Mastering the Trust Deed Format in India

- Rare Labs

- Nov 11, 2025

- 14 min read

A trust deed's format is the very skeleton of the trust itself. Think of it as the legal architecture that lays out the rules, the purpose, and the day-to-day management of the trust here in India. It's the foundational blueprint ensuring the trust's assets are handled exactly as the creator intended. Getting this format right isn't just about ticking a box; it's absolutely critical for the deed's legal validity and for clear operations down the road.

Understanding the Foundation of Your Trust Deed

Before you even think about drafting the first clause, you need to get your head around what a trust deed really is and why its structure is so vital. A properly formatted trust deed is more than a formality—it's the constitution for your trust. It’s a legally binding document designed to head off any ambiguity or future squabbles. It provides a crystal-clear roadmap for how the trust will function for years, sometimes even decades.

This is the document where you spell out who's involved and exactly what their role is. Nail this part, and you ensure everyone understands their duties and rights from day one.

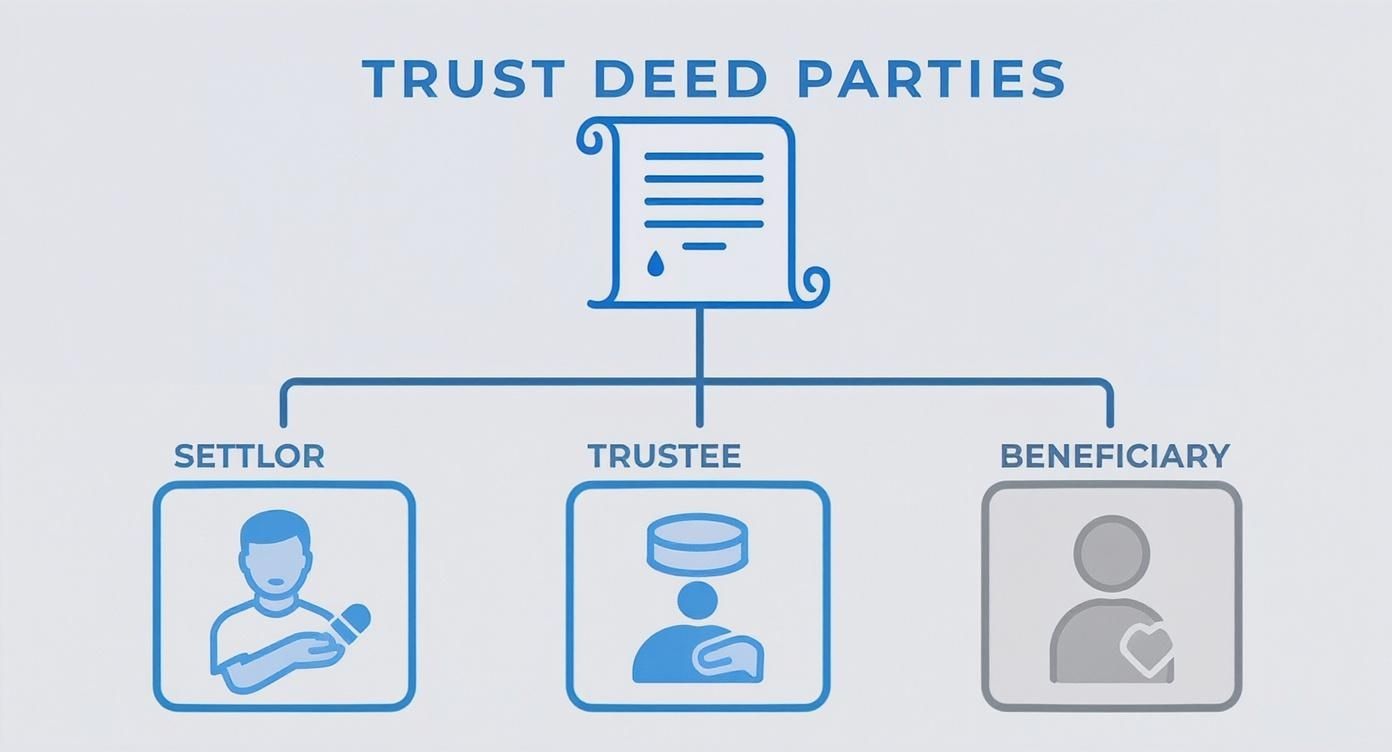

The Key Parties in a Trust

Every trust has three main players, and each has a very specific and distinct job to do. It's helpful to have a quick reference for who's who.

Key Parties in a Trust Deed

Role | Description | Primary Responsibility |

|---|---|---|

The Settlor | The individual or entity who establishes the trust and puts their assets into it. | To define the trust's purpose, appoint trustees, and transfer the initial assets. |

The Trustee | The person(s) or entity appointed to manage the trust. | To manage and invest trust assets prudently, acting in the best interests of the beneficiaries (a fiduciary duty). |

The Beneficiary | The person, group, or entity who will benefit from the trust. | To receive the income or assets from the trust as specified in the deed. |

Getting these roles clearly defined in the deed is the first step towards a functional and legally sound trust.

Public vs Private Trusts

The whole point of your trust will dictate its structure. In India, trusts generally fall into one of two buckets:

Private Trusts: These are set up for the benefit of specific, named people, like your family members. You'll see these all the time in estate planning and for protecting family wealth.

Public Trusts: These are established for broader, more public-facing goals—think charitable, religious, or educational work that benefits the community at large. Unsurprisingly, these come with stricter regulatory hoops to jump through.

Figuring out which category your trust falls into is step one in choosing the right trust deed format. Here in India, the trust deed is the primary legal instrument for both types, largely governed by the Indian Trusts Act, 1882. It absolutely must detail the trust's purpose, the duties of the trustees, and the rights of the beneficiaries to hold up in court. You can find more insights about the legal requirements for Indian trust deeds if you want to dig deeper.

Insights: The clarity of your trust deed directly impacts whether it can be enforced. Vague language about the roles of the Settlor, Trustee, or Beneficiary is one of the most common reasons these documents end up being challenged in court. Defining these roles with absolute precision isn't just a good idea—it's non-negotiable.

For anyone tackling a more complex deed, a Legal AI like Draft Bot Pro can be a real game-changer. It helps structure these initial, foundational sections with compliant templates, making sure the language you use to define roles and objectives is legally precise. It really helps you build a solid legal foundation right from the get-go.

Anatomy of a Legally Sound Trust Deed

Alright, let's move from theory to practice. A solid trust deed isn't just a single document; it's a carefully assembled framework of essential clauses. Each piece has a specific job, and when they come together correctly, they create a robust legal structure that leaves no room for confusion. Understanding the 'why' behind each part is the key to drafting a document that holds up under pressure and actually does what you intend it to do.

At its most basic, a trust deed needs to clearly identify everyone involved. This infographic lays out the core relationships.

As you can see, the Trust is the central entity. The Settlor creates it, the Trustee manages it, and the Beneficiary benefits from it. This shows the clear flow of responsibility and benefit.

The Declaration of Trust

This is the very heart of the document. The Declaration of Trust is where the Settlor formally states their intention to create a trust. It’s a clean, direct proclamation that specific assets are being set aside for a particular purpose.

Think of it as the foundational "I hereby create this trust" moment. This clause is what legally brings the trust into existence and binds everyone to its terms. It’s not just a formality; it's the legal switch that turns the whole arrangement on.

Defining the Trust Property

You can’t have a trust without something of value in it. This section must meticulously list every single asset being transferred. For immovable property, this means the full legal description, address, and all relevant title information. No shortcuts here.

For things like cash, shares, or even jewellery, the description needs to be just as precise. Vagueness is a recipe for future legal battles. Just writing "my investments" won't cut it; you need to specify account numbers, share certificate details, or other unique identifiers.

Insights: A common—and critical—mistake is forgetting to update the deed when more assets are added down the line. A clear schedule of properties should be attached, and the deed itself must explain how future assets can be added to the trust.

Articulating the Trust's Objectives

So, why does this trust exist in the first place? The objectives clause provides the answer. For a private family trust, the goal might be "to provide for the education and welfare of my minor children." For a public charitable trust, it could be "to provide free medical aid to the underprivileged in the district."

This clause becomes the Trustee’s guiding star. Every single decision they make must align with these stated objectives. Fuzzy goals like "for the family's benefit" are a nightmare because they’re wide open to interpretation and can easily lead to disputes. The more specific, the better.

Be Specific: Instead of a vague "charitable purposes," say "running a midday meal programme for primary school children."

Be Measurable: If you can, define what success looks like.

Be Realistic: The objectives must be achievable with the assets the trust actually holds.

Drafting these clauses from scratch is a heavy lift, and pulling from outdated templates is a huge risk. If you're looking for a more modern way forward, it's worth learning about the alternative to using old templates and how technology can ensure accuracy.

Trustee Powers and Responsibilities

This section is essentially the Trustee’s rulebook. It lays out exactly what they can and cannot do with the trust’s assets. A well-drafted trust deed format will grant specific powers, like the power to invest funds, sell property, or distribute income to beneficiaries.

It also clearly defines their duties—things like maintaining proper accounts, filing tax returns, and acting impartially. Spelling out these responsibilities protects both the Trustee and the Beneficiaries by setting clear expectations from day one.

For more complex trusts, drafting these specific clauses is where a Legal AI like Draft Bot Pro really proves its worth. It can generate legally precise clauses for trustee powers based on the objectives you've already set, ensuring you cover all necessary authorisations while staying compliant with Indian law. This helps you avoid those tricky situations where a Trustee is stuck, unable to act, simply because a specific power was accidentally left out of the deed.

Alright, let's get down to the brass tacks. We've talked theory, now it's time to put pen to paper (or fingers to keyboard) and actually draft the thing. This is where the trust deed format you've carefully planned starts to take shape, turning your client's intentions into legally binding instructions.

Crafting these clauses is all about precision and foresight. Let's walk through a couple of real-world scenarios to see how different goals demand different language.

Scenario 1: The Family Education Trust

Imagine a client wants to set up a private trust solely to fund their niece's university education. The goal is incredibly specific and has a clear timeline.

This is where the Beneficiary Definition Clause has to be airtight. I've seen too many deeds use vague language like "for the family's children," which is just asking for trouble down the line. You have to be precise.

Sample Language: "The sole Beneficiary of this trust shall be [Niece's Full Name], born on [Date of Birth], for the exclusive purpose of funding her undergraduate and postgraduate education at a recognised university."

By the same token, the Trustee Powers Clause needs to give the trustee the right kind of authority. Think about it – you'd want them to have the power to make conservative investments and, crucially, to pay the university fees directly.

Scenario 2: The Community Healthcare Trust

Now, let's switch gears. Picture a public charitable trust aimed at providing free medical services in a particular district. The scope here is much wider, and the clauses need to reflect that.

The Objectives Clause is your guiding star. It has to be detailed enough to keep the trustees on the straight and narrow and ensure the trust doesn't lose its charitable status.

Sample Language: "The primary objective of this trust is to establish and operate a free mobile medical clinic providing primary healthcare services to the residents of the [Name of District], with a focus on maternal and child health."

Getting this level of detail into your trust deed format from the outset is what stops the mission from drifting over time.

Insights: One of the most critical, and yet most frequently forgotten, clauses is the Residuary Clause. This little gem dictates what happens to any leftover trust assets after the main goals are fulfilled. Skipping it can ignite messy legal battles over the remaining funds. It's a simple addition that can save a world of headaches.

When you're tackling a complex document like this, using an outline generator tool can be a lifesaver. It helps you structure your thoughts and ensures you don't miss crucial elements like that residuary clause. It’s about building a solid framework before you start laying the bricks.

Of course, even the best outline is nothing without the right words. If you're looking to really hone your phrasing, you might want to check out our deep dive on how to improve your legal drafting skills in our detailed guide.

The real challenge is making sure every single clause isn't just clear, but also fully compliant with current Indian law. This is where having an AI co-pilot like Draft Bot Pro in your corner makes a huge difference. It can generate compliant clause templates for your specific scenario, whether it's a small family fund or a massive charitable foundation. Even better, Draft Bot Pro can review the clauses you've drafted yourself. It's brilliant at flagging ambiguous phrasing and suggesting clearer, more legally robust alternatives. Think of it as a final, critical check that helps you spot common drafting traps before they become serious liabilities.

Common Drafting Pitfalls and How to Avoid Them

Even seasoned professionals can fall into common traps when drafting a trust deed. Here’s a quick look at some frequent mistakes I’ve seen and, more importantly, how to steer clear of them.

Common Mistake | Potential Consequence | Recommended Solution |

|---|---|---|

Vague Beneficiary Descriptions | Disputes among potential beneficiaries, unintended inclusions/exclusions, and potential for litigation. | Name beneficiaries specifically (e.g., "[Full Name], DOB [Date]"). If defining a class, use clear, unambiguous criteria (e.g., "all children born to..."). |

Ambiguous Trustee Powers | Trustees may lack the authority to act effectively, or they might overstep their bounds, leading to legal challenges. | Explicitly list key powers (e.g., "power to invest in equities," "power to sell real property") and any specific limitations. |

Omitting a Residuary Clause | Uncertainty over how to distribute remaining assets after the trust's purpose is fulfilled, often requiring court intervention. | Always include a clause specifying how residual funds or assets should be handled, such as donating them to a specific charity or distributing them to named individuals. |

Ignoring Revocability Terms | The settlor may be unable to amend or dissolve the trust, even if circumstances change dramatically. | Clearly state whether the trust is revocable or irrevocable. If revocable, outline the exact procedure for amendment or termination. |

Avoiding these simple errors can drastically improve the strength and clarity of your trust deed, ensuring it functions exactly as intended for years to come.

Navigating Registration and Stamp Duty

So, you've got a perfectly drafted trust deed. That's a great start, but the job is only half done. A document, no matter how brilliantly written, is legally powerless in India until it's properly executed, stamped, and registered.

If you skip these steps, your entire trust deed format becomes unenforceable. It's little more than a piece of paper with good intentions, which won't hold up when it matters.

This final, crucial phase is governed by two key pieces of law: the Indian Stamp Act, 1899, and the Registration Act, 1908. Think of them as the procedural backbone that gives your trust deed its legal teeth.

Understanding Stamp Duty

Before you can even think about registration, your trust deed has to be executed on non-judicial stamp paper of the correct value. Stamp duty is essentially a tax on legal documents, and the amount can vary wildly from one state to another.

The calculation is typically a percentage of the value of the property or assets you're putting into the trust. For instance, a trust with immovable property worth a significant sum will attract a much higher stamp duty than one starting with just a nominal cash corpus. Getting this calculation wrong can mean penalties or your document getting flat-out rejected at the registrar's office.

Insights: The consequences of getting this wrong are severe. An improperly stamped document can't be used as evidence in court. Imagine the nightmare if the trust's validity is ever challenged. It's a procedural hurdle with massive substantive implications.

The Registration Process

Once the deed is properly stamped, the next stop is the Office of the Sub-Registrar of Assurances. You need to go to the one that has jurisdiction over the property or where the parties reside.

Registration is absolutely mandatory for any trust involving immovable property. If your trust only deals with movable assets (like cash or shares), registration is optional. However, I always recommend it. It creates an undeniable public record of the trust's existence, which can save a lot of headaches down the line.

To make sure things go smoothly, you'll need to have your documents in order. Typically, you'll need:

The original, correctly stamped trust deed.

Proof of identity and address for the settlor and all trustees.

Two passport-sized photos of each person involved.

No Objection Certificates (NOCs), if they apply to your situation.

Trust compliance in India, especially for public and charitable trusts, has been under a regulatory microscope lately. The Ministry of Home Affairs has been strict with enforcement under the Foreign Contribution Regulation Act (FCRA), leading to the cancellation of many non-compliant organisations. This just goes to show how critical it is to get every procedural detail right from day one. To dig deeper into the legal side of things, check out our guide on how to do legal research for fast results.

Figuring out the specific stamp duty and registration rules for each state can be a real grind. This is where a Legal AI like Draft Bot Pro comes in handy. The AI can help you quickly find the latest state-specific stamp duty rates and registration checklists. It ensures you have all the right information and paperwork ready before you even set foot in the Sub-Registrar's office. A simple check like this can save you from multiple trips and a lot of frustration.

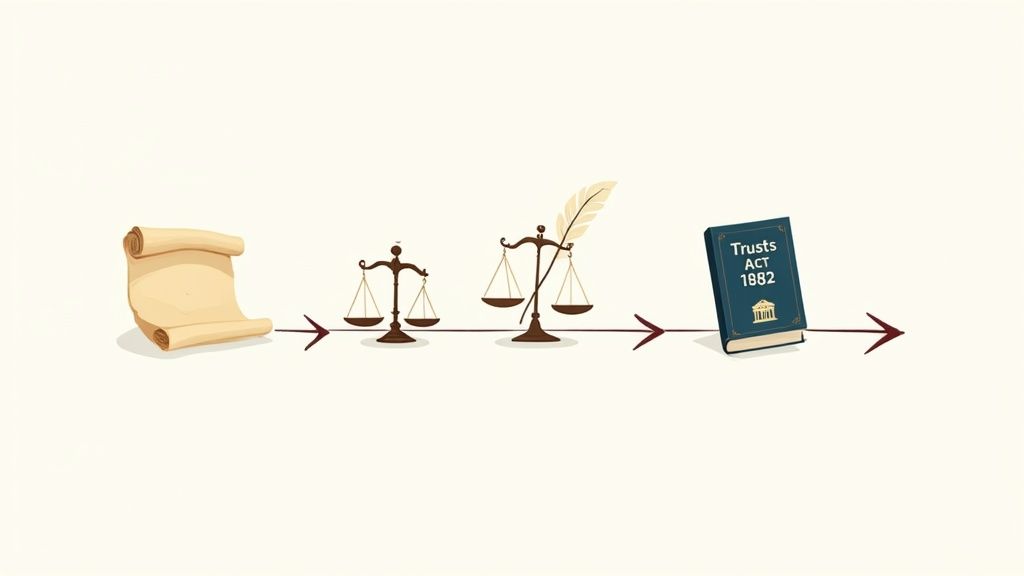

Historical Insights on Modern Trust Law

To get a real handle on the modern trust deed format, you have to look back. The idea of a trust isn't some new-fangled legal invention. Its origins in India are incredibly deep, existing long before anyone thought to write formal laws about it. When you understand this evolution, it clicks why today’s deeds are put together the way they are.

The story of the trust deed in India is really a story of adaptation. Early forms of trusteeship were already present in indigenous Hindu and Muslim laws, typically used for things like religious endowments or ensuring family succession. Before the British stepped in to codify everything, judges had to settle disputes by leaning heavily on English principles of equity.

The real game-changer was the Indian Trusts Act of 1882. This was the moment a proper, structured legal framework for private trusts finally came into being. You can dig deeper into this fascinating mix of customary and statutory law that shapes Indian trusts today. This history isn't just a trivia point; it directly impacts the clauses you’ll be drafting.

From English Equity to Indian Law

The British didn't just copy and paste their legal principles. These concepts had to be shaped and moulded to fit the unique social and cultural realities of India. It’s this fusion that explains why the duties and powers of a trustee are defined so meticulously in a modern trust deed.

The whole point was to prevent the mismanagement of assets—a huge problem when there was no formal legal structure to fall back on. This context is exactly why clauses spelling out a trustee's fiduciary duty are the absolute heart of the document. They are a direct legacy of the need to bring order and accountability to the table.

Insights: When you draft a deed, you're not just filling in a template. You're participating in a legal tradition that's well over a century old. Knowing this helps you appreciate that the formalities aren't just arbitrary rules; they are crucial safeguards built on decades of real-world legal experience and precedent.

Modern Drafting with Historical Awareness

This historical backdrop makes it crystal clear why precise drafting is so important. Many of the compliance headaches we see today come from deeds that just don't respect these foundational principles. A vaguely defined objective or an ambiguous power given to a trustee can completely undermine the very structure the 1882 Act worked so hard to establish.

This is where a Legal AI like Draft Bot Pro can be a lifesaver. By using its AI, you can generate clauses that are not only compliant with current laws but also honour the spirit of Indian trust law. The platform helps you build a trust deed format that is both technically correct and historically sound. In essence, Draft Bot Pro ensures your document is built on a solid foundation, connecting a long and rich legal history with the practical demands of today's legal work.

Still Have Questions About Trust Deed Formats?

Even with a solid guide, a few specific questions always seem to pop up when you're putting the final touches on a trust deed. It's completely normal. The nuances can be tricky, so let's walk through some of the most common queries I hear.

Can a Trust Deed Be Changed or Revoked?

This is probably the most fundamental question, and the answer comes down to one crucial decision made right at the start: was the trust set up as revocable or irrevocable?

If the deed explicitly states the trust is 'irrevocable', you’ve essentially locked the box. Making changes is incredibly difficult and almost always requires getting a court order, which is only granted under very specific, limited circumstances.

On the flip side, a 'revocable' trust is built for flexibility. It will contain a specific clause giving the settlor the power to tweak the terms or even dissolve the whole thing. This initial choice has massive implications down the line for things like asset protection and tax planning.

What Is the Difference Between a Trust and a Will?

It's easy to get these two confused, but they serve very different functions. A will is a fairly straightforward document that only kicks into gear after a person has passed away. It simply guides how their estate is distributed through a court process called probate.

A trust, especially a 'living trust', is a different beast altogether. It can be active and operational during the settlor's lifetime. This is a game-changer because it allows for the management and transfer of assets both before and after death, often letting your beneficiaries skip the long, drawn-out, and very public probate process.

Insights: One of the biggest advantages of a trust is privacy. Once a will enters probate, it becomes a public record. Anyone can walk in and see the details of your estate. A trust, however, stays private. Your financial affairs and who gets what remain confidential.

Is It Mandatory to Register a Trust Deed?

Whether or not you need to register the deed really depends on the type of trust and what assets it holds. Here’s a simple breakdown:

Immovable Property: If the trust involves any kind of immovable property—think land or a building—then registration under the Registration Act, 1908, is absolutely mandatory. No exceptions.

Movable Property Only: For a private trust holding only movable assets like cash, shares, or jewellery, registration is technically optional. But I always recommend it. It adds a powerful layer of legal validity that can save a lot of headaches later.

Public Charitable Trusts: These are a special case. They must be registered with the right authorities to legally accept donations and, crucially, to qualify for any tax exemptions.

How Can Draft Bot Pro Help Review My Deed?

Getting a second pair of eyes on your draft before it’s finalised is non-negotiable. This is where a Legal AI like Draft Bot Pro can be your best friend. It acts as an AI-powered review partner, giving your document a thorough compliance check.

You just upload your deed, and it scans for any ambiguous phrasing, missing clauses, or internal contradictions that you might have missed. It cross-references your draft against current legal standards, flagging potential risks. Think of it as that critical last check that gives you complete confidence before signing.

Ready to draft legally sound documents with greater speed and accuracy? Draft Bot Pro is the AI assistant built by Indian lawyers, for Indian lawyers. Create, research, and review your legal documents with an AI that understands the nuances of Indian law. Join over 46,000 legal professionals and see the difference for yourself at https://www.draftbotpro.com.