Understanding article 267 of indian constitution and its Contingency Fund

- Rare Labs

- 1 day ago

- 16 min read

When a national crisis hits—think of a super-cyclone barrelling towards the coast or an unexpected security threat—the government can't afford to wait. The standard process of getting Parliament to convene and sanction funds takes time, and in an emergency, time is the one thing you don't have.

This is precisely why the framers of our Constitution created a financial safety net: Article 267.

Decoding Article 267 and the Contingency Fund

Article 267 of the Indian Constitution is a constitutional lifeline. It establishes the Contingency Fund of India, giving the President the power to release funds immediately to deal with urgent, unforeseen expenses.

Essentially, it grants the executive branch the agility it needs to act decisively when disaster strikes, without getting bogged down in procedural delays.

What Is an Imprest Fund?

Think of the Contingency Fund as the nation's emergency cash box, held by the President on behalf of the country. It operates as an ‘imprest’—a fixed sum of money set aside for a specific purpose.

Once money is taken out, it has to be put back. The process is straightforward but crucial for maintaining accountability:

The President authorises a withdrawal to meet the immediate crisis.

After the fact, Parliament reviews and approves the expenditure.

An equal amount is then transferred from the Consolidated Fund of India to replenish the Contingency Fund, bringing it back to its original amount.

This two-step process brilliantly balances speed with oversight. The government can act fast, but Parliament retains the ultimate control over the nation's finances, reinforcing the checks and balances vital to our democracy. For more on parliamentary powers, check out our deep dive into understanding Article 247 of the Indian Constitution.

A Quick Glance at the Core Components

To break it down even further, here's a simple table outlining the key elements of Article 267. This gives you a bird's-eye view of how this constitutional provision works before we get into the finer details.

Component | Plain-Language Explanation | Constitutional Authority |

|---|---|---|

Contingency Fund | A dedicated emergency fund for unforeseen national expenses. | Article 267(1) |

Custodian | Held by the Finance Secretary on behalf of the President of India. | Contingency Fund of India Act, 1950 |

Authorisation | The President can authorise withdrawals without prior parliamentary approval. | Article 267(1) |

Replenishment | Funds withdrawn must be replenished from the Consolidated Fund after Parliament approves the expenditure. | Article 267(1) |

Nature of Fund | It is an ‘imprest’ fund, meaning it’s a fixed corpus that is restored after use. | Established by Law |

This table neatly summarises the fund's purpose and the operational mechanics that ensure both swift action and legislative control.

Origins and Initial Corpus

The need for such a fund was recognised right from the beginning. Enacted in 1950, Article 267 of the Indian Constitution laid the groundwork for the Contingency Fund of India. It authorised Parliament to create this imprest fund, which was initially set up with a corpus of ₹50 crore drawn from the Consolidated Fund of India (established under Article 266).

Insights For any lawyer working in public finance, administrative law, or disaster management, Article 267 is indispensable. It perfectly illustrates the dynamic tension between executive agility and legislative authority—a cornerstone of India's parliamentary system.

Getting a firm grip on these financial provisions is non-negotiable for legal professionals. Tools like an AI-powered legal assistant can be a game-changer here. A legal AI like Draft Bot Pro can instantly pull up the constitutional text, explain the nuances of an imprest system, and summarise related acts, saving you hours of research and helping you build a rock-solid understanding of these complex mechanisms.

The Purpose and Vision Behind Article 267

Why did the framers of the Indian Constitution feel the need for a dedicated emergency fund? The answer isn't just about money; it’s rooted in a deep, practical understanding of what it takes to govern a country, especially during a crisis. The vision behind Article 267 of the Indian Constitution was all about agility—ensuring the government could act decisively the moment disaster struck.

Picture this: a devastating flood rips through a state, leaving a trail of destruction. People need immediate shelter, food, and medical aid. Without Article 267, the government would be stuck. They’d have to wait for Parliament to convene, debate the crisis, and then pass a supplementary budget. That whole process, while crucial for maintaining financial discipline in normal times, could take days, if not weeks. In a real emergency, that’s time people simply don't have.

A Tale of Two Scenarios

To really get why the Contingency Fund is so vital, let's contrast two situations:

Scenario A (Without the Fund): A sudden economic crisis demands an urgent injection of funds to stabilise a key industry. The government sees the storm coming but its hands are tied. It can't spend a single rupee until Parliament goes through the entire legislative process. By the time the money is finally approved, the crisis has likely snowballed, causing far more damage.

Scenario B (With the Fund): The same crisis hits. This time, the President, on the advice of the Council of Ministers, can immediately authorise an advance from the Contingency Fund. This allows the government to step in right away, manage the fallout, and protect citizens. Governance doesn't grind to a halt.

This simple comparison gets to the very heart of Article 267. It gives the executive branch the speed to respond to the unexpected, without completely sidestepping Parliament's authority over the nation's finances.

Striking a Delicate Constitutional Balance

The framers of our Constitution were performing a masterful balancing act. On one hand, they needed an executive that could act with speed and authority. On the other, they were determined to prevent any misuse of public money. The Contingency Fund was their ingenious solution.

It works on a simple principle: 'act now, account later.'

The executive gets the financial firepower it needs to tackle unforeseen calamities—be it a pandemic, a natural disaster, or a sudden threat to national security. But this power isn't a blank cheque. Every rupee taken from the fund has to be justified before Parliament, which then authorises its replenishment. This ensures that while the government can act fast, the ultimate financial control stays exactly where it belongs: with the legislature.

To get a fuller picture of why this matters, it helps to understand the wider world of governmental financial concepts like debt and deficits, which really shape how a country prepares for these kinds of shocks.

Insights Understanding this original intent is crucial. The Contingency Fund isn't a backdoor for unchecked government spending. It’s a well-designed, structured safety valve for crisis management, built on a foundation of trust and accountability.

For anyone digging into the legislative history of India's financial laws, this balance is a fascinating subject. A look at the Constituent Assembly debates shows just how committed the framers were to building a government that was both powerful and answerable to the people.

This is where legal AI tools like Draft Bot Pro can be a game-changer. Instead of spending hours poring over dense historical records, a researcher can simply ask it to analyse the Constituent Assembly debates on Article 267 of the Indian Constitution. You can get a summary of the key arguments or identify the main concerns of the framers in minutes. It's a powerful way to get deeper context and enrich your legal analysis, fast.

How the Contingency Fund Works in Practice

To really get to grips with Article 267 of the Indian Constitution, you have to follow the money. The Contingency Fund isn't some abstract idea; it's a real-world mechanism with a clear, step-by-step process built for speed while keeping a firm handle on financial accountability.

Let's paint a picture. Imagine a powerful cyclone slams into a coastal state. Infrastructure is flattened, and thousands of people are left without homes. The state government needs cash, and fast, for relief and rescue—an expense that was utterly impossible to predict when the annual budget was drafted.

The Initial Trigger: Unforeseen Expenditure

The whole process kicks off when an urgent, unexpected need for money arises. This isn't for planned projects or day-to-day administrative costs. We're talking about a genuine emergency that falls completely outside the scope of any pre-approved budget.

In our cyclone scenario, the state's plea for immediate aid is a textbook case of unforeseen expenditure. The Union government sees the severity of the situation and recognises the need to get money on the ground quickly to prevent more loss of life and property.

The Role of the Executive and the President

Once the need is confirmed, the executive branch swings into action. The request goes to the President of India, who, acting on the advice of the Council of Ministers, can authorise an advance from the Contingency Fund. This is the crucial step that lets the government sidestep the otherwise lengthy process of getting Parliament's approval first.

The President's signature is the green light. There's no need to wait for Parliament to be in session. This is the executive agility that Article 267 was designed for, allowing the government to act decisively when a crisis hits.

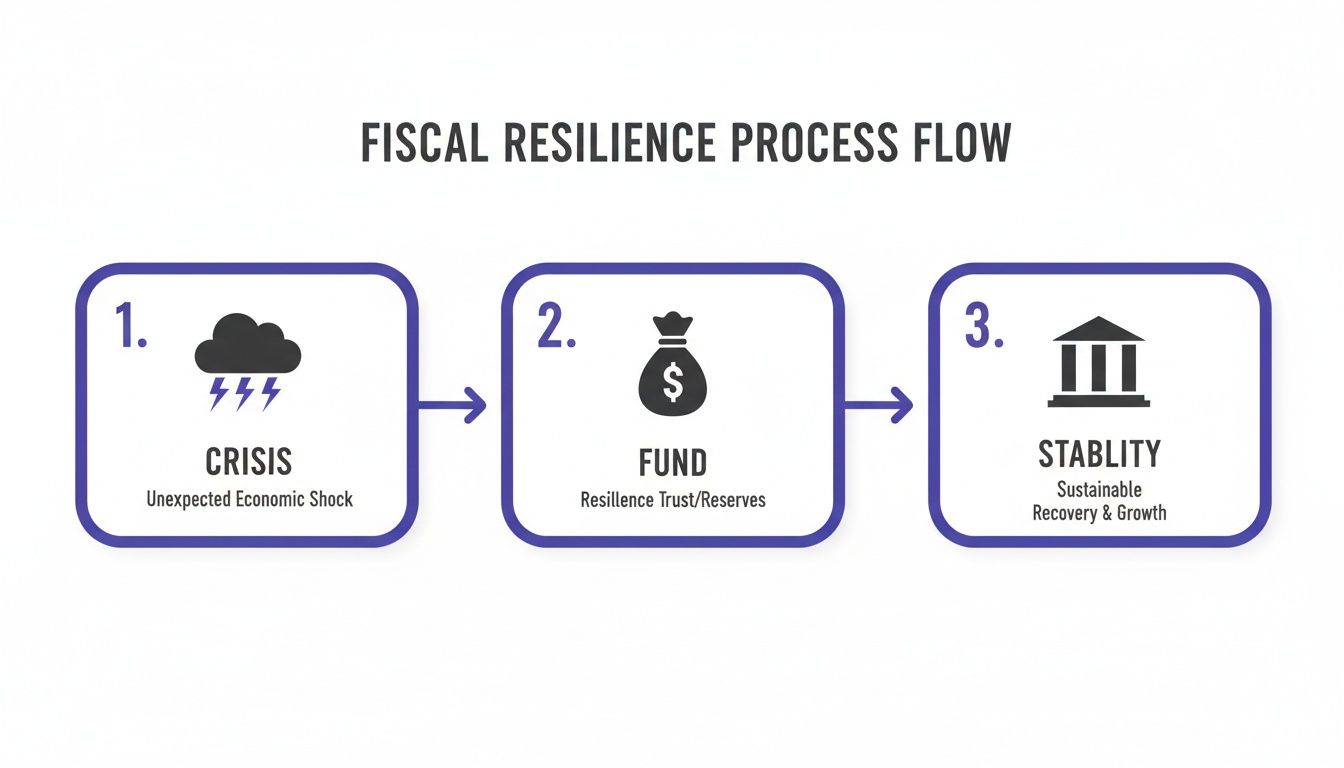

This entire flow shows how Article 267 paves the way for fiscal resilience, moving from a crisis event to deploying emergency funds and, ultimately, restoring stability.

As you can see, the fund acts as a vital bridge between chaos and control, giving the government the tool it needs to manage emergencies effectively.

From Authorisation to Disbursement

With the President's approval secured, the operational gears start turning. The Finance Secretary, on behalf of the President, releases the sanctioned amount to the relevant ministry or department. In our cyclone example, the funds would be wired quickly to manage disaster relief efforts on the ground.

These operational nuts and bolts really highlight Article 267's role in India's fiscal federalism. Just months after the Constitution came into force, The Contingency Fund of India Act, 1950, brought this provision to life. While the Finance Secretary holds the fund in custody, any advance requires a presidential warrant, which places clear responsibility on the executive. You can explore more about the foundations of India's governing framework on Wikipedia.

Insights The procedural safeguards are just as important as the fund itself. The need for a presidential warrant and the specific role of the Finance Secretary aren't just red tape; they are built-in checks to prevent misuse of this powerful financial tool and ensure every withdrawal is justified and documented.

Closing the Loop: Parliamentary Approval and Replenishment

The final—and arguably most important—step ensures that the legislature still has the final say. The money has been spent and the crisis is being managed, but the story isn't over. The executive must now go to Parliament for ex-post facto (after the fact) approval for the expenditure.

Parliament then authorises a supplementary grant to cover what was spent. This approved amount is drawn from the Consolidated Fund of India and used to top up the Contingency Fund, bringing it back to its original amount. This "act now, account later" model is a brilliant balance between speed and democratic accountability.

For legal professionals working in public finance, understanding these procedural steps is non-negotiable. Manually digging through government circulars or regulations to find the rules for these withdrawals can be a real headache. This is where a tool like Draft Bot Pro can be a game-changer. Its AI can pull up the relevant regulations, presidential orders, and parliamentary procedures related to Article 267 of the Indian Constitution in seconds, saving legal teams hours of tedious research.

Judicial Interpretation and Administrative Oversight

While Article 267 of the Indian Constitution gives the executive a powerful tool for quick action, it doesn't operate in a vacuum. Think of it as a necessary power, but one that comes with serious checks and balances. Its use is closely watched by both the judiciary and key administrative bodies, making sure this emergency financial power isn't misused. It’s a classic example of the separation of powers in action.

You won't see many direct legal challenges to Article 267 itself. Its purpose—managing crises—is something everyone generally agrees on. The real legal questions pop up when you start debating what truly counts as an 'unforeseen' expense. In these cases, the courts usually give the executive a lot of room to manoeuvre, a principle we call executive discretion.

What this means in practice is that the judiciary tends to trust the government's judgement call when it declares a crisis. The courts understand that the executive is often in the best position to judge how urgent and serious a situation is. They're hesitant to second-guess those decisions unless there's glaring evidence of bad faith or completely arbitrary action.

The Limits of Judicial Review

The courts have made it clear their job isn't to micromanage how the government spends money during a crisis. Their review is typically limited to making sure the process was followed correctly and that the action wasn't totally baseless.

A court might step in if:

The money was spent on a routine or planned event that should have been in the regular budget.

The executive's claim of an 'unforeseen' need was demonstrably false or just an excuse.

There was a clear violation of the constitutional steps for withdrawing and replenishing the fund.

But let's be realistic, proving any of these claims is tough. This judicial hands-off approach is a practical one. Emergencies demand swift, decisive action, and tying up every decision in long court battles would defeat the entire purpose of the Contingency Fund. If you're interested in how the judiciary has shaped constitutional law, it's worth reading about these 8 landmark cases in India that transformed the Constitution.

Insights The judiciary's position strikes a crucial balance. It protects the executive's power to act under Article 267 but keeps the door open to intervene if that power is used in a way that's obviously unconstitutional or random. This keeps a check on executive power without paralysing its ability to respond when it matters most.

The CAG's Watchful Eye

If the courts are the constitutional safety net, then administrative oversight is the day-to-day check on the system. And in this arena, no one is more important than the Comptroller and Auditor General (CAG) of India. The CAG is the country’s top auditor, responsible for examining all government spending.

Every single rupee pulled from the Contingency Fund is put under the CAG's microscope. This isn't just about adding up the numbers; it's a deep dive into performance and compliance. The CAG's report, which goes directly to Parliament, scrutinises whether the funds were actually used for the reason they were withdrawn and if the spending was justified.

This after-the-fact audit is a potent accountability tool. A negative report from the CAG can ignite a political firestorm and trigger intense parliamentary debate, which is a powerful deterrent against misuse. It ensures that even though the money can be accessed quickly, the accounting for it is thorough and public.

For lawyers working on public finance litigation, these CAG reports are a goldmine of evidence. However, digging through them to find what you need can be incredibly time-consuming. This is exactly where a legal AI like Draft Bot Pro can be a game-changer. Legal professionals can use its features to instantly find relevant judicial commentary or precedents on executive discretion and public funds. Its verifiable case law database ensures that any argument—whether you're challenging or defending an expenditure under Article 267 of the Indian Constitution—is built on solid legal ground, making your research faster and far more effective.

Practical Applications for Legal Professionals

Understanding Article 267 of the Indian Constitution isn't just for exams; it’s a real-world tool that gives savvy legal professionals a serious advantage. When you move past the textbook definition, you start to see how the Contingency Fund really works. It’s the key to understanding how the government’s financial machinery kicks into gear under pressure.

For a lawyer, this knowledge is gold. It bridges the gap between a dry constitutional provision and decisive legal action. Knowing exactly how and when the government can tap into emergency funds is crucial for holding power accountable, giving sharp advice to clients, and even shaping public policy through the courts.

Public Interest Litigation and Disaster Relief

For lawyers fighting on the front lines of social justice with Public Interest Litigation (PIL), Article 267 is a game-changer. When a natural disaster hits or a public health crisis explodes, the government's response time is everything. A well-argued PIL can be the very thing that compels a sluggish administration to act.

You can frame a powerful argument that the government's failure to deploy resources quickly is a direct violation of the fundamental right to life under Article 21. By pointing to the Contingency Fund, your petition proves that the state has the money to act but is choosing not to. Suddenly, the argument isn't about a lack of funds—it's about a lack of will and a failure of constitutional duty.

Insights Understanding the government's financial toolkit gives legal professionals a strategic edge. A command of Article 267 transforms a general plea for help into a precise legal demand, backed by constitutional authority, making it significantly harder for the government to justify inaction or delay.

This strategic approach is what separates an effective PIL from one that gets dismissed. If you're looking to sharpen your research game for these kinds of high-stakes cases, our guide on how to do legal research for fast, practical results is a great place to start.

Advisory Roles in Government Contracts and Procurement

It’s not just for the PIL warriors, either. Corporate and commercial lawyers can get huge mileage from understanding Article 267. During emergencies, the usual procurement rules are often fast-tracked to get essential goods and services where they're needed—think medical supplies during a pandemic or building materials after an earthquake.

These urgent contracts are almost always bankrolled by advances from the Contingency Fund. If you're advising a company that supplies to the government, you absolutely need to know the ins and outs of these emergency procedures. Your job is to guide clients on the legal framework, the payment guarantees tied to the fund, and the intense scrutiny from auditors like the CAG that will inevitably follow. It's all about managing risk in a very high-stakes environment.

Checklist for Drafting Petitions and Opinions

When you're dealing with a matter touching on Article 267, you need a structured game plan. Here’s a quick checklist to keep you on track:

Establish Urgency and Unforeseen Nature: Make it crystal clear why the situation is an "unforeseen" emergency that couldn't have been covered in the regular budget.

Reference Constitutional Duty: Connect the need for funds directly to the state's core duties, like protecting life (Article 21) or ensuring public health.

Cite Precedents on Executive Discretion: Acknowledge the government has discretion, but be ready to argue that its inaction is arbitrary, unreasonable, or just plain in bad faith.

Quantify the Need (If Possible): Use data, expert reports, or official estimates to show the scale of the crisis and how much money is actually needed for a meaningful response.

Demand Accountability: Don't just ask for the money. Frame your prayer to demand transparent accounting and a full report on spending to be tabled in the legislature later.

How Legal AI Can Accelerate Your Workflow

Let's be honest. Drafting a rock-solid PIL or a detailed legal opinion on Article 267 of the Indian Constitution means digging through case law, government circulars, and dense audit reports. That kind of research can eat up days, if not weeks. This is where a legal AI assistant like Draft Bot Pro becomes your most valuable player.

Instead of burning the midnight oil on manual research, you can use Draft Bot Pro to get a precise, well-supported first draft in minutes. Just upload the case files, relevant circulars, and CAG reports. The AI can analyse everything and draft a PIL that nails the legal provisions, weaves in the factual evidence, and builds compelling arguments. This frees you up to do what you do best: strategise and advocate for your client.

Got Questions About Article 267? We’ve Got Answers.

When you're digging into the nuts and bolts of constitutional finance, it’s easy to get tangled up. Let's clear up some of the most common questions about Article 267 of the Indian Constitution with some straightforward, practical answers.

What's the Real Difference Between the Contingency Fund and the Consolidated Fund?

Think of it like your own money management. The Consolidated Fund of India (Article 266) is your main salary account. Every rupee the government earns—from taxes, loans, you name it—gets deposited here. All regular, budgeted bills are paid from this account, but only after Parliament signs off on it.

The Contingency Fund (Article 267) is totally different. It’s more like your emergency credit card. It’s a much smaller, pre-set amount of cash stashed away for a true crisis. The President can dip into it immediately without waiting for Parliament's approval, but here's the catch: every rupee taken out must be paid back from the main salary account once Parliament eventually approves the expense.

Insights This isn't just a technicality; it's the heart of Indian public finance. The Consolidated Fund is for planned, everyday governance that's firmly under legislative control. The Contingency Fund is for the executive to act fast in an emergency, with legislative oversight coming after the fact.

Can the Government Use the Contingency Fund for Just Any Expense?

Not a chance. Its use is incredibly specific: it’s only for expenses that are both ‘unforeseen’ and ‘urgent’. This is the non-negotiable rule of Article 267.

You can't use it for routine government salaries, planned infrastructure projects, or anything that could have been predicted during the annual budget session. It's strictly for genuine emergencies where waiting for Parliament would cause serious damage.

A few classic examples include:

Kicking off immediate relief efforts after a sudden natural disaster like an earthquake or cyclone.

Funding an urgent public health response to a new pandemic.

Dealing with an unexpected national security threat that needs money right now.

The President has to be satisfied that an urgent need exists, but that decision isn't a blank cheque. It gets scrutinised later by both the Comptroller and Auditor General (CAG) and Parliament itself.

How Big is India's Contingency Fund Right Now?

The Constitution doesn't set a fixed amount. Instead, it wisely gives Parliament the power to decide the size of the fund by passing a law. This means the fund can grow as the country's economy and potential needs expand.

It started with a modest corpus of ₹50 crore back in 1950. Over the years, it's been topped up several times. The most dramatic increase came in 2021, when the fund was boosted from ₹500 crore all the way to ₹30,000 crore through the Finance Act. The Finance Secretary holds this fund on the President's behalf. For the most up-to-date figure, you always have to check the latest Finance Act.

Who’s Actually in Charge of the Fund Day-to-Day?

While the President of India is the one who gives the green light for withdrawals, the daily handling of the money falls to a top civil servant. The Finance Secretary to the Government of India is the custodian of the Contingency Fund, acting on behalf of the President.

When the President authorises a withdrawal, it's the Finance Secretary’s job to get the money out and transfer it to the right ministry. This keeps the operational side of things squarely within the Ministry of Finance, making sure proper financial discipline is maintained, even in a crisis.

Do States Have Their Own Contingency Funds?

Yes, absolutely. India's federal structure is reflected here. Article 267 of the Indian Constitution creates a framework for emergency funds at both the central and state levels.

Article 267(1) sets up the Contingency Fund of India for the Union Government.

Article 267(2) gives State Legislatures the power to create their own "Contingency Fund of the State" through law.

The state-level fund works exactly the same way. It's at the disposal of the State's Governor, who can approve advances for unforeseen needs. Later, the State Legislature has to pass a law to authorise the expenditure and pay the money back into the fund. It's a parallel system designed to give states the same financial agility to handle local emergencies.

How Can Draft Bot Pro Help Me Research Article 267?

When you need to go deeper than a simple FAQ, a legal AI assistant is a game-changer. Draft Bot Pro is built to make constitutional research faster and more insightful for legal pros and students.

You can use its AI Legal Research feature to ask pointed questions like, "Summarise landmark cases on executive discretion in financial matters" or "What are the procedural differences for withdrawal from the Union vs. a State Contingency Fund?" The AI will pull answers directly from constitutional text, statutes, and relevant case law.

Even better, the 'Chat with PDF' feature is a lifesaver. You can upload a dense CAG audit report or a complex academic paper on public finance, then ask the AI to summarise the key takeaways, create revision notes, or just explain a tricky concept in plain English. It turns overwhelming documents into actionable intelligence.

Ready to make your legal research and drafting faster and more accurate? Join over 46,379 legal professionals in India who trust Draft Bot Pro. Discover how our AI-powered tools, built by lawyers for lawyers, can support your work. Visit us at https://www.draftbotpro.com to get started.