Court Fee for Declaration Suit: A Litigant's Quick Guide

- Rare Labs

- Dec 3, 2025

- 17 min read

The court fee for a declaration suit isn't a simple, one-size-fits-all figure. It's a bit like a puzzle, where the final cost depends entirely on what you're asking the court to do. A straightforward request for the court to declare a legal right might only set you back a nominal, fixed amount. But, if that declaration involves valuable property or asks for further action, the fee can jump significantly, calculated ad valorem—that is, based on the property's market value.

Getting your head around this distinction is the first, most crucial step in figuring out your litigation costs.

Decoding the Cost of a Declaration Suit

When you walk into court with a declaration suit, you're essentially asking for a formal stamp of approval on your legal status or rights. The first question on any litigant's mind is, naturally, "How much is this going to cost?" The answer really boils down to one critical detail: are you only asking for a declaration, or is there more to your prayer?

Think of it like ordering food at a restaurant. A single dish has a set price. But if you start adding side orders, drinks, and a dessert, the bill goes up based on everything you've added to your plate. It’s the same principle in court. A standalone declaration has one fee structure. A declaration bundled with other requests—what we call consequential reliefs—is a different ball game entirely.

Fixed vs Value-Based Fees

The heart of the matter lies in understanding the difference between a fixed fee and an ad valorem fee.

Fixed Fee: This is a nominal, predetermined amount. It’s for a pure declaration where you can't easily slap a price tag on the relief sought. For example, a suit to declare your legal status or a right that doesn’t directly involve property.

Ad Valorem Fee: This Latin term simply means "according to the value." This fee kicks in when your declaration is tied to assets with a clear monetary worth, or when you ask for consequential relief, like an injunction or possession of a property.

The financial difference is huge. A simple declaration suit in Dehradun might cost a mere Rs. 200/-. But add a prayer for an injunction, and that figure climbs to Rs. 500/-. If property possession is involved, you could be looking at a fee that's 1-3% of its total value. You'll want to explore the detailed fee structures to see how these variations play out locally.

The Role of Consequential Relief

What exactly is consequential relief? It's any extra action you're asking the court to take beyond just making a statement. Common examples include asking for possession of land, an injunction to stop someone from interfering with your property, or the cancellation of a sale deed.

When your plaint includes these additional prayers, the court looks past the "declaration" label and tries to figure out the real substance of your suit. If your ultimate goal is to get your property back or prevent a financial loss, the court will require an ad valorem fee based on the value of that property or the potential loss.

InsightsThe wording of your plaint is absolutely critical here. A bit of clumsy drafting can lead a court to interpret your simple declaration as one seeking consequential relief, landing you with a demand for a much higher court fee. This is where precision matters. A legal AI like Draft Bot Pro can analyze the reliefs you're claiming and suggest precise language that truly reflects your intentions, which can be the difference between your plaint being accepted or rejected on a technicality.

The Legal Framework for Calculating Court Fees

If you want to figure out the court fee for a declaration suit, you first need to get your head around the laws that govern it. The whole system is built on one core piece of legislation: the Court-Fees Act of 1870. But while that Act is the backbone, the reality on the ground is way more complicated.

The complexity comes from the fact that individual states in India can amend this central Act. Over the years, this has created a patchwork of state-specific rules and fee schedules. What this means for you is that the calculation method—and the final fee—for the exact same declaration suit can be wildly different from one state to the next. A one-size-fits-all approach just won't work.

The Plaint Is Paramount

When a court has to calculate the fee, it follows a simple but powerful principle: substance over form. The judge isn't just going to look at the title of your lawsuit; they're going to dig into what you're really asking for. And for that, their focus is on one single document: your plaint.

The plaint is what you file to kick off the lawsuit, and two parts are absolutely crucial for calculating the fee:

Averments: These are the facts and claims you lay out in the body of your plaint.

Prayers: This is the section at the end where you spell out exactly what you want the court to do for you (the "reliefs").

The court pores over these sections to understand the true nature of your suit. Is it a straightforward declaration, or is it a sneaky way of asking for something more, like possession of a property or an injunction?

A Common MisconceptionIt's easy to think that the defendant's arguments or counterclaims might affect the court fee. That's a myth. The court's initial calculation is based only on what you, the plaintiff, have written in your plaint. The defendant’s written statement has zero impact on this specific step.

What Courts Ignore During Fee Calculation

This rule—that only the plaint matters—is a settled principle, consistently applied by courts across the country. The Court-Fees Act, 1870, makes it clear that the averments made and reliefs sought in the plaint are what determine the suit's character for fee purposes. You'll find countless high court judgments confirming that whatever the defendant says in their written statement is completely irrelevant for calculating the initial court fee.

This bright-line rule is practical. It stops defendants from trying to bog down the plaintiff by making counter-allegations designed to artificially inflate the court fees. The court’s focus stays locked on the case you brought to them.

How Draft Bot Pro Can Help

Getting this right requires a huge amount of precision. A poorly worded plaint can easily lead a court to think you're asking for consequential relief, even if that was never your plan. The result? A demand for a much higher ad valorem fee, calculated on the value of the property or right in question.

This is where a legal AI tool like Draft Bot Pro becomes a game-changer. It analyzes your proposed reliefs against the specific rules and case law for your state, helping you craft your averments and prayers with surgical clarity. It ensures your plaint says exactly what you mean, helping you sidestep those costly misinterpretations that can get your case stuck on a preliminary issue.

For a deeper dive into how these laws work together, you might want to check out our guide on mastering the Court Fees and Suit Valuation Act.

Fixed vs. Ad Valorem Fees: What's the Difference?

When you file a declaration suit, the court fee isn't just a number pulled out of a hat. It falls into one of two buckets: fixed or ad valorem. Getting your head around this distinction is absolutely critical, because it directly dictates how much it'll cost to get your case off the ground.

Think of it like this: a fixed fee is like buying a flat-rate ticket for the metro. It doesn't matter if you go one stop or all the way to the end of the line; the price is the same. This fee applies to simple declaration suits where it’s tough, or even impossible, to stick a price tag on the relief you're asking for.

On the other hand, an ad valorem fee is more like a taxi meter. The final cost isn't set in stone—it goes up based on the "distance" you travel, or in legal terms, the value of the subject matter. This "according to value" fee kicks in when your declaration is tied to an asset with a clear market value, like a piece of property or a specific sum of money.

When Does a Fixed Fee Apply?

A fixed court fee is usually reserved for what lawyers call a "pure" declaration suit. This is where you’re only asking the court to declare a legal right or status, without tacking on any other tangible relief.

The key here is that the right you want declared can't be easily measured in rupees and paise.

Here are a few classic scenarios where a fixed fee is the norm:

Declaring a Legal Status: A suit to declare someone as a legally adopted child or to confirm your status as a member of a particular family.

Challenging a Document as Void: A suit to have a will or a gift deed declared void, but—and this is crucial—where you aren't also asking for possession of any property mentioned in that document.

Confirming a Right to an Office: A suit to declare your right to hold a position in a society, trust, or other organisation.

In these situations, the law recognises that you aren't chasing money or property, but legal certainty. Because of this, a nominal, fixed fee laid out in your state's Court-Fees Act is all that's required.

A Word from ExperienceCourts are sharp. They can spot when a suit is cleverly worded to look like a simple declaration just to dodge higher fees. If the guts of your plaint clearly show you're trying to get control of valuable assets, the judge will see right through it and demand an ad valorem fee. This is why precise, honest drafting is your best friend—it saves you from major headaches down the road.

The Shift to Ad Valorem Fees

The game changes the second your suit asks for something more than just a declaration. As soon as you add what's known as consequential relief, the calculation flips to an ad valorem basis. This is where the court fee for a declaration suit can get seriously expensive.

Consequential relief is any follow-up action you ask the court to order that flows directly from the declaration you're seeking.

Let's look at some common examples:

Declaration with Possession: You ask the court to declare a sale deed fraudulent and to put you in possession of the property.

Declaration with an Injunction: You want a declaration of your ownership rights and an injunction to stop someone from trespassing on your land.

Cancellation of a Sale Deed: You want to cancel a sale deed for a property valued at ₹50 lakhs. Here, the court fee will be calculated on that ₹50 lakh valuation.

In all these cases, the declaration is just the first domino. The real prize is a tangible, valuable asset. The court, therefore, expects you to pay a fee that's proportional to the value of that asset. It's a way of ensuring that litigants seeking high-value outcomes contribute fairly to the costs of running the judicial system.

Figuring out this distinction requires careful legal strategy. Get it wrong, and you're looking at delays, objections from the other side, and a demand from the court registry to pay the deficit fee. This is where modern tools can give you a real edge. A legal AI assistant like Draft Bot Pro can analyze the specific reliefs you’re claiming, cross-reference them with the relevant state laws, and help you figure out whether a fixed or ad valorem fee applies, making sure your plaint is valued correctly from day one.

How To Calculate Court Fees In Different Scenarios

Alright, let's move from the black-and-white text of the law to the real world. Calculating the court fee for a declaration suit is where the rubber really meets the road. It's not some abstract legal theory; it's about digging into the specifics of what you're asking the court to do—your "prayers"—and the actual value of what's at stake.

You could have two cases that look almost identical on the surface, but end up with wildly different court fee bills. It all comes down to the substance of the suit and, crucially, the state where you file it. Let's walk through a few practical examples to see how this plays out in a real-world setting.

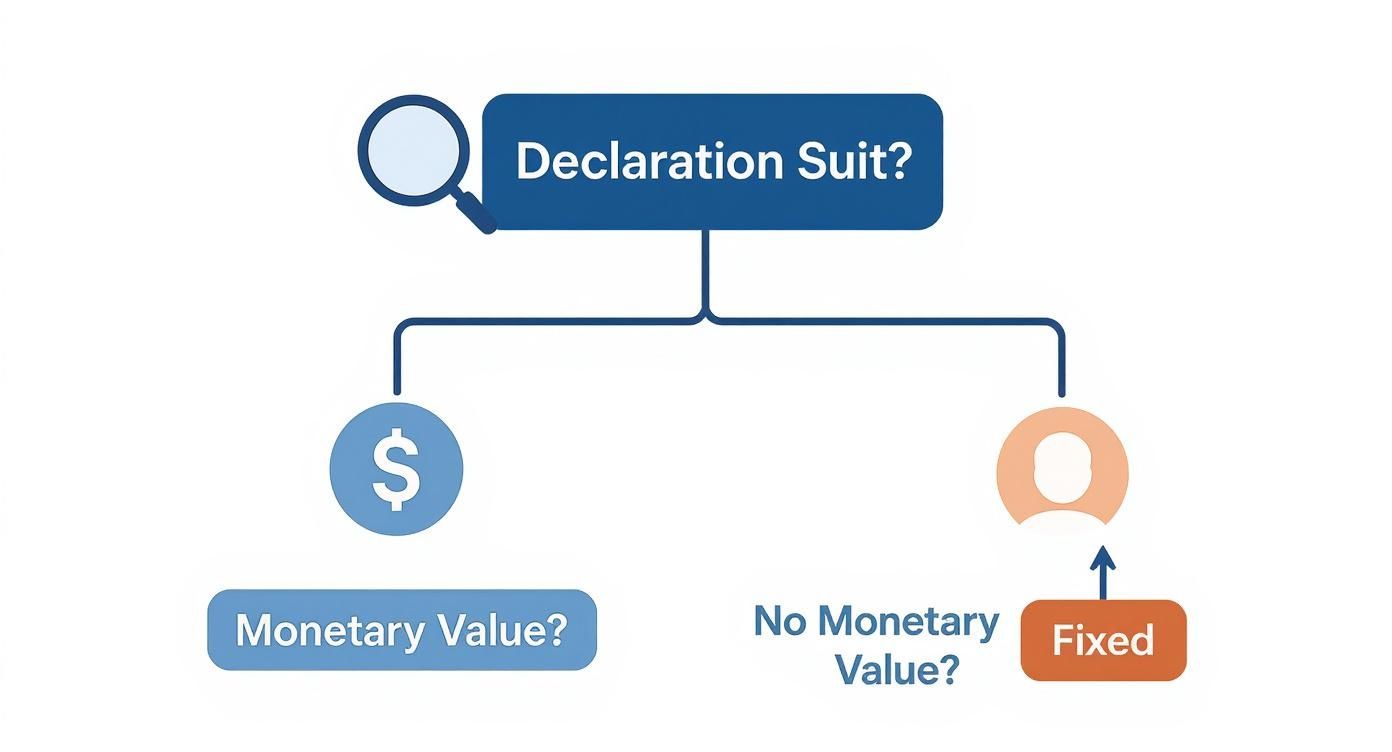

This flowchart gives you a quick visual breakdown of the basic logic.

The key takeaway is simple: the second a quantifiable monetary value gets attached to what you're asking for, the calculation flips. You're no longer looking at a simple fixed fee; you've entered the world of ad valorem fees, which are based on the value of your claim.

Scenario 1: The Simple Declaration

Picture this: someone files a suit asking for one thing and one thing only—a declaration that they are the legal heir of their late father. They aren't asking for possession of any property or for a specific document to be cancelled.

Valuation: In this situation, the relief being sought (legal heir status) doesn't have a market price you can slap on it.

Fee Type: This is the textbook case for a fixed court fee.

Calculation: The plaintiff will just pay the nominal, flat fee that the state's Court-Fees Act specifies for a simple declaration. We're often talking about just a few hundred rupees.

This is the most straightforward kind of declaration suit. The goal is legal certainty, not a tangible asset.

Scenario 2: Declaration With A Consequential Kicker

Now, let's ramp up the complexity. A plaintiff wants a sale deed for an ancestral property, valued at ₹25 Lakhs, to be declared null and void. But here's the crucial part: they also ask for an injunction to stop the buyer from ever taking possession.

Valuation: The court is going to see right through the "declaration" label. The real point of the lawsuit is to undo a transaction involving a high-value asset and stop its transfer. The suit will be valued at the consideration mentioned in that sale deed—the full ₹25 Lakhs.

Fee Type: Because a consequential relief (the injunction) is directly tied to a valuable property, the fee immediately becomes ad valorem.

Calculation: The court fee won't be a flat rate. It will be a percentage of that ₹25 Lakhs valuation, calculated based on the slab rates in that particular state's law. This means a much more substantial fee, likely running into tens of thousands of rupees. You can dive deeper into how injunctions impact a case in our guide on suits for permanent injunction based on possession.

The Big Impact Of State Laws

Never underestimate geography when it comes to court fees. Where you file your suit makes a huge difference because each state has its own version of the Court-Fees Act. The variations can be massive.

Just look at the court fee schedule in Dehradun. A simple declaration suit costs a fixed ₹200. But the moment you add a prayer for an injunction, that fee jumps to ₹500—and that's before even considering the property's value. This isn't just a local quirk. The Madhya Pradesh High Court drove this point home in a ruling where it ordered the plaintiff to pay fees on the full sale consideration of ₹11,05,000 for a suit cleverly disguised as a "declaration with injunction."

This table gives a snapshot of how fees can differ for the exact same suit across states.

State-Wise Court Fee Comparison For A Declaration Suit

Here, we compare the estimated court fees for a hypothetical declaration suit with consequential relief, where the property is valued at ₹15 Lakhs. This really highlights how significant the jurisdictional differences are.

State | Governing Law | Estimated Ad Valorem Court Fee |

|---|---|---|

Delhi | Court-Fees Act, 1870 (as applicable) | Fee calculated on ₹15 Lakhs, often around ₹17,000 - ₹18,000 |

Maharashtra | Maharashtra Court-Fees Act, 1959 | Fee can be as high as ₹3,00,000 (capped maximum) |

Karnataka | Karnataka Court-Fees and Suits Valuation Act, 1957 | Fee is typically ¾ of the fee on market value, could be around ₹50,000 |

Tamil Nadu | Tamil Nadu Court-Fees and Suits Valuation Act, 1955 | Similar to Karnataka, calculated on ¾ of the market value |

Uttar Pradesh | Court-Fees Act, 1870 (U.P. Amendment) | Fee is capped, but can still be substantial, often up to ₹25,000 |

Disclaimer: These are simplified estimates for illustrative purposes. The actual fee depends on the specific schedule, slab rates, and any applicable amendments in each state.

As you can see, the same case could cost you ₹17,000 in one state and potentially over ₹50,000 in another. It’s a critical factor to consider.

InsightsA classic mistake litigants make is trying to get clever by undervaluing a suit to save on court fees. They’ll frame a suit that is really about getting possession of a property as a “mere declaration.” Courts have seen this a thousand times. They are trained to look past the wording and scrutinise the substance of the plaint. If your ultimate goal is to get back a valuable asset, the judge will almost certainly order you to pay the full ad valorem fee on its market value. This just leads to delays and could even get your plaint rejected.

How Draft Bot Pro Can Help

Navigating these state-specific rules and valuation minefields is, frankly, a massive headache. This is exactly where Draft Bot Pro comes in.

The platform analyzes the specific reliefs you plan to claim. It then cross-references your prayers with the legal framework of your chosen state, helping you pinpoint the correct valuation and calculate the right court fee. This drastically minimizes the risk of the court registry sending your plaint back with a deficit fee notice, ensuring your case gets off the ground on a solid procedural footing.

What Happens If You Get the Court Fee Wrong?

Let’s be clear: underpaying the court fee on a declaration suit isn't just a minor administrative hiccup. It can be a fatal blow to your case before it even gets off the ground. The law is brutally straightforward on this point. Under Order 7 Rule 11 of the Code of Civil Procedure, the court has the power to throw out your entire plaint if it's found to be undervalued or insufficiently stamped.

This isn't some obscure, theoretical risk. It happens all the time. Litigants who miscalculate the fee often face infuriating delays, and in the worst-case scenario, their lawsuits are dismissed before a single argument on the merits is even heard. Getting the court fee right isn’t just a box to tick; it’s the very key that unlocks the courtroom door.

The Court's Process When a Fee is Short

Now, courts usually don't reject a plaint outright the moment a fee deficiency is spotted. The standard practice is to give the plaintiff a chance to make it right. The court will issue an order pointing out the exact deficit and give you a specific deadline to pay the remaining amount.

This is your window of opportunity—and you don't want to miss it. If you ignore this order or simply fail to pay up within the given time, the court is well within its rights to reject the plaint. That's it. Your lawsuit is over on a technicality, and all the time and money you've invested goes down the drain.

InsightsA deficit fee isn't just a procedural hurdle; it can be a strategic weapon for your opponent. A sharp defendant will often file a preliminary objection, arguing the suit is improperly valued and the fee is deficient. This can stall your case for months, forcing you into a battle over fees before you ever get to the real issues.

Real-World Repercussions and a Cautionary Tale

The consequences of a miscalculation can be financially crippling and legally disastrous. A case from the Madhya Pradesh High Court is the perfect example. A plaintiff filed a suit for declaration and permanent injunction over coparcenary rights, valuing the suit at ₹13,60,000/-. But they only paid ₹1,000/- in court fees.

The court calculated the correct fee to be ₹1,11,400/-, leaving a staggering deficit of ₹1,10,400/-. The entire plaint was deemed deficient and liable for rejection under Order 7 Rule 11. You can read the details of this consequential ruling to see just how serious the court was.

This single mistake created two massive problems:

A Sudden Financial Shock: The litigant was suddenly on the hook for a huge, unexpected payment just to keep their case alive.

The Ultimate Risk: Failing to pay would have meant the complete dismissal of their suit.

How to Avoid These Traps from the Start

Navigating the labyrinth of state-specific valuation rules and fee schedules is where most people go wrong. It's a complex, easy-to-mess-up process, and this is exactly where a specialised legal AI tool becomes indispensable.

This is what Draft Bot Pro was built for. It helps you sidestep these risks from the very beginning. By analyzing the reliefs you're claiming and the specific facts of your case, the tool cross-references everything against the right state laws and relevant case law. This guides you to an accurate valuation and helps you calculate the correct court fee for a declaration suit. It even assists in drafting a rock-solid valuation clause for your plaint, giving you a clear justification for the fee you've paid. This proactive approach dramatically cuts down the risk of your plaint being challenged or rejected, ensuring your case gets a smooth start.

Using Legal AI for Accurate Plaint Drafting

Let's be honest, wading through the dense web of suit valuation and court fees can feel like a minefield. One tiny miscalculation, one wrong interpretation of a schedule, and you risk delays or even an outright rejection of your plaint under Order 7. It’s high-stakes and nerve-wracking. This is precisely where modern legal technology offers a serious advantage.

Legal AI platforms like Draft Bot Pro are built to help lawyers and litigants tackle this exact challenge with far greater precision. Think of them as an intelligent co-pilot, right there with you during that critical drafting phase.

The process is deceptively simple but incredibly powerful. The AI analyzes the specific reliefs you’re claiming in your suit. It then cross-references your claims against a massive, constantly updated database of state-specific statutes, court fee schedules, and binding case law to guide you on the correct valuation.

Enhancing Precision and Avoiding Rejection

This kind of analysis helps you draft a valuation clause that is not just accurate, but justifiable. An AI-assisted clause is built to withstand scrutiny from both the court registry and, just as importantly, a sharp-eyed opposing counsel. The principle of using tech for accuracy isn't limited to drafting; for instance, tools like Whisper AI for flawless transcription show a broader trend towards ensuring textual integrity in legal work.

When your valuation is solid, you dramatically cut down the risk of your plaint being thrown out under Order 7 Rule 11 for being improperly valued. By handling the heavy lifting of tedious research and verification, these tools free you up to focus on what really matters: your legal strategy.

InsightsThe real benefit of using a legal AI here is risk mitigation. It transforms the calculation of the court fee for a declaration suit from a manual, error-prone chore into a data-driven process. This brings a much-needed dose of efficiency and confidence to one of the most pivotal steps in any civil suit.

For lawyers who want to build stronger, more defensible plaints right from the start, understanding the role of AI for drafting plaints is quickly becoming non-negotiable. It’s all about making sure your case gets off the blocks on the strongest possible procedural footing.

Common Questions and Practical Answers

Navigating court fees can throw up some tricky questions. Let's tackle some of the most common scenarios you might face when filing a declaration suit.

Can I Just Ask for a Declaration of Ownership to Pay a Low Fee?

It's a tempting thought, but courts are wise to this strategy. They are trained to look past the label you've put on your lawsuit and dig into its real purpose.

If your "declaration of ownership" is actually a roundabout way of trying to get possession of a property from someone else, the court will see right through it. In that situation, the judge will likely order you to pay the full ad valorem fee based on the property's market value, not the minimal fixed fee you were hoping for. Ultimately, it all comes down to the facts of your specific case and the laws in your state.

What Happens If I Accidentally Pay Too Much Court Fee?

Paying too much is definitely the lesser of two evils. Unlike underpayment, it won't get your case thrown out under Order 7 Rule 11. Your suit will move forward without a hitch from the court registry.

The downside? Getting your money back is a slow, bureaucratic marathon. You'll need to file a formal application, and the refund process can drag on for a very long time. This is exactly why it pays to get the valuation right from the start—it saves you from a world of administrative headaches down the line.

InsightsPrecision is your best friend here. An accurate calculation upfront saves you from scrambling to pay a deficit later and from the tedious quest of reclaiming overpaid fees from the court system. This is where a legal AI like Draft Bot Pro can be invaluable, ensuring you calculate the correct fee from the outset.

Is Any Court Fee Refunded If My Case Settles Early?

Yes, absolutely. Most states want to encourage parties to settle their disputes outside of a lengthy trial. To do this, they offer a partial or even a full refund of the court fee you paid. This is a key principle under Section 89 of the Code of Civil Procedure, which champions alternative dispute resolution.

If you manage to resolve your case through mediation, arbitration, or a simple settlement agreement, you can usually apply to get a good chunk of your court fee back. The exact percentage and the application process will differ from state to state, so always check the local High Court rules.

How Does Draft Bot Pro Handle Different State Laws?

A specialised legal AI like Draft Bot Pro is built on a massive, constantly updated database. It contains the specific statutes, court fee schedules, and crucial case law from every state across India.

When you start your draft and select the state where you're filing, the platform automatically applies the correct local laws to its analysis. This ensures that the valuation clause in your plaint is perfectly aligned with the rules of that specific court. It's a simple way to minimise errors and give your case a rock-solid procedural foundation from day one.

Ready to draft with confidence? Draft Bot Pro gives Indian legal professionals the AI-powered tools needed to handle complex procedures like suit valuation with ease. Cut down on errors, save precious time, and start building stronger cases. Learn more at https://www.draftbotpro.com.