Salomon v Salomon Case Summary A Corporate Law Deep Dive

- Rare Labs

- Nov 16, 2025

- 14 min read

The case of Salomon v Salomon is one of those stories that every law student learns, and for good reason. It lays the groundwork for one of the most fundamental ideas in modern business law: a company is its own legal person, completely separate from the people who own it.

This landmark decision established that a company's debts are its own, not the personal responsibility of its shareholders. This protects their personal assets if the business runs into trouble. This whole concept is called separate legal personality, and it's the bedrock of corporate law as we know it today.

The Case That Defined Modern Corporate Law

The story of modern corporate law really kicks off with a 19th-century leather merchant, Aron Salomon. A business dispute he was involved in ended up before the UK's House of Lords, and their ruling completely changed how we think about companies. Before this, the line between a business owner and their business was blurry, putting their personal wealth at risk for business failures.

Mr. Salomon's case forced the courts to ask a big question: is a company just a different name for its owner, or is it something more? The final decision was crystal clear, creating a protective wall between the two.

For a quick overview, here's a breakdown of the key elements of the case.

Salomon v Salomon Case At a Glance

Element | Description |

|---|---|

Case Name | Salomon v A Salomon & Co Ltd |

Jurisdiction | United Kingdom (House of Lords) |

Decided | 1897 |

Core Principle | Separate Legal Personality; Corporate Veil |

Key Takeaway | A company is a distinct legal entity, separate from its shareholders, even if one person owns almost all the shares. |

This table provides a snapshot, but the real impact of the case is felt in how it has shaped business law ever since.

The Global Impact of a 19th-Century Ruling

The principles from Salomon v Salomon & Co Ltd, decided way back in 1897, aren't just a historical curiosity. They are the foundation of company law across the globe. Although it started in the UK, its influence in India has been massive. Both the Companies Act, 2013, and the laws that came before it are built on these British legal traditions.

Just look at the numbers. As of March 2023, India had over 1.4 million registered companies. More than 90% of these are private limited companies—a structure that simply wouldn't work without the Salomon principle of a separate legal entity. You can find more details on this from the Ministry of Corporate Affairs.

This single ruling gave entrepreneurs the confidence to innovate and take risks, knowing their personal assets weren't on the line for company debts. It’s the legal DNA that allows everything from a small tech startup to a huge multinational corporation to operate as its own entity.

Insights: The easiest way to think about a "separate legal person" is to imagine the company as a real person. When it's incorporated, it gets its own legal birth certificate. It can own property, sign contracts, and rack up debt, all in its own name, completely separate from the people who created or own it.

Why This Case Still Matters

Getting your head around this case is non-negotiable for anyone studying or working in corporate law. It answers the most basic questions about how businesses are structured and who is liable when things go wrong. While Salomon v Salomon was a game-changer, exploring other landmark legal case examples can show how different judicial decisions have created lasting precedents in other areas of law.

For law students and professionals, digging through old cases to see how they apply today can be a real grind. This is exactly where a Legal AI tool like Draft Bot Pro can help. It can whip up instant, detailed summaries of landmark cases, compare legal principles across different judgments, and help you draft memos that dive into the nuances of concepts like the corporate personality.

Untangling the Facts of the Salomon Case

To really get what makes this case so important, you have to picture Aron Salomon, a successful leather merchant and boot maker in 19th-century England. For over 30 years, he ran his business as a sole proprietorship. It was a straightforward setup where, legally speaking, he and his business were one and the same entity.

As his business thrived, Salomon wanted to shift to a more formal structure. The new Companies Act of 1862 was creating a buzz, and he saw an opportunity. Forming a limited company would shield his personal assets and create a clear succession path for his sons.

So, ‘Aron Salomon and Company, Limited’ was born. The law at the time said you needed at least seven shareholders to form a company. To tick this box, Salomon brought in his wife and five children, giving each of them a single share. This small detail, which seemed like just a formality, would later become the explosive centre of the whole dispute.

The Key Business Transaction

The next step was for Salomon to sell his personal business to the new company he had just created. He set the price at a hefty £39,000, a figure that supposedly reflected the business's true worth.

But this wasn't a simple cash deal. The payment was cleverly structured:

£20,000 in shares: Salomon took 20,000 shares in the company, cementing his position as the overwhelming majority owner.

£10,000 in debentures: He was also issued secured debentures. Think of this as a loan he made to his own company, secured against its assets. This move made him a secured creditor.

The remainder in cash: The rest was paid out in cash.

This setup put Salomon in two very powerful positions at once: he was the main owner (via shares) and a top-priority creditor (via debentures).

Insights: Those debentures were the real game-changer. A debenture holder gets paid back first if a company goes bust. By holding them, Salomon put himself at the front of the queue, ahead of any other lenders, if his business ever failed.

Unfortunately, the good times didn't last. The economy took a nosedive, and the leather industry suffered. Within a year, ‘Salomon & Co. Ltd.’ was in deep trouble. The company couldn't find a buyer and was forced into liquidation—the process of shutting down and selling off everything to pay its debts.

The Conflict with Creditors

This is where it all went wrong. When the liquidator started sorting out the company’s finances, a massive problem surfaced. After the company's assets were used to pay Salomon his £10,000 from the secured debentures, there was virtually nothing left for the other, unsecured creditors.

They were, understandably, furious. They argued that the entire company was a fraud, a sham set up for the sole purpose of shielding Salomon from his debts. This kicked off a legal fight that would challenge the very definition of a company. Digging through old case files like this can be a real headache, but knowing how to do legal research is a superpower for any law student or professional. The liquidator, fighting for the creditors, sued Salomon, and the stage was set for one of the most famous cases in legal history.

For anyone trying to wrap their head around complex legal histories, an AI assistant like Draft Bot Pro can help. It can instantly break down the factual matrix of landmark cases like this one, helping you pinpoint the crucial transactions that sparked the legal fire. This lets you focus on the legal principles and their impact, instead of getting lost in the historical weeds.

The Core Legal Challenge: Was the Company Just a Sham?

When Salomon's business went under, everything came down to one explosive question: was ‘Salomon & Co. Ltd.’ a real, independent company, or was it just a front for Aron Salomon himself? This was the battleground for the entire case, pitting the company's liquidator, who was fighting for the unpaid creditors, against Salomon.

The liquidator came out swinging. He argued that the whole company setup was a clever trick. In his eyes, the company was simply an ‘alias’ or an ‘agent’ for Aron Salomon. He claimed it was designed for one reason only: to let Salomon operate his business with zero personal risk, while sneakily putting himself at the front of the line to get paid if things went sour, ahead of genuine, external creditors.

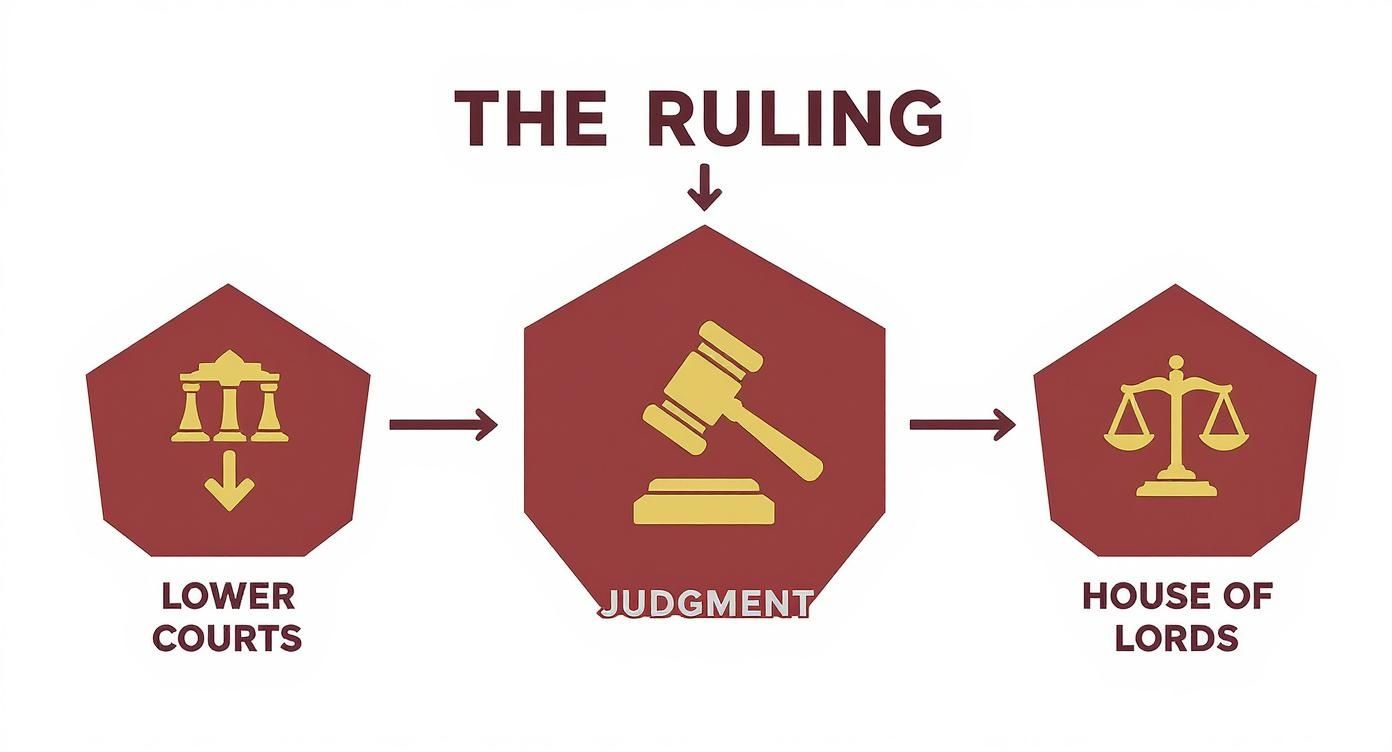

The Lower Courts Sided with the Creditors

At first, the courts completely bought this argument. Both the High Court and, later, the Court of Appeal ruled in favour of the creditors. They decided the company was nothing more than a one-man show, with Salomon pulling all the strings.

This led them to a simple, yet devastating, conclusion. If the company was just Salomon’s agent, then Salomon, as the boss (the principal), had to cover the debts his agent racked up. In plain English, he was personally on the hook for everything the company owed. The judges saw the shares given to his family as a mere formality, a box-ticking exercise to meet the legal minimum of seven members, not a true distribution of ownership.

Key Takeaway: The lower courts' rulings revolved around the concepts of 'agency' and 'alter ego'. They basically said the company couldn't think for itself; it was just Salomon's puppet. This reasoning completely bulldozed the idea of a separate legal personality that the Companies Act was meant to create.

This initial verdict was a total disaster for Salomon. For the creditors, it was a huge win, as it wiped out the boundary between the man and his company, making Salomon personally liable for the financial mess.

How Legal AI Can Untangle Court Arguments

Trying to follow the back-and-forth arguments from the High Court all the way to the House of Lords can feel like a maze. This is where a legal AI tool like Draft Bot Pro can help. It can quickly break down each court's reasoning into simple summaries, highlighting the exact legal ideas, like 'agency', that were in play at each level. This makes it so much easier to see how the legal thinking evolved from one court to the next, leading to the final landmark ruling.

With the lower courts' decision, the stage was set for an epic legal showdown in the highest court in the UK, the House of Lords. The very foundation of modern company law was hanging by a thread.

The Historic House of Lords Judgment

The whole saga came to a head when Aron Salomon, refusing to back down, took his case all the way to the House of Lords, the highest court in the land. What happened next was a stunning reversal. The Lords unanimously threw out the lower courts' rulings in a decision that would not just save Salomon, but would go on to shape modern company law as we know it.

The core of their judgment was powerful in its simplicity: once a company is legally formed under the Companies Act, it becomes a person in its own right. A completely separate legal entity. This new "person" stands apart from its shareholders, no matter who they are or how many shares they own.

The Reasoning Behind the Landmark Ruling

The House of Lords methodically took apart the arguments that had convinced the lower courts. They completely rejected the idea that the company was just a front, an "agent" or "alter ego" for Mr. Salomon himself.

Lord Halsbury, one of the presiding judges, made it crystal clear that the Companies Act didn't care one bit about the founder's motives. As long as the paperwork was in order and the formal requirements were met—in this case, having seven members subscribe to the memorandum—the company was legitimate. The fact that six of them were Salomon's family members holding a single share each? Totally irrelevant.

The company is at law a different person altogether from the subscribers to the Memorandum; and, though it may be that after incorporation the business is precisely the same as it was before, and the same persons are managers, and the same hands receive the profits, the company is not in law the agent of the subscribers or a trustee for them.— Lord Macnaghten, Salomon v A Salomon & Co Ltd [1897]

This quote from Lord Macnaghten’s judgment is perhaps the most famous and powerful explanation of the principle. It cemented the idea that the corporate structure wasn't a sham but a real, legal creation with its own rights and its own debts.

The Impact on Salomon and His Creditors

So, what did this mean in practice? The outcome was massive. Because the company was a separate legal person, it was the company—not Aron Salomon—that owed money to the unsecured creditors.

And what about the debentures Salomon held? The court declared them perfectly valid. This instantly made him a secured creditor. In plain English, this meant he had the legal right to be paid from the company's leftover assets before any of the unsecured creditors saw a single penny. The company was responsible for its own debts, and Salomon, as a secured creditor, was at the very front of the queue to get his money back.

How Legal AI Can Clarify Judgments

Let's be honest, trying to make sense of the dense language and layered reasoning in a judgment from the 1890s can be tough. This is where a tool like Draft Bot Pro can help. It can instantly analyse and summarise historic rulings like this one. It helps pull out the key quotes, explains the court's logic in modern language, and even shows how principles from this salomon v salomon case summary have been applied in later Indian case law. It makes complex legal history feel accessible and relevant for today's students and legal professionals.

Understanding the Principles Established by Salomon

The House of Lords' decision in the Salomon v Salomon case wasn't just about settling one man's business dispute. It went much further, erecting the three foundational pillars that support modern corporate law. These ideas completely revolutionised how businesses are structured, drawing a clear legal line between a company and its owners.

The first and most critical principle is Separate Legal Personality. The easiest way to think about it is this: when a company is properly incorporated, it gets its own legal "birth certificate." It becomes a distinct person in the eyes of the law, totally separate from its founders, directors, and shareholders. This means the company itself can own property, sign contracts, and rack up debt, all in its own name.

The concept map below really drives home the dramatic U-turn in legal thinking from the lower courts to the final judgment in the House of Lords.

As you can see, the initial rulings saw the company as nothing more than an alias for Salomon himself. The House of Lords, however, cemented its status as a completely independent legal entity.

Limited Liability and the Corporate Veil

Flowing directly from this idea of a separate personality is the principle of Limited Liability. Since the company is its own person and responsible for its own debts, the shareholders' personal wealth is protected. Their financial risk is capped at the amount they agreed to pay for their shares. This keeps their homes, savings, and other personal assets safe from business creditors if things go south.

This protective barrier is often described with a powerful metaphor: the Corporate Veil. Picture an imaginary veil that separates the company's identity from that of its owners. It acts as a shield, stopping creditors from reaching through the company to grab the personal assets of the shareholders.

Insights: The corporate veil is simply the practical effect of the separate legal personality principle. It's the very reason entrepreneurs can take calculated risks without betting their personal financial future on a venture's success—a concept that has fuelled economic growth for more than a century.

Lifting the Corporate Veil: The Exception to the Rule

But this protective veil isn't invincible. In some exceptional situations, the courts can choose to "lift" or "pierce" the corporate veil. When this happens, they disregard the company's separate identity and hold the individuals behind it directly responsible for its debts and obligations.

This is a rare move, typically reserved for cases where the corporate structure is being abused, like for committing fraud or dodging a legal duty. The Salomon v Salomon & Co Ltd ruling has profoundly shaped how the Indian judiciary handles this exception. While Indian courts firmly uphold the Salomon principle, they also recognise the need to lift the veil when the system is being misused.

Supreme Court of India data shows that between 2010 and 2022, there were 1,234 cases where lifting the veil was argued. However, it was only actually pierced in 12% of those instances, and only when there was clear proof of fraud or other improper conduct. This low percentage shows just how enduring the Salomon principle is; you need compelling evidence of wrongdoing to get around it. You can explore the Supreme Court of India's stance for more details.

Figuring out these complex situations can be a real headache, especially when they involve dealings between related parties. You can get a better handle on how technology can help navigate these waters in our guide on AI for related party transactions. For any law student or legal professional, mastering these exceptions is just as important as knowing the rule itself.

Insights: How Legal AI Simplifies Corporate Law

Connecting a landmark case like Salomon v Salomon to the daily grind of a modern lawyer really shows how much things have changed, but also how much they’ve stayed the same. The core principles from this case are still the bedrock of company law. But applying them today? That means wading through an ocean of subsequent case law, especially here in India.

This is where technology, specifically legal AI, is completely changing the game for students and seasoned lawyers alike.

Picture this: you need to track down every single instance where the corporate veil was pierced in India over the last ten years. Manually, that’s a nightmare. You’re looking at days, maybe even weeks, of painstaking library and database searches.

Speeding Up Legal Analysis

This is exactly the kind of task where a legal assistant like Draft Bot Pro becomes indispensable. It can pull up a detailed summary of the Salomon v Salomon case summary in seconds, cross-reference its principles against the latest High Court judgments, or even help you draft a sharp memo on the nuances of lifting the corporate veil.

Instead of burning hours sifting through endless search results, you can simply ask the AI to spot the patterns. It can analyse hundreds of cases and highlight the common factors that lead courts to lift the veil. What you get are data-driven insights that make your legal arguments stronger and your understanding deeper.

Insights: The real magic of legal AI isn't just about finding information faster. It’s about transforming that raw data into actual intelligence you can use. It handles the monotonous, time-sucking parts of legal research, freeing you up to focus on what really matters: strategy, critical thinking, and advising your clients.

If you're thinking about bringing these capabilities into your own practice, our guide on AI tools for corporate lawyers is the perfect place to start.

At the end of the day, these tools are about giving you an edge. They help you master complex areas of corporate law with a level of speed and precision that just wasn't possible before.

Frequently Asked Questions

When you dig into a landmark case like Salomon v Salomon, it’s natural for a few questions to pop up. Let's tackle some of the most common ones you might be wondering about.

What’s the Big Idea from Salomon v Salomon?

The whole case boils down to one powerful concept: ‘separate legal personality’. Think of it this way: the moment a company is properly registered, it’s like a new 'person' is born in the eyes of the law. This new legal 'person' is completely distinct from the people who own or run it.

Because it's a separate entity, the company can own its own property, take on its own debts, and even get into legal battles under its own name. The real magic here is that this shields the owners' personal assets from the company's financial troubles, which is a massive incentive for anyone looking to start a business.

Is the Salomon Case Still a Big Deal Today?

Absolutely. It’s not just a dusty old case; the principles from Salomon v Salomon are the very foundation of modern company law all over the world, especially in places like India that follow the English common law tradition.

Without it, the idea of a limited liability company wouldn't exist as we know it. Every entrepreneur who starts a company without risking their family home has this 19th-century ruling to thank. It's what gives people the confidence to take calculated business risks.

Insights: It's one thing to know a legal principle, but it's another to see how it has evolved over time. Tracing these threads can be tough. This is where an AI legal assistant like Draft Bot Pro can help. It can instantly pull up case summaries, show you how a principle has been applied in later judgments, and break down dense legal jargon into plain English, speeding up your research big time.

What Does "Lifting the Corporate Veil" Mean?

"Lifting the corporate veil" is the rare exception to the Salomon rule. It's when a court decides to ignore the company's separate identity and go directly after the shareholders or directors, holding them personally responsible for the company's debts or misdeeds.

But courts don't do this lightly. It’s reserved for serious situations where it’s clear the company structure is just a smokescreen for fraud or a blatant attempt to dodge a legal duty. Essentially, it’s the law’s way of saying, "You can't hide behind a corporate structure to do something illegal."

Getting a handle on complex legal ideas is a lot easier when you have the right support. Draft Bot Pro is an AI legal assistant designed by Indian lawyers, specifically for Indian lawyers. You can generate spot-on legal documents, run research that’s actually verifiable with cited sources, and even chat with your case files. Join the 46,379+ legal professionals who trust it as the most affordable and verifiable legal AI out there. Find out how Draft Bot Pro can transform your practice today.