A Guide to India's Cheque Bounce Act

- Rare Labs

- Oct 15, 2025

- 16 min read

Getting a cheque that bounces is more than just an annoying setback; under Indian law, it’s a criminal offence. The law in question is Section 138 of the Negotiable Instruments Act, 1881, and it’s designed to make sure that a cheque is treated as a serious promise to pay, not just a piece of paper.

Why a Bounced Cheque Is Treated as a Crime

When you're holding a returned cheque, it’s easy to see it as a simple payment failure. But the law sees something deeper. The whole point of the Cheque Bounce Act is to protect the credibility of cheques as a reliable way to do business.

Think of it this way: a cheque isn't just a request for money. It's a guarantee. When someone hands you a cheque, they're making a legally binding promise that the money is in their account, ready for you.

When that promise is broken, it can throw a wrench in everything. It disrupts cash flow for businesses, creates financial stress for individuals, and, on a larger scale, chips away at the trust we all place in our financial system.

The Bedrock of Financial Trust

So, why make it a criminal matter? Because trust is the glue that holds commerce together. If there were no serious consequences for writing a bad cheque, people would stop accepting them.

Their value as a dependable instrument would plummet, and that could cause a ripple effect of financial instability. The law steps in to make that promise of payment enforceable, giving the person who received the cheque a powerful tool to get what they're owed.

This legal muscle ensures that cheques don't just become worthless IOUs. It keeps them as a vital, trustworthy part of how we all do business. Understanding just how seriously the law takes this is your first step toward getting justice.

The Staggering Burden on Indian Courts

You might be surprised by just how common this issue is. Cheque bounce cases have flooded the judicial system, creating a massive backlog.

To give you an idea, by the end of last year, Delhi's trial courts alone were dealing with a backlog of around 5.55 lakh pending cheque bounce cases. That's a staggering 36% of all pending cases in the city. This isn't just a Delhi problem; it's a snapshot of a national trend where these cases make up a huge chunk of the criminal caseload. You can dig deeper into this challenge by reading reports on pending court cases.

Insights: The law isn't just about punishment. It's about prevention. By making a bounced cheque a criminal offence, the act discourages people from writing cheques they can't honour, thereby protecting the integrity of everyday business transactions.

Let's break down the essential ingredients that turn a simple dishonoured cheque into a criminal offence under Section 138. For a case to stand, all of these conditions must be met.

Core Elements of a Cheque Bounce Offence

Condition | Brief Explanation |

|---|---|

Valid Cheque Issued | The cheque must be drawn on an account maintained by the drawer. |

For Discharge of a Debt | It must be issued to pay off a legally enforceable debt or liability. |

Presented Within Validity | The cheque must be presented to the bank within 3 months of its issue date or its validity period, whichever is earlier. |

Dishonoured by the Bank | The bank must return the cheque unpaid, typically for "insufficient funds" or "payment stopped." |

Written Demand Notice Sent | The payee must send a legal notice to the drawer within 30 days of receiving the dishonour memo from the bank. |

Failure to Pay | The drawer must fail to make the payment within 15 days of receiving the notice. |

Complaint Filed in Time | The payee must file a complaint in the appropriate court within one month after the 15-day notice period expires. |

Failing to meet even one of these conditions can weaken or completely derail a case. It's a procedural path that requires careful attention to detail and timelines.

How a Legal AI Can Help You Immediately

Trying to navigate the Cheque Bounce Act while dealing with the stress of a lost payment can feel overwhelming. This is where a Legal AI tool like Draft Bot Pro can become your secret weapon, right from day one.

Instead of getting bogged down in dense legal texts, it can help you understand where you stand and what your immediate next steps should be. You get clear, structured guidance to protect your rights without the guesswork.

Navigating the Legal Process Step by Step

The moment a cheque bounces, a very specific and unforgiving legal clock starts ticking. The cheque bounce act, particularly Section 138 of the Negotiable Instruments Act, 1881, sets out a strict sequence of steps you have to follow. Miss even one deadline, and your entire claim could be thrown out. It's crucial to move fast, but also with absolute precision.

Think of it less like simply asking for your money and more like building a solid legal case from the very first day. Each step has a purpose, and the timelines are completely non-negotiable.

The First Move: Your Legal Demand Notice

Your journey begins the second you get that cheque return memo from your bank. This slip of paper is your official proof, stating exactly why the cheque was dishonoured—usually "funds insufficient." From the date you receive this memo, the law gives you exactly 30 days to send a formal legal demand notice to the person who gave you the cheque (the drawer).

This isn't just a simple letter asking for payment. This notice is the legal foundation for everything that follows. It has to clearly state the cheque details, the amount owed, and give the drawer a final chance to pay the full amount within 15 days of receiving it.

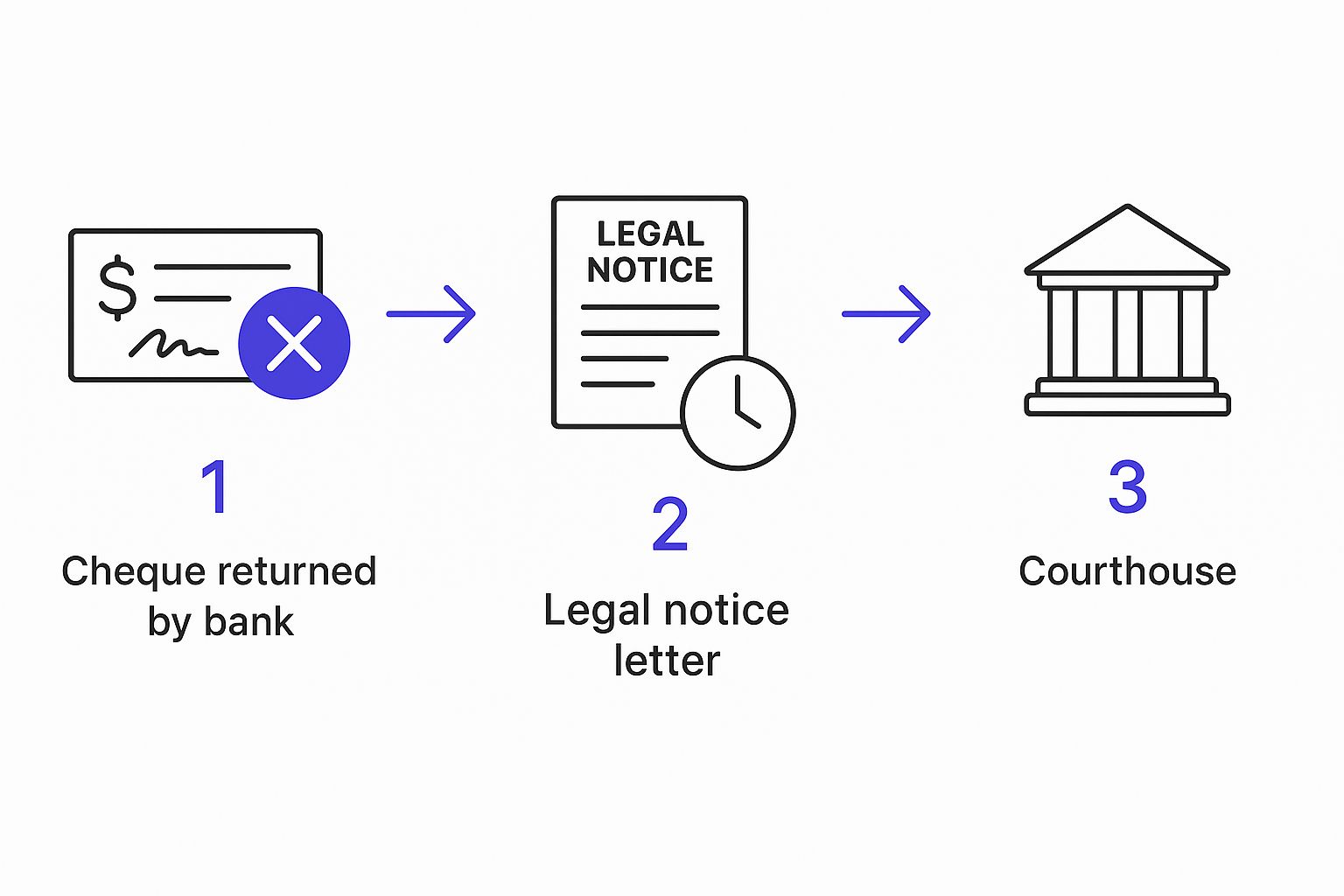

The infographic below breaks down this critical timeline, from the initial bounce to the possibility of heading to court.

As you can see, every stage is time-sensitive. Sticking to these deadlines is the only way to protect your legal rights under the cheque bounce act.

How Draft Bot Pro Secures Your Foundation

Insights: The demand notice is the single most important document before you even think about court. A notice that's poorly written—with factual errors, wrong details, or a failure to meet legal requirements—is a fatal flaw. It hands the other side a powerful defence to get your case dismissed later.

This is exactly why a tool like Draft Bot Pro is a game-changer. Instead of risking a costly mistake by drafting it yourself, its AI can generate a legally precise and compliant demand notice for you. The platform ensures every necessary detail is included and the language meets the strict standards of the cheque bounce act. It helps you build a strong, error-free foundation for whatever comes next.

A crucial part of this process is gathering solid evidence. This includes mastering bank statement verification to get official confirmation of the dishonoured cheque. Good documentation is everything.

The Mandatory Waiting Period

Once the demand notice is sent, you have to play the waiting game. The law gives the drawer a 15-day period from the day they receive your notice to make the full payment. This isn't optional; you cannot file a case before this period is over.

During these 15 days, keep your records meticulous. Have a copy of the legal notice and the postal receipts (it's always best to use Registered Post with Acknowledgement Due). This proves you sent the notice and they received it—vital evidence if you end up in court.

If the drawer pays up within the 15 days, fantastic. The matter is closed. But if that deadline comes and goes with no payment, they have now officially committed a criminal offence under Section 138.

Filing the Criminal Complaint

The moment the 15-day notice period ends without payment, a new clock starts. You now have one month to file a criminal complaint in the appropriate Magistrate's Court. This is the step that formally kicks off legal proceedings.

Your complaint must include:

A clear, detailed story of what happened.

The original bounced cheque and the bank's return memo.

A copy of the legal demand notice you sent.

Proof that the notice was delivered (like postal receipts or the acknowledgement card).

The Negotiable Instruments Act, 1881, treats a cheque bounce as a criminal offence. It's serious business, punishable with up to two years in prison, a fine of up to double the cheque amount, or both. While these cases used to drag on for years, recent legal changes are pushing for much faster resolutions.

Crafting a Powerful Cheque Bounce Complaint

So, the demand notice period has come and gone, and you still haven't been paid. Now what? Your next move is to file a criminal complaint. This isn't just a piece of paper; it’s the entire story of your case, carefully constructed with hard evidence.

A powerful complaint under the cheque bounce act is more than just stating the facts. It's about weaving a clear, logical, and legally watertight argument that leaves zero room for doubt. To get the court on your side, you need to prove a very specific set of legal ingredients. It's not enough to just say the cheque bounced. You have to build the whole picture that makes it a criminal offence under Section 138.

Think of it like building a house brick by brick. Each fact, each document, is a crucial component of the final structure.

Proving a Legally Enforceable Debt

This is the absolute foundation of your case: the concept of a "legally enforceable debt or other liability." So many cases fall apart right here. You have to understand that the law is there to enforce real financial obligations, not to sort out personal favours or gifts.

For instance, if you loaned a friend money for their business and they gave you a cheque to pay it back, that’s a clear, legally enforceable debt. But if you gave someone a cheque as a birthday gift and it bounced? You can't file a case under Section 138. Why? Because there was no underlying debt to enforce.

This distinction is non-negotiable. A cheque given for a donation, a gift, or even as an advance without any corresponding liability falls completely outside the scope of the cheque bounce act. Your complaint must hammer home the point that the cheque was issued to settle a genuine, verifiable financial obligation.

The Essential Ingredients of Your Complaint

To build an undeniable case, your complaint must meticulously lay out several key elements. Each one acts as a pillar holding up your claim. Miss one, and the whole thing could come crashing down. This is where your documentation becomes your most powerful weapon.

A rock-solid complaint should always include:

The Original Transaction: A straightforward explanation of the debt or liability the cheque was meant to cover (e.g., for goods sold, services provided, or a loan).

Cheque Details: You need the cheque number, date, amount, and the names of both the drawer and the bank.

Presentation and Dishonour: You must prove the cheque was presented to the bank within its three-month validity period and was dishonoured. The original bank return memo is your proof here.

The Demand Notice: Include a copy of the legal notice you sent, along with proof of delivery (like postal receipts). This shows you followed the correct procedure.

Failure to Pay: A simple statement confirming the drawer didn't pay up within the 15-day window after receiving your notice.

Insights: Your complaint is essentially a story told through documents. The clearer and more organised your evidence, the stronger your narrative. The aim is to present the facts so logically that the court can follow the sequence of events without any confusion, from the initial debt right through to the final failure to pay.

How Legal AI Constructs an Airtight Case

Weaving together all these facts, documents, and legal arguments into a compelling complaint can be a daunting task. This is where a Legal AI tool like Draft Bot Pro can give you a serious edge. It acts like an architect for your case, helping you structure the entire complaint logically and effectively.

By analysing your case details, Draft Bot Pro makes sure every crucial fact is included and every piece of evidence is properly referenced. The AI helps you frame the legal arguments, turning a simple collection of facts into a persuasive legal document built to win. It excels at articulating the "legally enforceable debt" and tying it directly to the bounced cheque.

For those just starting this journey, you can learn more about how to draft a legal notice online before you even get to the complaint stage.

Common Defences Against a Cheque Bounce Case

Every story has two sides, and a cheque bounce case is no exception. While the person who received the cheque builds their case, the person who wrote it (the drawer) has every right to mount a defence. But simply saying "I don't owe the money" won't cut it. Under the law, any defence needs to be legitimate, legally sound, and most importantly, backed by solid evidence.

Finding yourself on the receiving end of a Section 138 notice can be incredibly stressful. But understanding the common defences is the first step to protecting your rights. A good defence isn't just about denial; it's about strategically challenging the very foundation of the complainant's case, proving that one of the essential ingredients of the offence is missing.

The Misused Security Cheque

One of the most common battlegrounds in these cases involves the "security cheque." This isn't a cheque for a payment that's due right now. Instead, it’s handed over as a guarantee for a future obligation—think of it as collateral for a loan or a promise to fulfil a contract down the line.

The entire case hinges on a simple question: was there a legally enforceable debt when the cheque was presented for payment? Imagine you gave a signed, blank cheque to a business partner as security. If they fill it out and deposit it before you actually owe them any money, you have a strong argument that the cheque was misused. The core of this defence is that the cheque was never meant to clear a current debt; it was just a security deposit.

Insights: The law initially sides with the person who filed the complaint, presuming the cheque was for a valid debt once a basic case is made. It's then up to the accused to present a strong, evidence-based defence to challenge this presumption and push the burden of proof back onto the complainant.

Questioning the Debt Itself

Another powerful defence strategy is to attack the very existence or validity of the debt. If you can prove the supposed debt isn't legally enforceable, the cheque bounce case collapses on its own.

Here are a few scenarios where this works:

Time-Barred Debt: The Limitation Act in India puts a clock on debt recovery, usually three years for most types. If someone tries to cash a cheque for a loan that's over three years old, that debt is considered "time-barred" and can't be enforced in court.

Cheque for an Illegal Purpose: The law won't help someone recover money from an illegal deal. If a cheque was written to cover a gambling debt or any other unlawful transaction, it's a dud in the eyes of the law.

No Existing Liability: This is straightforward. If you can prove you already settled the debt—perhaps in cash or through another bank transfer—before the cheque was deposited, the complaint has no legal standing.

Technical and Procedural Flaws

Sometimes, the best defence is found not in your arguments, but in the complainant's mistakes. The law lays out a very strict, step-by-step process for filing a cheque bounce case, and any slip-up can get the case thrown out.

Keep an eye out for these key procedural tripwires:

Notice Not Received: The complainant has to prove they sent the legal demand notice to your correct address. If you never got it, you were never given the mandatory 15-day window to make the payment.

Material Alteration: If the cheque was tampered with after you signed it—for instance, if the amount or date was changed without your permission—the instrument is legally void.

Signature Mismatch: A classic. If the signature on the cheque doesn't match the one your bank has on file, that’s a perfectly valid reason for the bank to dishonour it and a very strong point for your defence.

A well-prepared defence is your best shot at a favourable outcome. Here’s a quick look at how the responsibilities and options stack up for both sides.

Complainant vs Accused Key Actions and Defences

Aspect | Action/Responsibility for Complainant (Payee) | Potential Defence for Accused (Drawer) |

|---|---|---|

Initial Action | Present the cheque within its validity period (3 months). | Argue the cheque was presented after its validity expired. |

Legal Notice | Send a demand notice within 30 days of the dishonour. | Prove the notice was never received or sent to the wrong address. |

Debt Proof | Establish that the cheque was for a legally enforceable debt. | Prove the debt was time-barred, illegal, or already paid. |

Cheque Authenticity | Ensure the cheque is unaltered and valid. | Show evidence of material alteration or a signature mismatch. |

Filing Complaint | File the court complaint within 30 days of the 15-day notice period ending. | Point out that the complaint was filed too late, missing the deadline. |

Ultimately, navigating these defences requires a clear and logical legal strategy, ensuring every point is addressed correctly.

How Draft Bot Pro Can Fortify Your Defence

Building a rock-solid defence takes meticulous planning. This is where a tool like Draft Bot Pro can become an indispensable ally for you and your lawyer. By uploading the complaint and other case documents, the AI can dissect the allegations, spot potential loopholes or procedural errors, and help you structure a legally sound reply.

It helps in thinking through counter-arguments and making sure your defence is organised, coherent, and persuasive. For anyone facing these allegations, knowing how to frame your official response is crucial. You can learn more about how AI can help in the early stages of a case by reading about [AI for drafting plaints](https://www.draftbotpro.com/pseo/ai-for-drafting-plaints). The same principles apply to crafting a powerful written statement in your defence, making sure no critical angle is missed.

How Recent Legal Changes Impact Your Case

The legal world doesn't stand still, and the laws governing cheque bounce cases are certainly no exception. To bolster the credibility of cheques and deliver swifter justice, the Indian judiciary has rolled out some significant updates through both amendments and landmark judgements. These changes directly impact how your case will be handled, from the moment it's filed right through to the final verdict.

Whether you're the one filing the complaint or defending against it, getting your head around these new rules is absolutely critical. The landscape has definitely shifted, becoming more favourable to the payee in an effort to discourage frivolous delays and get these disputes sorted out much faster.

The Introduction of Interim Compensation

One of the biggest game-changers recently is the introduction of Section 143A into the Negotiable Instruments Act. This new provision gives the court the power to order the drawer—the person who wrote the cheque—to pay interim compensation to the complainant. Think of it not as a final settlement, but as a provisional payment to provide relief while the case is still being fought.

The court can direct the drawer to pay up to 20% of the cheque amount within 60 days of the order. This is a massive help for the payee, who is often left in the lurch, struggling with cash flow because of the bounced cheque. It also sends a strong message to drawers who might be tempted to drag out legal proceedings for no good reason.

Insights: These reforms are a clear signal from the judiciary. They are actively working to clear the massive backlog of cases under the cheque bounce act and strengthen the position of the person who is rightfully owed money. The focus is shifting from a long, drawn-out process to a faster, more decisive one.

A Renewed Push for Speedy Trials

Let's be honest, the sheer volume of cheque bounce cases has long been a heavy burden on the Indian court system. In response, there’s been a real, concerted effort to speed up the entire legal process. The Supreme Court has been a driving force behind this push, recognising that the old way just wasn't working.

The judiciary has been implementing a series of reforms to tackle this backlog head-on. As of March 2020, the Supreme Court even initiated a suo motu case to develop a coordinated mechanism for expediting these cases. The current framework includes provisions like the interim compensation orders we just discussed and tougher penalties for repeat offenders.

Staying Current with Legal AI

For any legal professional—or anyone involved in a cheque bounce case, for that matter—keeping up with these evolving laws and judicial precedents is non-negotiable. A document or an argument built on outdated law can be shot down in an instant. This is where modern legal tools can give you a real edge.

Draft Bot Pro is designed specifically to stay on top of these critical legal updates. The AI's knowledge base is regularly refreshed to reflect the latest amendments and significant Supreme Court rulings. When you use it to generate a legal notice, complaint, or even a defence strategy, you can be confident the output is aligned with the most current legal standards. This ensures your documents aren't just well-written, but are legally relevant and powerful in today's judicial climate. For a deeper dive into important legal rulings, you might be interested in our article on the [top 8 landmark judgements of the Supreme Court of India](https://www.draftbotpro.com/post/top-8-landmark-judgements-of-supreme-court-of-india).

Frequently Asked Questions

When you're dealing with the practical side of a bounced cheque, a lot of specific questions pop up. Let's walk through some of the most common scenarios you might encounter and get you some clear, straightforward answers.

What Happens If I Cannot Find the Drawer?

This is a classic problem. You need to send a legal notice, but the person who wrote the cheque is nowhere to be found. The law anticipates this.

As long as you send the notice via registered post to their last known correct address, the law considers it delivered. This is a concept called 'deemed service'. Even if the notice comes back undelivered, you've done your part. This provision is crucial because it stops people from simply avoiding a notice to escape liability.

Can a Case Be Filed for a Security Cheque?

This is a tricky area and a very common question. The short answer is yes, you can file a case for a bounced security cheque, but there's a huge "if" attached.

The case only holds water if the cheque was given to secure a legally enforceable debt that had actually become due when you presented it. If it was just a security deposit for a future obligation that never arose, a Section 138 case won't stand up in court. The debt needs to be real and payable at that moment.

Is It Possible to Settle Out of Court?

Absolutely, and in fact, the courts encourage it. You can settle a cheque bounce case at any point in the process, even after a conviction. This is done through a process known as 'compounding' the offence.

Both sides simply need to agree on a settlement amount. Once you inform the court and get its permission, the case can be withdrawn. It’s a practical way to resolve the matter without dragging it through the entire legal system.

Insights: The real goal of Section 138 isn't just to punish someone. It's about making sure financial promises are kept. Compounding serves this purpose perfectly. It provides a path for resolution that saves everyone time and money, reinforcing the idea that the law is there to restore financial order, not just penalise.

What If the Cheque Was for a Gift?

Section 138 is crystal clear on this one. It only applies to cheques written to cover a "legally enforceable debt or other liability."

A cheque given as a gift, a donation, or for any promise that isn't legally binding falls outside this law. Since there's no actual debt to collect, a bounced gift cheque doesn't create grounds for a criminal case. If you're running into unfamiliar terms, this guide to essential legal terminology can be a big help.

Navigating the complexities of the cheque bounce act demands precision and solid legal groundwork. Draft Bot Pro can assist by generating accurate legal notices and complaints, ensuring every document is structured for success. Explore how our AI-powered platform can support your legal needs at https://www.draftbotpro.com.