9 Landmark Case Laws on Income Tax You Must Know in 2025

- Rare Labs

- Nov 6, 2025

- 17 min read

The landscape of Indian income tax is not merely defined by statutes but is profoundly shaped by judicial precedents. For legal professionals and aspiring lawyers, a deep understanding of landmark case laws on income tax is non-negotiable. These judgements provide clarity, establish binding principles, and offer a strategic advantage in tax litigation and advisory services. They are the cornerstones upon which complex tax arguments are built and defended, transforming theoretical sections of the Income Tax Act, 1961, into practical, applicable rules.

This article moves beyond mere summaries, dissecting pivotal cases that have fundamentally defined the contours of income tax in India. We will break down each case's core facts, the court's crucial reasoning, and its lasting impact on tax practice. You will gain specific, actionable insights into how these precedents influence everything from defining income to structuring commercial transactions.

Furthermore, we will explore how a legal AI assistant like Draft Bot Pro can revolutionise how you research and apply these complex precedents. By leveraging AI, you can streamline the process of identifying relevant case law, analysing judicial reasoning, and integrating these insights into your legal arguments, making your analysis faster and more accurate. Let's begin our journey through the seminal decisions every tax professional must master.

1. Commissioner v. Glenshaw Glass Co. (1955) - Source of Income Doctrine

While an American case, Commissioner v. Glenshaw Glass Co. holds a foundational place in global tax jurisprudence, significantly influencing how tax authorities worldwide, including in India, interpret the concept of "income." The U.S. Supreme Court established a broad and enduring definition of gross income: any "undeniable accessions to wealth, clearly realized, and over which the taxpayers have complete dominion." This ruling was pivotal because it detached the definition of income from its source, meaning that money received could be taxable even if it did not arise from traditional sources like labour, business, or capital.

Legal Principle and Practical Implications

The core principle is that the form of receipt is irrelevant; what matters is the economic gain. Before this, there was ambiguity about whether punitive damages (money awarded to punish a wrongdoer) constituted taxable income. The Court concluded they did, as the recipient was unequivocally richer after receiving the payment.

This principle is crucial for Indian lawyers and students analysing the scope of Section 2(24) of the Income Tax Act, 1961, which provides an inclusive definition of income. Understanding Glenshaw Glass helps in constructing arguments for or against the taxability of non-traditional receipts like windfalls, subsidies, or certain litigation awards. When researching such complex precedents, a systematic approach is key; you can explore this further by learning more about effective legal research techniques.

Insights

This case serves as a powerful reminder that tax law often prioritises substance over form. For legal professionals, this means advising clients that any realised economic benefit could potentially attract tax liability, irrespective of its origin. This expansive view is a cornerstone of modern tax administration and a vital concept in any discussion of foundational case laws on income tax. For complex case analysis, a legal AI tool like Draft Bot Pro can be invaluable. It can swiftly summarise rulings, identify key principles from historical cases like Glenshaw Glass, and help you draw parallels to current Indian tax statutes, thereby accelerating your research and strengthening your legal arguments.

2. Eisner v. Macomber (1920) - Capital Gains and Realisation Doctrine

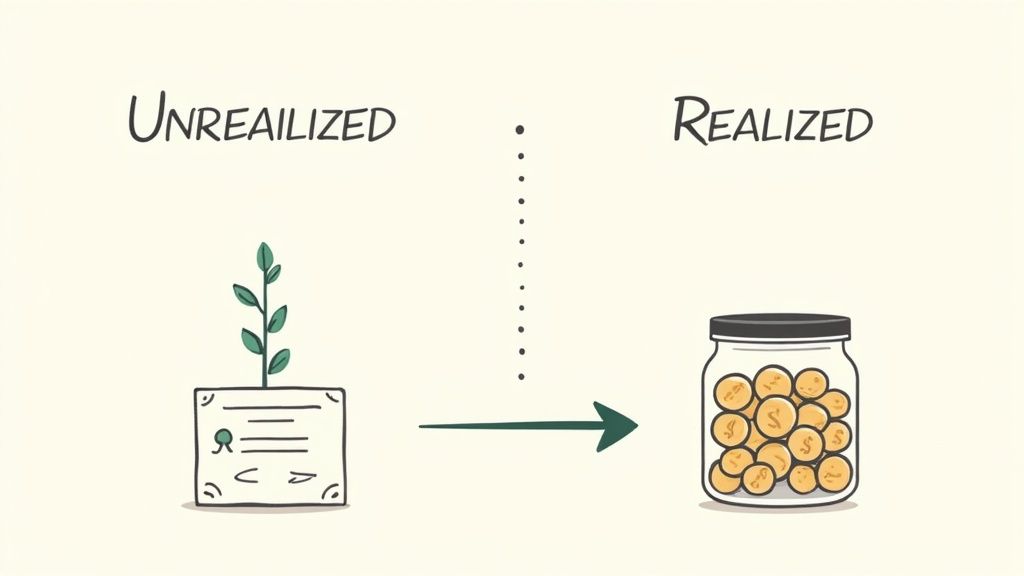

Another landmark U.S. case with far-reaching influence, Eisner v. Macomber established the crucial "realisation doctrine," a principle that underpins modern capital gains taxation globally. The U.S. Supreme Court held that income must be realised, meaning a gain must be severed from the capital and received by the taxpayer, before it can be taxed. The Court ruled that a stock dividend, which merely gives a shareholder more shares representing the same underlying ownership, was not a realisation of income but simply an adjustment of the form of capital.

Legal Principle and Practical Implications

The core principle is that a mere increase in the value of an asset (appreciation) does not constitute taxable income until that value is realised through a sale or exchange. This prevents taxpayers from being taxed on unrealised, paper gains. This doctrine is foundational to the concept of capital gains as defined under Section 45 of the Indian Income Tax Act, 1961, which triggers tax liability upon the "transfer" of a capital asset.

This distinction is fundamental for advising clients on investment strategies and corporate structuring. For instance, the ruling helps explain why holding an appreciated stock is not a taxable event, but selling it is. For a deeper dive into the practical applications of these principles, learn more about understanding capital gains taxes.

Insights

This case cemented the critical difference between wealth and income. While your wealth may increase as an asset appreciates, you only generate taxable income when that gain is realised. This principle is a cornerstone of tax planning, allowing for the deferral of tax liability. When dealing with such seminal case laws on income tax, a clear grasp of the timeline and its evolution is key. Legal AI tools like Draft Bot Pro can analyse the lineage of the realisation doctrine from Eisner v. Macomber to its application in contemporary Indian tax disputes. It can help identify how courts have interpreted "transfer" and "realisation" in complex transactions, providing a robust foundation for your legal arguments.

3. Lucas v. Earl (1930) - Income Assignment and Anticipatory Assignment Doctrine

Although an American ruling, Lucas v. Earl is a cornerstone of tax law globally and its principles deeply resonate within the framework of the Indian Income Tax Act. The U.S. Supreme Court delivered a seminal judgment establishing the "assignment of income doctrine." It held that income is taxed to the person who earns it, not to the person to whom it is assigned. The court famously articulated that one cannot prevent the "fruit" (income) from being attributed to the "tree" on which it grew (the earner). This prevents taxpayers from avoiding higher tax brackets by simply redirecting their earnings to family members or others in lower tax brackets before they receive it.

Legal Principle and Practical Implications

The core principle is that a taxpayer cannot escape taxation on income earned through personal services by contractually assigning it to another person. The legal obligation to pay tax attaches to the earner at the moment the income is generated. In this case, a husband had assigned half his future earnings to his wife, but the Court ruled that he was still liable for tax on the entire amount.

For Indian legal practitioners, this doctrine is fundamental when advising on family arrangements, partnership income distribution, and corporate structuring. It directly informs the interpretation of clubbing provisions under Sections 60 to 64 of the Income Tax Act, 1961, which are designed to counter similar tax avoidance strategies. Understanding Lucas v. Earl helps in analysing whether an income-splitting arrangement is a legitimate transaction or merely an anticipatory assignment designed to evade tax.

Insights

This case establishes a vital substance-over-form principle: tax liability follows economic reality, not contractual formalities. Legal professionals must advise clients that merely redirecting income on paper without transferring the underlying income-generating asset or activity is unlikely to shift the tax burden. This remains a crucial point of contention in many case laws on income tax. For intricate scenarios involving income assignment, a tool like Draft Bot Pro can be invaluable. It can help analyse complex contracts and family settlement deeds against the backdrop of foundational principles from Lucas v. Earl, identifying potential red flags for tax authorities and strengthening advisory opinions by referencing historical and analogous case law.

4. Old Colony Trust Co. v. Commissioner (1929) - Constructive Receipt Doctrine

Though another U.S. case, Old Colony Trust Co. v. Commissioner is a landmark ruling that introduced the doctrine of constructive receipt, a principle with profound implications for tax systems globally, including India. The U.S. Supreme Court held that if a third party (like an employer) pays an expense or liability on behalf of a taxpayer (an employee), that payment constitutes taxable income to the taxpayer. The core idea is that the taxpayer has received an economic benefit equivalent to cash.

Legal Principle and Practical Implications

The fundamental principle established is that income need not be physically received to be taxable; it is enough that a clear economic benefit is conferred and a liability is discharged on one's behalf. In this case, the employer's payment of the employee's income tax was deemed additional salary to the employee. The employee was deemed to have "constructively received" the funds used to pay their tax liability.

This doctrine is highly relevant in India for interpreting the scope of "salary" under Section 17 of the Income Tax Act, 1961, and for determining when income accrues or arises. Legal professionals must advise clients that any perquisite or benefit, even if paid directly to a third party to satisfy the employee's obligation, can be treated as taxable income. Understanding this is vital when structuring compensation packages or when responding to tax assessments. For instance, correctly handling such nuances is critical when preparing an AI-driven reply to an income tax notice.

Insights

This case underscores that the taxability of income is determined by the economic reality of a transaction, not its form. For legal advisors, this means scrutinising arrangements where benefits are provided indirectly. The key question is whether the payment discharged a personal obligation of the taxpayer. If so, it is likely taxable. This principle is a cornerstone of case laws on income tax that prevent tax avoidance through indirect payment structures. For complex scenarios involving third-party payments and perquisites, a legal AI tool like Draft Bot Pro can be exceptionally useful. It can quickly analyse case law precedents like Old Colony Trust and help you construct robust arguments about whether a particular benefit constitutes a constructive receipt under current Indian tax law, ensuring your advice is precise and well-supported.

5. United States v. O'Brien (1991) - Hobby Loss Doctrine and Profit Motive Test

While another American case, the principles from United States v. O'Brien resonate strongly within Indian tax law, particularly when distinguishing between a genuine business and a personal hobby. The U.S. Supreme Court addressed the 'hobby loss' rule, which prevents taxpayers from deducting losses from activities not engaged in for profit. This case helped solidify a multi-factor test to determine if a taxpayer possesses the requisite profit motive, making the activity a business rather than a hobby.

Legal Principle and Practical Implications

The central principle is that for an activity's losses to be deductible against other income, it must be undertaken with an actual and honest objective of making a profit. The Court endorsed a non-exhaustive, nine-factor test to ascertain this motive, looking at aspects like the manner in which the taxpayer carries on the activity, the expertise of the taxpayer or their advisors, and the time and effort expended. This framework provides a structured way to differentiate a commercial enterprise, such as a struggling agricultural venture, from a recreational pursuit like part-time consulting with no real expectation of profit.

For Indian legal professionals, this case offers a robust analytical model when advising on the deductibility of losses under Section 28 of the Income Tax Act, 1961. It is especially relevant in scenarios involving horse breeding, art collection, or boutique farming where the line between business and pleasure can be blurred. The multi-factor test helps build a compelling case to prove a genuine business intention to tax authorities.

Insights

This ruling underscores that a taxpayer's subjective intent, evidenced by objective factors, is paramount in tax assessments. It's a critical reminder that simply declaring an activity a "business" is insufficient; one must operate it with a demonstrable profit-seeking motive. This is a foundational concept in the landscape of case laws on income tax because it protects the tax base from being eroded by deductions from what are essentially personal expenditures. When dealing with such fact-intensive inquiries, a legal AI tool like Draft Bot Pro can be exceptionally useful. It can help analyse a client's situation against the established factors from cases like O'Brien, identify potential weaknesses in the profit-motive argument, and assist in structuring a defence that showcases the commercial nature of the undertaking.

6. Corn Products Refining Co. v. Commissioner (1955) - Capital Asset Definition

Although an American case, Corn Products Refining Co. v. Commissioner is a landmark ruling that profoundly shaped the interpretation of what constitutes a "capital asset." The U.S. Supreme Court held that assets integrally related to a taxpayer's ordinary course of business should be treated as ordinary assets, not capital assets, for tax purposes. This decision was instrumental in distinguishing profits arising from everyday business operations (ordinary income) from gains on long-term investments (capital gains), a distinction that remains fundamental in global tax systems, including India.

Legal Principle and Practical Implications

The core principle established is that the motive and purpose for holding an asset determine its character. In this case, a company traded in corn futures to ensure a stable supply of raw materials for its manufacturing business, not as a separate investment activity. The Court ruled that the profits and losses from these futures were part of its ordinary business income.

This precedent is highly relevant when interpreting Section 2(14) of the Income Tax Act, 1961, which defines "capital asset." For legal professionals in India, the Corn Products doctrine provides a strong basis for arguing that assets, which might otherwise appear to be capital in nature, should be treated as business assets if they are acquired and held to facilitate core business operations. For instance, hedging transactions or the acquisition of shares in another company to secure a supply chain could be assessed under this principle.

Insights

This case underscores the critical importance of a taxpayer’s intent when classifying assets. For legal advisors, this means meticulously documenting the business purpose behind acquiring and holding specific assets to justify their classification as non-capital. The ruling is a cornerstone in any analysis of case laws on income tax dealing with capital gains versus business income. Analysing the nuances of such foundational cases can be complex. Legal AI tools like Draft Bot Pro can efficiently dissect the ruling's key arguments, identify its application in subsequent Indian judgments, and help construct a compelling argument regarding an asset's true character, saving valuable research time.

7. Cottage Savings Association v. Commissioner (1991) - Realisation Through Exchange

Another landmark U.S. Supreme Court case with significant persuasive value, Cottage Savings Association v. Commissioner, clarified the crucial tax principle of "realisation." The Court addressed whether an exchange of economically similar assets (in this case, mortgage portfolios) could trigger a taxable event. It held that a gain or loss is "realised" for tax purposes when the exchanged properties are "materially different," meaning they embody legally distinct entitlements. This established that a transaction does not need to involve cash for a realisation to occur.

Legal Principle and Practical Implications

The core principle is that a change in legal rights, not just economic substance, can trigger tax consequences. The Court ruled that because the exchanged mortgages were made to different obligors and secured by different properties, they were materially different, and the S&L had realised a deductible loss.

For Indian tax professionals, this case offers a nuanced perspective on transactions that might otherwise seem like a mere substitution of assets. It is particularly relevant when analysing the taxability of property swaps, debt restructuring, or the exchange of financial instruments under the Income Tax Act, 1961. The ruling underscores the importance of examining the specific legal rights attached to assets before and after an exchange to determine if a taxable event has taken place, a key consideration in any list of important case laws on income tax.

Insights

This case teaches that form and legal entitlement can be as important as economic substance in tax law. Lawyers must advise clients that even a non-cash exchange of assets that appear economically equivalent can create a taxable gain or a deductible loss if the underlying legal rights have changed. This principle is fundamental to structuring transactions to manage tax liabilities effectively. Analysing the nuances of "material difference" can be complex. A legal AI tool like Draft Bot Pro can assist by comparing asset characteristics from different transactions described in case law, helping you build a strong argument about whether a realisation event has occurred under Indian tax statutes.

8. Knetsch v. United States (1960) - Substance Over Form and Tax Shelter Doctrine

Another seminal U.S. Supreme Court case with far-reaching influence, Knetsch v. United States is a cornerstone of anti-tax avoidance jurisprudence globally. It firmly established the "substance over form" doctrine, asserting that a transaction's tax consequences should be determined by its underlying economic reality, not its formal structure. The Court scrutinised a complex scheme involving the purchase of annuity bonds with borrowed funds, which was designed solely to generate massive interest deductions. It found the transaction to be a sham, lacking any genuine economic purpose or profit motive beyond securing a tax benefit.

Legal Principle and Practical Implications

The core principle of Knetsch is that transactions devoid of economic substance cannot be used to create tax deductions, even if they technically comply with the letter of the law. The Court famously labelled the transaction a "sham" because the taxpayer was no better or worse off financially, apart from the anticipated tax deduction. This ruling armed tax authorities with a powerful tool to disregard artificial arrangements created purely for tax evasion.

In the Indian context, this doctrine is mirrored in the General Anti-Avoidance Rules (GAAR) under the Income Tax Act, 1961, and has been cited in numerous domestic cases like McDowell & Co. Ltd. v. CTO. For legal professionals advising on complex financial structuring, Knetsch underscores the critical need to ensure that transactions have a legitimate, non-tax business purpose. Navigating such nuanced areas requires sharp analytical tools, and you can explore how technology is advancing this field by reading about AI for tax law professionals.

Insights

This case serves as a vital lesson in the perpetual battle between tax planners and revenue authorities. It confirms that courts will look through contrived arrangements to uncover the true intent. For lawyers, this means advising clients to document the commercial rationale and potential for economic profit in any significant transaction, independent of its tax effects. The ruling remains a foundational pillar in the study of case laws on income tax that address tax shelters. When dealing with transactions that could be scrutinised for economic substance, an AI tool like Draft Bot Pro can be instrumental. It can help analyse judicial precedents, identify fact patterns that courts have previously deemed to be shams, and assist in drafting opinions that robustly defend the commercial legitimacy of a client's arrangements, ensuring they stand up to regulatory scrutiny.

9. McDowell & Co. Ltd. vs. Commercial Tax Officer (1985) - Tax Avoidance vs. Tax Evasion

The Supreme Court's judgment in McDowell & Co. Ltd. vs. Commercial Tax Officer is a landmark ruling that fundamentally altered the judicial approach towards tax avoidance in India. Moving away from the lenient Westminster principle (which distinguished between legal tax avoidance and illegal tax evasion), the Court adopted a more substance-over-form approach. It held that colourable devices and dubious methods used to avoid tax, even if technically legal, could be disregarded by tax authorities.

Legal Principle and Practical Implications

The core principle established is that tax planning is legitimate, but it must be within the framework of the law. Any scheme or transaction that has no commercial substance and is designed solely to evade tax liability can be deemed impermissible. This ruling effectively narrowed the gap between tax avoidance and tax evasion, empowering tax authorities to look beyond the legal facade of a transaction to its true economic reality.

For legal professionals, this case is a critical reference point when advising on tax planning structures. It underscores the need to ensure that any arrangement has a genuine commercial purpose beyond just tax reduction. This judgment laid the groundwork for the later introduction of the General Anti-Avoidance Rules (GAAR) in the Income Tax Act, 1961, making it one of the most significant case laws on income tax regarding anti-avoidance jurisprudence.

Insights

The McDowell ruling serves as a strong caution against aggressive tax planning that lacks commercial rationale. For lawyers and students, it highlights the judiciary's role in interpreting the spirit of the law, not just the letter. When structuring complex transactions, it is now imperative to document the commercial substance and business purpose to withstand scrutiny from tax authorities. Analysing such nuanced judgments and their legislative impact can be complex. A tool like Draft Bot Pro can efficiently trace the evolution of anti-avoidance principles from McDowell to the current GAAR regime, providing a comprehensive overview and helping you build robust, compliant tax strategies for clients.

9-Case Comparison of Income Tax Doctrines

Case / Doctrine | 🔄 Complexity | ⚡ Resources Required | ⭐📊 Expected Outcomes & Impact | 📊 Ideal Use Cases | 💡 Key Advantages / Tips |

|---|---|---|---|---|---|

Commissioner v. Glenshaw Glass Co. (1955) — Source of Income Doctrine | Moderate — three-part, fact-specific test | Moderate — factual proof of realization & dominion | High — broadens taxable income; foundational precedent | Nontraditional receipts (punitive damages, settlements, windfalls) | Document realization and control; labels won't avoid tax |

Eisner v. Macomber (1920) — Realization Doctrine | Moderate — focuses on timing of conversion | Low–Moderate — transaction timing records suffice | Significant — protects against taxation of unrealized appreciation | Stock dividends, unrealized gains, deferral planning | Retain evidence of non-conversion; use to justify deferral |

Lucas v. Earl (1930) — Assignment of Income Doctrine | Low–Moderate — principle clear but exceptions exist | Moderate — contracts and earning records needed | High — prevents assignment-based income shifting | Personal service income, attempted pre-receipt assignments | Income taxed to earner; avoid pre-assignment schemes without substance |

Old Colony Trust Co. v. Commissioner (1929) — Constructive Receipt | Moderate — determining "availability" can be nuanced | Moderate — employer/payment records and timing evidence | High — taxes income when available, not only when received | Third-party payments, employer-paid taxes, fringe benefits | Document when benefits became available; distinguish actual vs constructive receipt |

United States v. O'Brien (1991) — Hobby Loss / Profit Motive Test | High — nine-factor, highly fact-intensive | High — extensive records of operations, intent, profitability | Moderate–High — clarifies business vs hobby treatment; affects deductions | Farming, part-time ventures, loss-making activities | Keep businesslike records; weigh O'Brien factors consistently |

Moderate — depends on business purpose and ordinary-course test | Moderate — intent and business practice documentation | High — prevents mischaracterizing ordinary income as capital gains | Inventory classification, dealers vs investors, hedging positions | Document acquisition intent and ordinary course of business | |

Cottage Savings Assn. v. Commissioner (1991) — Realization Through Exchange | High — material-difference analysis can be complex | High — legal analysis & valuations for exchanged property | High — treats materially different exchanges as realization events | Mortgage/debt exchanges, property swaps, complex securities swaps | Evaluate legal rights changes; obtain valuations and legal opinions |

Knetsch v. United States (1960) — Economic Substance / Substance-Over-Form | High — subjective, evolving doctrine | High — must document business purpose and profit potential | High — invalidates tax-motivated shelters; deters artificial transactions | Tax-shelter arrangements, transactions lacking commercial purpose | Ensure genuine economic substance; maintain contemporaneous documentation |

Integrating Precedent with Modern Practice

The landscape of Indian income tax law is not a static monolith; it is a dynamic and evolving tapestry woven from legislative acts, administrative circulars, and, most importantly, judicial precedents. The landmark case laws on income tax detailed in this article, from the foundational principles of income realisation established in Eisner v. Macomber to the critical substance-over-form doctrine in Knetsch v. United States, are far more than academic exercises. They represent the core intellectual framework through which tax disputes are analysed, argued, and ultimately resolved.

For legal professionals and students, a surface-level acquaintance with these judgements is insufficient. True mastery lies in understanding the 'why' behind each ruling: the economic realities, the judicial reasoning, and the enduring principles that emerged. These cases provide the essential vocabulary for constructing persuasive legal arguments, identifying vulnerabilities in an opponent's position, and advising clients with confidence and foresight. They are the building blocks for navigating the complexities of tax planning, compliance, and litigation in today's intricate economic environment.

Key Insights and Actionable Next Steps

To truly integrate this knowledge into your practice, consider the following actionable steps:

Create a Precedent Map: For each case, diagram its influence on subsequent Indian High Court and Supreme Court rulings. This helps you trace the evolution of a legal principle and identify its current interpretation.

Conduct Thematic Research: Group these cases by theme (e.g., anti-avoidance, definition of income, capital vs. revenue) rather than just chronologically. This thematic approach strengthens your ability to apply the right precedent to a specific factual matrix your client is facing.

Simulate Case Arguments: Use the facts of these landmark cases as a training ground. Argue both for the taxpayer and the revenue, using only the legal principles available at that time. This exercise sharpens your analytical and argumentative skills significantly.

The Synergy of Knowledge and Technology

While a deep understanding of these foundational case laws on income tax is non-negotiable, the modern legal practitioner has access to tools that can amplify this expertise. The future of tax law practice is not about replacing human intellect but augmenting it with powerful technology. This is where the synergy between foundational knowledge and advanced AI becomes a game-changer.

Legal AI platforms, like Draft Bot Pro, can process vast databases of case law in seconds, identifying patterns and connections that would take a human researcher days to uncover. By leveraging such tools, you can quickly find contemporary judgements that cite these landmark cases, analyse how different judicial forums have interpreted them, and draft initial arguments with unparalleled speed and accuracy. This fusion allows you to focus on the higher-level strategic aspects of a case, secure in the knowledge that your foundational research is comprehensive and robust. Ultimately, this integration of classic legal wisdom and modern technological efficiency is what will distinguish the leading tax professionals of tomorrow.

Ready to elevate your legal research and drafting process? Discover how Draft Bot Pro can help you instantly analyse precedent, find supporting case laws on income tax, and build stronger arguments in a fraction of the time. Visit Draft Bot Pro to see how our AI-powered tools can transform your practice.