Maharashtra Ownership of Flats Act: Guide to maharashtra ownership of flats act

- Rare Labs

- Dec 11, 2025

- 18 min read

The Maharashtra Ownership of Flats Act (MOFA) of 1963 is a foundational piece of consumer protection law in Maharashtra. Long before RERA came onto the scene, MOFA was the original rulebook designed to shield homebuyers from questionable developer practices and regulate the sale, management, and transfer of flats.

Understanding the Foundation of MOFA

Before the Real Estate (Regulation and Development) Act (RERA) arrived in 2016, the Maharashtra Ownership of Flats Act (MOFA), 1963, was the primary shield for anyone buying property in the state. Just imagine trying to buy a home in a booming city like Mumbai or Pune back in the 1960s. The real estate market was a bit like the Wild West—largely unregulated, leaving buyers at the mercy of vague agreements and developers who didn't always play fair.

MOFA was enacted to bring some much-needed order to this chaos. It was one of India's first housing laws to focus squarely on the rights of flat owners, introduced to tackle a major housing crunch and widespread developer misconduct. By creating a clear legal framework, MOFA’s goal was simple: protect flat buyers from being exploited and bring transparency to property deals. You can read more about the historical context and ongoing relevance of MOFA on housiey.com.

Key Objectives of the MOFA 1963

The Maharashtra Ownership of Flats Act was created with several core goals in mind, all aimed at protecting the interests of homebuyers and bringing discipline to the real estate sector. The table below summarises the main objectives that formed the bedrock of this landmark legislation.

Objective | Impact on Flat Buyers |

|---|---|

Mandate Written Agreements | Required developers to execute a detailed, registered agreement before taking a large deposit, ending vague verbal promises. |

Ensure Transparency | Compelled developers to disclose project plans, specifications, and financial details upfront, giving buyers a clear picture of what they were purchasing. |

Regulate Financial Dealings | Introduced rules on how developers could handle funds collected from buyers, preventing money meant for construction from being misused. |

Facilitate Handover of Title | Made it the developer's duty to form a legal body (like a cooperative society) and transfer the building and land title to it. |

In essence, these objectives worked together to level the playing field, ensuring that buyers had a legal safety net and developers were held accountable for their commitments.

The Core Mission Behind MOFA

At its heart, the mission of the Act was to balance the scales of power between developers and homebuyers. It did this by setting down a few non-negotiable rules that changed real estate in the state for good.

At its core, the Act's mission was to:

Mandate Clear Written Agreements: MOFA made it compulsory for developers to sign a detailed, registered agreement before accepting more than 20% of the flat's cost. This simple rule put an end to the era of handshake deals and empty promises.

Regulate Financial Dealings: The Act laid down strict rules for how developers could handle the money they collected from buyers, ensuring it was used for the intended purpose—building the project.

Ensure Proper Handover: A critical goal was making sure the developer not only delivered the physical flat but also helped form a legal entity (like a cooperative society) and, most importantly, transferred the building and land title to it.

InsightsThink of MOFA as the first-ever "terms and conditions" for real estate in Maharashtra. It forced developers to put everything in writing—from the exact carpet area and total cost to the possession date—making them legally accountable for their promises.

Why MOFA Still Matters Today

Even with the arrival of RERA, MOFA hasn’t become obsolete, especially for older housing societies built before 2017. Thousands of these buildings still rely on MOFA's provisions for critical steps like getting the conveyance of land from their builder. For countless flat owners across Maharashtra, understanding MOFA is absolutely essential—it provides the legal foundation for their rights and is often the key to unlocking the full legal ownership of their property.

For societies and homeowners navigating these old but crucial rules, modern tools can make a huge difference. A legal AI tool like Draft Bot Pro can help generate notices, review old agreements for MOFA compliance, and run verifiable legal research on specific sections of the Act. This empowers homeowners to understand their position and take the right steps with confidence.

Know Your Rights and Developer Obligations

Navigating the world of real estate can often feel like trying to read a map in a foreign language. The Maharashtra Ownership of Flats Act (MOFA) is your translator, clearly laying out the rules of engagement between you and a developer. It creates a balanced relationship where both sides have specific, legally enforceable rights and duties.

For you, the homebuyer, this isn't just about getting the keys to a new flat; it's about making sure every promise made is a promise kept. For a developer, it's about understanding that their job comes with non-negotiable responsibilities designed to protect your investment and trust.

Developer Obligations Under MOFA

Under MOFA, a developer (or 'promoter' in legal terms) isn't just a seller. They're a custodian of your investment, bound by a strict set of duties to ensure total transparency and accountability from start to finish.

Here are the big ones:

Full Disclosure: Before a single rupee changes hands, the developer has to give you the complete picture. This means showing you the property title, all approvals from municipal authorities, detailed layout plans, and a clear construction timeline. No secrets allowed.

Registered Agreement: A developer cannot legally accept more than 20% of the flat's total cost without first signing a formal, written agreement with you. This isn't just any piece of paper; it must be officially registered with the sub-registrar, making it a rock-solid, legally binding contract.

Separate Bank Account: Every rupee collected from homebuyers must go into a dedicated bank account. These funds are earmarked specifically for that project's construction and can't be siphoned off for other ventures. This rule enforces crucial financial discipline.

Timely Possession: The developer is legally bound to hand over the flat on the date promised in the agreement. And they can only do so after getting the necessary completion and occupation certificates from the local authorities.

Ignoring these obligations isn't just bad business—it's a direct violation of the law that can land the developer in serious legal trouble.

A Pro Tip: That registered agreement is your single most powerful tool. Think of it less as a receipt and more as a legally enforceable contract that details every single aspect of your purchase, from the exact carpet area to the promised swimming pool. If the developer deviates from it, you have solid legal ground to stand on.

Your Fundamental Rights as a Homebuyer

Just as developers have duties, you have fundamental rights protected by MOFA. Knowing them is what empowers you to hold your developer accountable and protect what's likely your biggest investment.

Your core rights include:

Right to a Registered Agreement: You have an absolute right to get a copy of the detailed, registered sale agreement before paying any significant amount. You can check out our guide on mastering the agreement to sale format to learn which clauses are non-negotiable.

Right to Access Documents: You are entitled to inspect all the critical project paperwork, like the land's title deed, the commencement certificate, and the approved building plans.

Right to Form a Society: This is a game-changer. MOFA gives you the power to form a cooperative housing society or a similar legal body with other owners. This is the first step toward taking collective ownership and control of your building and all its common areas.

Right to Timely Possession and Conveyance: You have a legal right to get possession of your flat on the date you both agreed on. Beyond that, the developer is legally required to transfer the title of the land and building (the conveyance) to your housing society within a set timeframe.

Resolving Common Friction Points

The rules in MOFA weren't just pulled out of thin air; they were born from real-world problems. Historically, Maharashtra’s explosive urban growth, especially in cities like Mumbai and Pune, created massive housing demand. With an urban population already past 50 million by the 2011 Census, the stage was set for malpractices like vague contracts and illegal constructions. MOFA was designed specifically to stop these issues by forcing clear, documented records of all sales.

For instance, if a developer delays handing over your flat without a good reason, they are liable to refund your money with interest. Likewise, if they drag their feet on forming the housing society or refuse to execute the conveyance deed, MOFA gives you a legal path to force their hand through a process known as Deemed Conveyance.

How Legal AI Can Empower You

Knowing your rights is one thing, but acting on them can feel overwhelming. This is where a legal AI tool like Draft Bot Pro can be a massive help. Instead of wrestling with legal jargon to draft notices or applications from scratch, you can use the AI to generate precise, MOFA-compliant documents in minutes.

Imagine your developer is delaying the society formation. With Draft Bot Pro, you can quickly draft a formal letter that cites the specific sections of the Act that obligate them to act. This doesn't just save you time; it ensures your communication is legally sound, showing the developer you're well-informed and serious about protecting your rights.

Securing Your Property with Deemed Conveyance

One of the most powerful tools MOFA gives homeowners is the path to getting final ownership transferred from the developer to the residents. This process is your legal key to unlocking full control over your property—not just the building, but the land it stands on. When a developer sells you a flat, they’re legally bound to eventually hand over the title of the land and building to the residents' collective body, usually a cooperative housing society.

This transfer, known as conveyance, isn't just a piece of paper. It's the final, critical step to becoming the true, legal owner. Without it, your society only has occupational rights. That means you can live there, but you can't redevelop, take out loans against the property, or benefit from any future increase in Floor Space Index (FSI). The developer has a deadline for this: they must initiate the conveyance within four months of the society's formation.

What Happens When Developers Delay?

It's an unfortunate reality that developers don't always follow through. They might drag their feet, or outright refuse to sign the conveyance deed, leaving the society stuck in a legal grey area. This is where Deemed Conveyance comes in—it’s your legal trump card.

Introduced as a MOFA amendment in 2008, Deemed Conveyance provides a legal remedy for societies when a promoter refuses to cooperate. Think of it as the law stepping in to say the transfer is presumed to have happened, even without the builder's signature. This gives your society the power to go to a designated authority, the District Deputy Registrar, and get the property title legally transferred into its name.

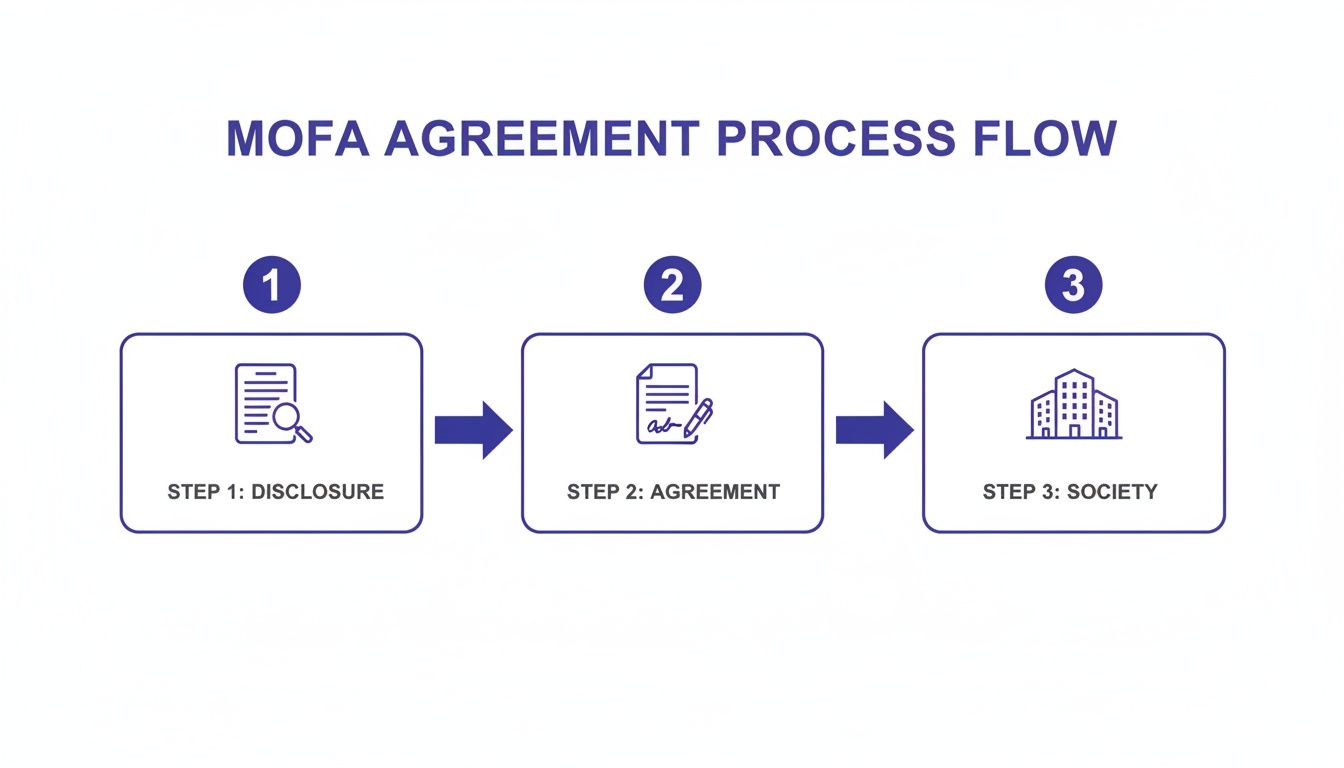

This simple flow shows the fundamental steps a developer must take under MOFA, all leading up to the formation of the society.

Deemed Conveyance acts as the crucial safety net if that final, all-important transfer step fails.

The Application Process for Deemed Conveyance

Getting a Deemed Conveyance order is a structured process that hinges on meticulous paperwork. The society has to file an application with the competent authority, backed by a whole host of documents to prove its claim over the land and building.

Here’s a look at what you’ll typically need to submit:

Application Form: The official application in Form VII, filled out correctly.

Society Registration: A copy of your society’s registration certificate is a must.

Property Records: Crucial documents like the 7/12 extract or the property card to establish the land's ownership history.

Agreements: Copies of the registered agreements for sale for every single flat, along with proof of stamp duty payment (the Index-II).

Building Plans: The society must provide copies of the approved building plans and the Commencement Certificate from the local authority.

InsightsA common roadblock for societies, especially in older buildings, is missing paperwork. Incomplete flat agreements or the lack of an Occupation Certificate can completely derail the process. It's so important to start gathering and organising these documents way ahead of time to keep things moving smoothly.

Overcoming Common Obstacles

The journey to Deemed Conveyance isn't always straightforward. You might face hurdles like an uncooperative builder or messy land records. Verifying the land title is absolutely critical; a thorough title search is non-negotiable to ensure there aren't any hidden claims or legal skeletons in the closet. For anyone navigating this, figuring out how to use AI for encumbrance certificate analysis can be a huge help in spotting hidden liabilities on the property.

How Draft Bot Pro Can Help

The Deemed Conveyance application involves drafting a number of legal documents, affidavits, and notices. A legal AI tool like Draft Bot Pro can be a massive asset here. It helps societies generate the required application forms, society resolutions, and public notices with precision, making sure everything is compliant with the maharashtra ownership of flats act. By using Draft Bot Pro, managing committees can put together a solid, error-free application, which seriously boosts their chances of getting a successful and timely order from the Registrar.

Managing Society Finances And Legal Precedents

Once a cooperative society is finally formed under the Maharashtra Ownership of Flats Act, the game changes. The focus shifts from just knowing your rights and obligations to the nitty-gritty of actually running the place. A massive part of that is managing the society's money—especially how maintenance charges are collected and spent.

This isn't just about balancing a spreadsheet; it's a serious legal responsibility. If you get it wrong, you can quickly find yourself in the middle of heated disputes with your neighbours.

The developer's job doesn't end the second they hand over the keys. MOFA is crystal clear on this: the promoter is legally on the hook for managing the building's maintenance and collecting charges until the cooperative society is officially up and running. Crucially, they have to keep a separate, transparent account for all of this.

When the society eventually takes the reins, a smooth, complete handover of these accounts is absolutely vital. It gives the new managing committee a clean start and a clear view of the building's financial health right from day one.

The Developer's Financial Duties

Think of the developer as a temporary caretaker of the building's finances before the society is formed. This period is governed by some pretty strict rules under the Maharashtra Ownership of Flats Act, all designed to protect the homeowners' money.

Here's what the developer must do:

Maintain Separate Accounts: Every rupee collected for maintenance has to go into a dedicated bank account. It can't be mixed with the promoter's other business funds. No exceptions.

Provide Full Disclosure: When it's time for the handover, the developer is required to provide a detailed statement of accounts to the society, showing every single transaction—all income and all expenses.

Hand Over Unspent Funds: If there's any maintenance money left over that was collected from flat owners, it has to be transferred directly to the society’s bank account.

This whole process is designed to prevent any financial shenanigans and make sure the society starts on solid ground, ready to manage its own affairs.

Landmark Rulings and Maintenance Fees

One of the most common battlegrounds in any housing society is how the monthly maintenance fees are calculated. Should every flat pay the same amount, or should it be based on the size of the flat? It's a question that has caused endless arguments.

Thankfully, some landmark legal cases have brought much-needed clarity.

A key judgment came from the Bombay High Court, which tackled the differences in maintenance fee rules under MOFA (1963) and the later Maharashtra Apartment Ownership Act (1970). The court clarified that for condominiums registered under the 1970 Act, maintenance fees must be calculated proportionally. This means it’s based on the apartment's size or its 'undivided share' in the common areas, not a flat rate for everyone.

This ruling is a perfect example of how different laws can completely change how financial responsibilities are structured. If you want to dive into the details of this important decision, you can find out more about the Bombay High Court's ruling on maintenance fees.

InsightsUnderstanding these legal precedents isn't just for lawyers. It's essential knowledge for every single managing committee member. If you know the legal basis for your society's maintenance fee structure, you can head off costly internal disputes before they even start and ensure your financial management is fair, transparent, and legally bulletproof.

Beyond just MOFA, it's also a great idea to explore general best practices in service charge accounting practices to pick up valuable tips for managing your society’s funds like a pro.

How Draft Bot Pro Can Help

Let's be honest, navigating the financial and legal maze of society management can be a real headache. This is where a legal AI tool like Draft Bot Pro can be a game-changer.

Imagine you're on the managing committee and need to propose changes to the maintenance fees. You can use Draft Bot Pro to draft a legally compliant notice for the general body meeting where this will be discussed. The AI can also help you research specific court judgments related to financial disputes under the Maharashtra Ownership of Flats Act, giving you verifiable case law to back up your committee's decisions.

By generating accurate minutes or resolutions, Draft Bot Pro makes sure every financial decision is properly documented, protecting the society from legal challenges down the road.

Streamlining MOFA Compliance With Legal AI

Navigating the legal maze of the Maharashtra Ownership of Flats Act can feel like a full-time job. Between the mountain of paperwork, strict deadlines, and specific legal phrases, it’s easy for homeowners and busy society committee members to feel completely overwhelmed.

Thankfully, you don’t have to go it alone. Modern tools like legal AI are changing the game. With something like Draft Bot Pro, you get a much smarter way to handle MOFA compliance. Forget spending hours hunting for the right template or second-guessing if your draft is legally sound. You can generate what you need in minutes, giving you the confidence to manage legal tasks correctly and efficiently.

Generating Essential Documents Instantly

One of the biggest headaches with MOFA is the sheer volume of paperwork. Whether you're calling a general body meeting or filing a Deemed Conveyance application, every step needs precise, compliant documents. Trying to create these from scratch is not just slow—it's risky.

This is where Draft Bot Pro steps in, acting like your personal drafting assistant. Just think about these common situations:

Notice for a Society Meeting: Need to let members know about a crucial vote on raising maintenance fees? The AI can instantly produce a formal notice that covers all required agenda points and sticks to your society's by-laws.

Application for Deemed Conveyance: This process is famous for its complex paperwork. Draft Bot Pro can generate the core application, affidavits, and public notices, making sure you don't miss any critical details.

Communication with Developers: If you need to send a formal letter demanding the developer hand over the accounts, the AI can draft a sharp, professional letter that clearly references their duties under the Maharashtra Ownership of Flats Act.

What was once a daunting legal chore becomes a simple, manageable task, leaving you with accurate and professional documents every time.

InsightsThe real game-changer here is that legal AI makes legal knowledge accessible to everyone. It gives regular homeowners and volunteer committee members the kind of tools that were once only available to seasoned lawyers. This levels the playing field, especially when dealing with developers, and helps ensure your rights are protected without a long, drawn-out fight.

Speeding Up Legal Research and Verification

Drafting is only half the battle. You also need to know exactly where you stand legally. What does Section 11 of MOFA really say about conveyance timelines? Is there a High Court judgment that backs up your society’s stance on parking spaces? Traditionally, finding these answers meant digging through dense legal books for hours.

Now, you can just ask. Draft Bot Pro’s research function lets you pose specific questions about the Maharashtra Ownership of Flats Act and get clear answers, complete with verifiable sources and relevant case law. This kind of instant information is priceless when you're prepping for a meeting or replying to a legal notice. To get a better sense of how these tools work, our guide on using an AI legal assistant in India breaks it down further.

Saving Time and Cutting Down Legal Costs

At the end of the day, you want to enforce your rights without draining your society’s bank account. By using an AI tool like Draft Bot Pro for the initial drafting and research, you can slash the time and money spent on legal consultations. You can walk into a lawyer’s office with a well-researched, perfectly drafted file already in hand.

A big part of what makes Legal AI so effective is how it structures information to deliver precise answers, a concept similar to Answer Engine Optimization. This ensures the responses you receive aren't just generic fluff but are directly relevant to your specific question under MOFA. This efficiency lets you act quickly and decisively, protecting your investment and making sure your society runs smoothly and within the law.

Turning Knowledge into Action: Checklists for Homebuyers and Societies

Knowing the ins and outs of the Maharashtra Ownership of Flats Act is one thing, but actually using that knowledge to protect yourself is a whole different ball game. To safeguard your investment and stay on the right side of the law, you need a clear, practical game plan. That's exactly what this section offers: two simple checklists, one for individual homebuyers and another for the managing committees of housing societies.

Think of these as your roadmap. They break down the complex legal duties of the Act into straightforward, easy-to-follow steps. From checking the developer’s paperwork before you even think about signing a cheque, to the long-term duties of running a society, these lists are your go-to guide for confident, compliant property ownership.

Your Checklist as a Homebuyer

For anyone buying a flat, being diligent is your best defence. Following these steps can save you from common headaches and ensure your rights under the Maharashtra Ownership of Flats Act are fully protected from day one.

Do Your Homework First: Before you even put down a booking amount, ask the developer for the property's title certificate, the approved building plans, and the Commencement Certificate. This is non-negotiable; it's your proof that the project is legit.

Get it in Writing (and Registered): Always, always insist on a registered Agreement for Sale before you pay more than 20% of the flat's total cost. Read every single clause, paying special attention to the possession date and promised amenities. Don't just skim it.

Keep a Paper Trail: Be meticulous. Keep a clear record of every single payment you make to the developer. Make sure you get an official, stamped receipt for every transaction. No exceptions.

The Magic Words: "Occupation Certificate": Do not, under any circumstances, take possession of your flat without the developer giving you the Occupation Certificate (OC) from the municipal authorities. This little piece of paper is your proof that the building is safe and legal to live in.

Form the Society: Don't be a passive observer. Get actively involved when it's time to form the cooperative housing society. This is the single most important step for you and your neighbours to take collective control of the building's management and future.

The Final Step: Conveyance: Stay on top of the society and the developer to make sure the final Conveyance Deed is signed. This is the ultimate goal – it officially transfers the ownership of the land and building from the developer to your society.

The Managing Committee's Checklist

Once the society is formed, the managing committee takes on some serious legal and financial responsibilities. This checklist covers the essentials for running a tight, compliant, and effective ship.

InsightsLet's be honest, juggling these legal steps can feel overwhelming, especially when you're dealing with complex documents. This is where a tool like Draft Bot Pro can be a real game-changer. It can help you draft legally sound notices, cross-check your sale agreement against MOFA rules, or even prepare society resolutions, making sure every move you make is properly documented and compliant.

The Official Handover: Your first job is to get a complete and formal handover of all documents from the developer. This includes all building plans, the final list of members, and all financial records.

Keep Your Books in Order: You are now required to maintain statutory records. This means keeping an updated share register, proper minute books for all meetings, and transparent books of accounts.

Manage the Money: Immediately open a bank account in the society's name. Prepare an annual budget for expenses, and make sure maintenance charges are collected and used transparently for the building's upkeep.

Annual Audit is a Must: The law requires you to conduct an annual audit of the society’s accounts. This isn't optional. It ensures financial transparency and holds the committee accountable to all the members.

Chase That Conveyance: If the developer is dragging their feet on the conveyance, don't just wait. You have the power to initiate the process for Deemed Conveyance. Act on it quickly to secure legal ownership of the property for everyone.

Got Questions About MOFA? We've Got Answers.

When you're dealing with property in Maharashtra, the Maharashtra Ownership of Flats Act (MOFA) is bound to come up. It's a foundational piece of law, but that doesn't mean it's simple. Let's tackle some of the most common questions that pop up for homebuyers and society members.

What If the Builder Drags Their Feet on Conveyance or Changes the Plans?

This is probably the most common headache we see. You've formed a society, everyone's moved in, but the builder is nowhere to be found when it's time to hand over the building and land titles. What can you do?

If your developer fails to transfer the title within four months of the society’s formation, don't panic. MOFA gives you a powerful tool: Deemed Conveyance. This is a legal process where the society can go to a competent authority and get the ownership of the land and building transferred to its name, even if the builder refuses to cooperate. It’s your legal right.

Another classic problem: the builder suddenly decides to change the building plans after you've already signed on the dotted line. Can they do that? The answer is a hard no. MOFA is crystal clear on this. A promoter cannot make any changes to the plans you were shown in the agreement without getting your consent first. Any unilateral changes are a straight-up violation of the Act.

Is MOFA Still a Big Deal in the Age of RERA?

With the Real Estate (Regulation and Development) Act (RERA) now on the scene, many people wonder if MOFA has become obsolete. Not at all. While RERA is the go-to law for new projects, MOFA’s rules are still absolutely essential for the thousands of buildings constructed before 2017.

InsightsHere's a simple way to think about it: RERA is like the latest operating system for brand-new real estate projects. MOFA, on the other hand, is the foundational code that older buildings still run on. For countless housing societies, critical steps like getting the society formed and, most importantly, securing the final conveyance of the land, are still governed by the solid principles laid out in MOFA. The two laws don't cancel each other out; they often work together.

If you're stuck on a specific legal question, a tool like Draft Bot Pro can cut through the noise. Its AI legal research feature can help you pinpoint specific clauses in both MOFA and RERA, explaining how they interact and apply to your situation, all backed by verifiable legal sources.

Navigating the maze of property law demands accuracy you can trust. Draft Bot Pro delivers expert AI-powered legal drafting and research, helping you generate compliant documents and find verified answers in an instant. Take your legal work to the next level by visiting https://www.draftbotpro.com to learn more.