entire trading statement and automatically classify transactions into speculative, non-speculative, and capital gains buckets based on the Income Tax Act's rules. Just upload your client's documents, and you'll get a clean, organised summary in minutes. It ensures your filings are spot-on and that you never miss out on carrying forward an eligible loss, saving you time and preventing very costly errors down the line.

Tired of the tax compliance grind? Streamline your advisory work with Draft Bot Pro. Our AI platform helps you research complex tax laws, analyse client documents, and draft precise submissions far more efficiently. Join over 46,379 legal professionals who trust us to stay ahead. Explore how Draft Bot Pro can assist you today.