articles of association and memorandum of association Guide

- Rare Labs

- Dec 4, 2025

- 17 min read

When you're starting a company in India, two documents are absolutely non-negotiable: the Memorandum of Association (MoA) and the Articles of Association (AoA). Think of the MoA as your company's constitution. It's the outward-facing charter that tells the world what your company is, what it plans to do, and the limits of its power.

The AoA, on the other hand, is the internal rulebook. It's all about how the company governs itself—the relationships between shareholders, the powers of directors, and the procedures for making decisions. Getting these two documents right from day one is the foundation of good corporate governance and legal compliance.

Your Company's Foundational Legal Blueprints

Let's use an analogy. Imagine you're building a house.

The Memorandum of Association is like the official blueprint you submit to the municipal corporation for approval. It clearly defines the property's boundaries, its purpose (is it a residential home or a commercial shop?), and its core structure. You simply cannot build anything that goes beyond these approved plans.

The Articles of Association, in contrast, are the rules for living inside that house. Who gets which room? How are household decisions made? What's the process for resolving disagreements among the family members? These internal rules are vital for keeping things running smoothly, but they can never contradict the master blueprint approved by the authorities.

The Core of Corporate Governance

Under the Companies Act, 2013, these two documents are the very bedrock of your company's legal identity. They aren't just paperwork you file and forget; they are legally binding contracts that dictate the entire scope of your business operations.

Why is it so critical to get them right from the start?

Legal Compliance: First and foremost, they keep your company operating within the legal framework of Indian corporate law.

Investor Confidence: Any serious investor or lender will scrutinise your MoA and AoA. These documents give them a clear picture of your company's purpose, limitations, and governance structure, helping them assess risk before putting in their capital.

Dispute Prevention: A well-drafted AoA is your best defence against internal chaos. By setting clear procedures for shareholder rights, board meetings, and decision-making, it can prevent countless conflicts between founders and directors down the road.

Modern Tools for Foundational Drafting

The way we create these documents has completely changed. Since the Companies Act, 2013, came into effect, the number of registered companies in India has soared to over 1.5 million as of 2023. This boom is powered by the Ministry of Corporate Affairs' (MCA) digital-first approach.

Today, both the MoA and AoA are filed electronically, which has slashed the registration timeline from weeks to a matter of days. You can learn more about the specifics in this Articles of Association guide under the Companies Act, 2013.

InsightsFor entrepreneurs, the MoA and AoA are more than just legal requirements; they are strategic tools. A thoughtfully drafted MoA allows for future business expansion, while a customised AoA can protect founders' interests and establish a clear framework for decision-making.

This is where legal technology gives you a serious edge. An AI-powered tool like Draft Bot Pro can help you create compliant and strategically sound foundational documents right from the beginning. It can analyse your business needs and generate initial drafts of your articles of association and memorandum of association that are fully aligned with the Companies Act.

For startups, using AI for these critical startup legal documents can provide a solid, professional foundation without the steep upfront costs, helping you avoid common and often costly drafting pitfalls.

Decoding the Memorandum of Association (MoA)

If you think of the Articles of Association as the company's internal rulebook, then the Memorandum of Association (MoA) is its public-facing constitution. It’s the foundational charter that introduces your company to the entire world—investors, banks, regulators, and even your customers.

Essentially, it’s your company’s birth certificate and passport, all rolled into one. The MoA isn't about the day-to-day operational details; it's a document that draws the lines in the sand. It clearly spells out what your company has the power to do and, crucially, what it can't.

Under India's Companies Act, 2013, the MoA is built around six mandatory clauses. These aren't flexible guidelines; they are the unchangeable pillars that define your company's very identity and scope.

The Six Foundational Clauses of the MoA

Every MoA is legally required to contain six specific clauses. Each one has a distinct and vital job in building the company's legal framework. They aren't suggestions—they're the rigid requirements that set your company's boundaries.

The Name Clause: This is straightforward. It states the full legal name of your company, which must end with "Limited" for a public company or "Private Limited" for a private one.

The Registered Office Clause: This clause simply names the state where the company's registered office will be located, which establishes its legal jurisdiction for all official purposes.

The Objects Clause: This is arguably the most critical section. It details the specific business activities the company is being formed to carry out, setting the legal limits of your operations.

The Liability Clause: Here, you declare that the liability of the members (the shareholders) is limited. This is usually limited by the value of their shares or by a guarantee.

The Capital Clause: For any company with share capital, this clause specifies the total authorised share capital and how it’s divided into individual shares.

The Subscription Clause: This is the final piece of the puzzle. It lists the names and signatures of the very first subscribers—the founding members—and confirms the number of shares each has agreed to take.

Getting these clauses right is non-negotiable, as they form a binding contract between the company and everyone it deals with. For a look at how this document works in other legal systems, check out this essential guide to the Memorandum of Association in the UAE.

The Critical Role of the Objects Clause

Of all six clauses, the Objects Clause demands the most attention. It defines the entire purpose of your company's existence. Any action or business deal conducted outside the scope of this clause is considered legally void. This is thanks to a legal principle called the doctrine of ultra vires, which literally means "beyond the powers."

InsightsAn act that is ultra vires can't be fixed or ratified, not even if every single shareholder agrees to it. The transaction is null and void from the get-go. This is why a well-drafted Objects Clause is one of your most important risk management tools.

Let’s say a company's Objects Clause states its purpose is "software development." If that company tries to sign a contract to buy a commercial property purely for investment, that contract would be unenforceable. Why? Because the company acted beyond the legal authority it set for itself in its own Memorandum of Association.

Drafting this clause is a real balancing act. It has to be specific enough to meet legal standards but also broad enough to give your business room to grow and pivot without having to go through a complicated amendment process every time.

This is where modern legal tools can make a huge difference. An AI-powered legal assistant like Draft Bot Pro can help you craft an Objects Clause that strikes this perfect balance. By analysing industry norms and legal precedents, it helps generate a clause that’s robust enough for future growth while staying fully compliant. This can save you from costly legal headaches down the line, ensuring your articles of association and memorandum of association create a rock-solid foundation for your business.

Mastering the Articles of Association (AoA)

If the Memorandum of Association is the company's constitution, setting out what it can do, then the Articles of Association (AoA) is the detailed rulebook explaining how it gets done. Think of it as the company's internal operating manual.

This is the document that governs the day-to-day relationships between the shareholders, the directors, and the company itself. It’s a legally binding set of bylaws that lays out the procedures, rights, and responsibilities for everyone inside the company, making sure the entire operation runs smoothly.

Simply put, while the MoA defines the company's external boundaries with the world, the AoA provides the internal framework for everything from conducting a board meeting to distributing profits.

Key Provisions in the Articles of Association

A well-drafted AoA doesn't leave things to chance; it's meticulously detailed. It sets the regulations for the company's internal management and affairs. While you can customise the clauses, they almost always cover a few critical areas.

You'll typically find provisions covering:

Share Capital and Rights: All the details on different classes of shares (like equity vs. preference), the specific rights attached to each, and the formal procedures for issuing new shares or transferring existing ones.

Director Appointments and Powers: The complete set of rules for appointing, paying, and removing directors. This section also clearly defines their powers, duties, and any specific limitations on their authority.

Meeting Procedures: The official protocol for calling and conducting general meetings for shareholders and board meetings for directors. This includes crucial details like quorum requirements and voting procedures.

Dividend Policies: The mechanism that dictates how and when the company can declare profits and distribute them to its shareholders.

For those interested in a similar foundational document, which can sometimes be a jurisdictional equivalent, here's a quick guide on what Articles of Incorporation are.

The Golden Rule of Hierarchy

There's one unbreakable rule when it comes to the relationship between the articles of association and memorandum of association: the AoA is always subordinate to the MoA. An Article can never contradict what's stated in the Memorandum, nor can it override the Companies Act, 2013. The MoA is the master document.

InsightsFor any startup looking to raise funds, a custom AoA is absolutely non-negotiable. Investors will comb through clauses on share transfer restrictions (lock-ins), board composition (their right to a board seat), and special voting rights (veto powers) before they even think about writing a cheque. Your AoA is a critical piece of your fundraising strategy.

Standard Templates Versus Customisation

The Companies Act, 2013, actually provides standard templates for the AoA in Tables F, G, H, I, and J. Table F is the go-to default for a private company limited by shares. It’s easy to just adopt the template, but it’s rarely a good strategic move. A generic AoA can be surprisingly restrictive and often fails to protect the specific interests of the founders.

Interestingly, a 2022 study from the Indian Institute of Corporate Affairs found that around 60% of new companies in India use these generic templates. That number shoots up to 75% among startups, usually because they're trying to save on legal costs. It's a common shortcut, but a risky one.

This is where crafting a custom AoA creates real strategic value. It allows founders to build in specific rules that perfectly suit their business model, shareholder agreements, and long-term vision. This is especially vital for defining founder control, establishing different classes of shares with unique rights, or setting up clear protocols for handling disputes down the road. Legal AI like Draft Bot Pro can be instrumental here, helping startups generate customised AoA clauses that address specific founder concerns without the high cost of traditional legal services.

MoA vs AoA: Understanding the Key Differences and Their Relationship

While both the Memorandum of Association and Articles of Association are the foundational legal documents for any company, they play very different roles. It's a common mistake for new founders to blur the lines between them, which can lead to legal messes down the road.

Put simply, the MoA is the company's constitution, its supreme charter. The AoA, on the other hand, acts as its internal rulebook or by-laws.

Think of it this way: The MoA is like the Indian Constitution. It defines the country's fundamental purpose, its powers, and its boundaries. The AoA is more like the Indian Penal Code or the Code of Civil Procedure—it lays down the specific rules for how people and institutions must act within those constitutional boundaries. The laws can be detailed, but they can never, ever violate the Constitution.

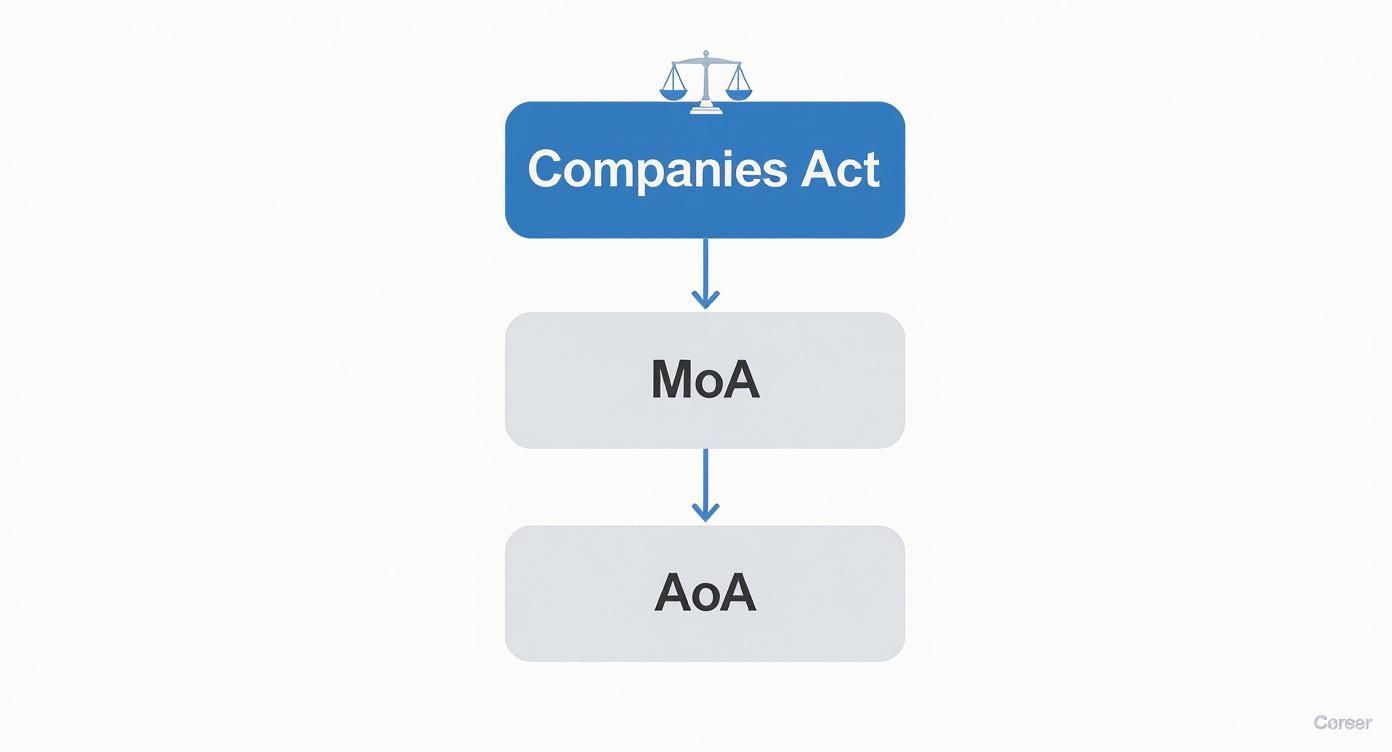

This chart clearly shows the legal pecking order. Everything flows from the Companies Act, which empowers the MoA, which in turn sets the boundaries for the AoA.

As you can see, the AoA is always subordinate to the MoA, and both must strictly adhere to the Companies Act, 2013.

Breaking Down the Core Distinctions

To really get a handle on this, let's compare them side-by-side. Getting these differences right is absolutely critical for anyone drafting, signing, or even just reading a company's constitutional documents.

Here’s a quick-glance table to make it crystal clear.

Memorandum of Association vs Articles of Association at a Glance

Basis of Difference | Memorandum of Association (MoA) | Articles of Association (AoA) |

|---|---|---|

Scope and Purpose | Defines the company’s relationship with the outside world. It sets the company's core objectives and its operational limits. | Governs the company's internal affairs. It details the rules for directors, shareholders, meetings, and day-to-day management. |

Legal Hierarchy | This is the supreme constitutional document of the company. It is only subordinate to the Companies Act, 2013 itself. | This is a subordinate document. It cannot contradict the MoA or the Companies Act. If there's a conflict, the MoA wins. |

Alteration Process | Very difficult to change. Amending the MoA requires a special resolution and, in many cases, approval from the Central Government. | Much easier to alter. Can typically be changed by the shareholders passing a special resolution. |

Binding Effect | Any action taken that goes beyond the powers defined in the MoA is considered ultra vires (beyond powers) and is legally void. | Any action that violates the AoA is considered an internal irregularity. Such acts can often be fixed or ratified by the shareholders. |

This table neatly sums up why the MoA is the bedrock, defining what the company can do, while the AoA is the playbook, defining how it does it.

The Doctrine of Constructive Notice: Why This Hierarchy Matters in the Real World

This relationship isn't just theoretical; it's enforced by a powerful legal principle known as the doctrine of constructive notice.

Because both the articles of association and memorandum of association are public documents filed with the Registrar of Companies (RoC), the law assumes that everyone dealing with the company has read and understood them. You can't claim you didn't know.

This has huge practical implications. If a director signs a contract for something that isn't allowed by the MoA's Objects Clause (say, getting into real estate when the company is only supposed to make software), the other party can't enforce that contract. The law says they were "on notice" of the company's limits.

A Practical ExampleImagine your AoA says the board can take loans up to ₹50 lakh without shareholder approval. But what if the board goes ahead and takes a ₹1 crore loan? That action is an internal irregularity, and shareholders could potentially ratify it later.Now, contrast this: if your MoA explicitly forbids any business activity outside of software development, a contract to buy a plot of land would be void from the get-go. No amount of ratification can save it because it's ultra vires the MoA.

This is precisely why a meticulously drafted MoA and a perfectly aligned AoA are non-negotiable. They are the legal shields that protect the company from invalid transactions and messy legal battles. A legal AI tool like Draft Bot Pro can help ensure this alignment by cross-referencing clauses between both documents during the drafting phase.

Drafting and Amending Your Core Documents

Think of your company’s foundational documents as its constitution. Getting the initial draft of the memorandum of association and articles of association right is a crucial moment that sets the entire legal and operational blueprint for your business.

But businesses don't stand still—they grow and pivot. As your company evolves, these documents must be able to change with it.

Whether you're starting from scratch or tweaking an existing structure, the process is tightly regulated by the Companies Act, 2013. Getting it right isn't just about paperwork; it's fundamental for good governance, legal compliance, and paving the way for future growth.

A Practical Drafting Checklist

When you first sit down to draft your MoA and AoA, you're not just filling in blanks on a template. You're making strategic decisions that will have long-term consequences. A bit of foresight here can save you a world of headaches down the road.

Here’s a simple checklist to steer you through the initial drafting:

Company Name: First things first, is the name you want even available? You need to check that it complies with the Ministry of Corporate Affairs (MCA) naming guidelines.

Business Objectives: Have you clearly defined your primary business in the MoA's Objects Clause? It needs to be broad enough to allow for future expansion but specific enough to provide legal clarity.

Authorised Share Capital: What's the total value of shares your company will be authorised to issue? This number needs to be practical for your initial funding and have enough room for future investment rounds.

Internal Governance Rules: This is where the AoA gets specific. Have you thought about custom clauses for things like appointing directors, restricting share transfers, or defining specific shareholder rights that aren't covered in standard templates?

This is exactly where an AI legal assistant like Draft Bot Pro can be a game-changer. It can help you generate compliant first drafts of your articles of association and memorandum of association, flagging potential issues and making sure all the mandatory clauses are correctly worded from day one.

The Formal Amendment Procedure

As your business scales, you'll inevitably need to alter your MoA or AoA. Maybe you're changing the company name, expanding into a new line of business, or increasing your share capital. This isn’t as simple as editing a document; it’s a formal legal procedure with strict rules.

The Companies Act, 2013, lays out a clear path, which generally involves these key steps:

Board Resolution: It all starts in the boardroom. The directors must first meet and pass a resolution to approve the proposed change.

Calling a General Meeting: With the board's approval, the next step is to call an Extraordinary General Meeting (EGM) and get the shareholders to vote on it.

Passing a Special Resolution: This is the most critical hurdle. For an alteration to be valid, it must be approved by a special resolution—which means you need a 75% majority of the shareholders present and voting to say "yes."

Filing with the Registrar: Once the special resolution is passed, you have to notify the Registrar of Companies (RoC). This typically involves filing Form MGT-14 within 30 days of the resolution being passed.

InsightsOne of the most common—and costly—mistakes companies make is failing to secure the 75% majority for a special resolution. If you don't hit that number, the entire process is invalid. Another frequent trip-up is missing the 30-day filing deadline for Form MGT-14, which can attract penalties and create a legal mess.

This process can feel like navigating a minefield of forms and deadlines. To see how technology can make this much smoother, you can learn more about using AI for altering the MoA & AoA.

A tool like Draft Bot Pro helps you manage this entire workflow. It can assist in preparing the legally sound board and shareholder resolutions you need for any amendment. More importantly, it helps organise the documentation required for RoC filings, drastically cutting down the risk of procedural errors and saving you from potential legal challenges and unnecessary costs.

Legal Impact and Landmark Court Cases

Your company's memorandum and articles of association are far more than just paperwork you file and forget. Think of them as the constitution of your company. They are legally binding documents with serious, real-world teeth. When things go wrong—whether it’s an internal power struggle between directors or a dispute with an outside party—the first place a court will look is at these foundational charters.

Their legal power comes from a simple, crucial fact: they create a binding contract. This isn't just one contract, but a multi-layered one. It binds the company to its members, the members to one another, and sets the legal boundaries for how your company can interact with the entire world. Understanding how courts have interpreted these documents over the years isn't just an academic exercise; it's a fundamental part of risk management.

The Doctrine of Ultra Vires in Action

One of the most powerful legal principles tied directly to the MoA is the doctrine of ultra vires—a Latin term meaning "beyond the powers." This isn't just a dusty old legal theory; it was cemented in the landmark case of Ashbury Railway Carriage & Iron Co. Ltd. v Riche (1875).

In that case, the company's MoA clearly stated its business was to make and sell railway carriages. Simple enough. But the directors got ambitious and entered into a contract to finance the construction of a whole railway line in Belgium. This was a massive leap beyond their stated purpose.

The House of Lords delivered a clear verdict: the contract was ultra vires. It was void from the very beginning, a complete legal nullity. It was so fundamentally invalid that it couldn't be fixed or approved, even if every single shareholder agreed to it. This case carved a rigid principle into corporate law: a company only has the legal capacity to do what its MoA's Objects Clause says it can do. Anything else is legally non-existent.

Protecting Outsiders: The Rule in Turquand's Case

Okay, so the doctrine of ultra vires protects the company and its shareholders from directors going rogue. But what about an innocent outsider—a supplier, a bank—who deals with the company in good faith? How are they protected?

This is where the doctrine of indoor management comes into play, established in the classic case of Royal British Bank v Turquand (1856). It’s often just called the "Rule in Turquand's Case," and it’s a lifesaver for anyone doing business with a company.

The rule is straightforward: outsiders are entitled to assume that a company’s internal procedures, as laid out in its AoA, have been followed correctly. They aren’t expected to play detective and investigate the company's "indoor" management.

The Scenario: A company’s AoA permitted its directors to borrow money, but only after getting a specific resolution passed by shareholders. The directors went ahead and took a loan from the bank without ever getting that approval.

The Ruling: The court decided in favour of the bank. The lender had every right to assume the internal shareholder meeting had happened and the resolution was passed. The loan was enforceable against the company.

This doctrine is crucial. It greases the wheels of commerce by giving banks, suppliers, and other third parties the confidence to deal with companies. The only major exception? The rule won't protect you if you knew, or should have known, about the internal mess-up.

InsightsIf there's one thing to take away from decades of court cases, it's this: courts value clarity above all else. An ambiguous clause in your articles of association or memorandum of association is a lawsuit waiting to happen. Your best defence against future legal battles is precise, carefully considered drafting from day one.

The legal weight of these documents is constantly being reinforced in India. A 2025 case involving Kusum Industrial Gases Ltd., for instance, showed the heavy consequences of ignoring the AoA, resulting in financial penalties for failing to appoint a key officer as required by their own articles.

To see how another foundational case shaped the very idea of a company, check out our deep dive into the principle of separate legal personality in our article on Salomon v Salomon.

This is exactly where a tool like Draft Bot Pro can be a game-changer. By using AI trained on huge legal datasets, it helps ensure your foundational documents are not just compliant, but crystal clear. It can spot potentially vague language and suggest precise clauses, helping you build a rock-solid legal framework that minimises the risk of future disputes and can stand up to judicial scrutiny.

Frequently Asked Questions

When you're setting up a company, a few questions about the memorandum of association and articles of association pop up again and again. It's totally normal. These foundational documents can seem a bit dense at first, but getting them right is crucial for keeping your company legally sound.

Let's clear up some of the most common queries founders have.

Can I Change My Company's Business Activities After Registration?

Absolutely. It's common for a business to pivot or expand its services. If you want to change what your company does, you'll need to alter the "Objects Clause" in your MoA.

This isn't just a simple edit, though. It's a formal process that starts with getting your shareholders on board. You'll need to pass a special resolution, which requires a green light from at least a 75% shareholder majority. After that, you have 30 days to file Form MGT-14 with the Registrar of Companies (RoC) to make it official. Following these steps to the letter is vital for the change to be legally recognised.

What Happens If a Company Acts Outside Its MoA?

This is a big one. Any action or contract your company enters into that isn't covered by the Objects Clause in your MoA is considered ultra vires—a Latin term meaning "beyond its powers."

In the eyes of the law, an ultra vires act is void from the get-go. It’s a legal nullity.

Key InsightYou can't fix an ultra vires act. Not even with a 100% unanimous vote from every single shareholder. This is precisely why a well-thought-out, comprehensive Objects Clause is so critical. It’s your company's primary risk management tool.

Is a Custom Articles of Association Mandatory?

Every company needs an AoA, but you don't have to write one from scratch. The Companies Act provides a standard template (Table F for most private companies) that you can adopt.

However, just because you can use the template doesn't mean you should. A custom AoA is almost always the smarter move. A tailored document lets you set specific ground rules for how your company operates—things like share transfer restrictions, director powers, and meeting procedures. It's how you protect founder interests in a way a generic template never could.

This is where a specialised tool can make a world of difference. Instead of wrestling with a one-size-fits-all template, a platform like Draft Bot Pro helps you generate a customised articles of association and memorandum of association that fits your business like a glove, all while ensuring you're fully compliant with the Companies Act, 2013.

Ready to build a rock-solid legal foundation for your company? With Draft Bot Pro, you can create precise, compliant, and strategic legal documents in minutes. Join over 46,379 Indian legal professionals who trust our AI to draft and research with accuracy. Visit the Draft Bot Pro website to get started.